[ad_1]

Blockchain solutions company Ripple has unveiled its strategy to launch a stablecoin pegged to the U.S. dollar, aiming to boost liquidity on the XRP Ledger. Ripple Set to Introduce U.S. Dollar-Linked Stablecoin, Aiming for Wider Crypto Adoption In a statement released on Thursday, Ripple revealed its intention to introduce a stablecoin token linked to the […]

Blockchain solutions company Ripple has unveiled its strategy to launch a stablecoin pegged to the U.S. dollar, aiming to boost liquidity on the XRP Ledger. Ripple Set to Introduce U.S. Dollar-Linked Stablecoin, Aiming for Wider Crypto Adoption In a statement released on Thursday, Ripple revealed its intention to introduce a stablecoin token linked to the […]

[ad_2]

Source link

Tag: XRP

-

XRP ETF Premium Primed For Big Leap: Eyes Set On $500

[ad_1]

XRP enthusiasts are in a frenzy after prominent community figure Chad Steingraber proposed a scenario where an XRP exchange-traded fund (ETF) could trade at a staggering 100x premium.

Steingraber, a seasoned game designer, laid out his thoughts in a recent post, igniting discussions about the potential trajectory of an XRP ETF, particularly in light of the ongoing push for institutional adoption of the altcoin.

Targeting A $500 XRP ETF Share Price

Steingraber’s speculation centers around the price at which an XRP ETF’s shares might trade. His hypothesis hinges on the crypto reaching an unprecedented price of $5 per coin. In this scenario, he theorizes that the corresponding ETF could soar to equally unprecedented heights, potentially reaching a solid $500 per share.

The actual underlying asset price does NOT have to skyrocket. The fund can trade at MASSIVE Premiums.

Let’s say #XRP breaks ATH @ $5, its ETF fund could literally trade at 100x premium if the institutional demand kicks in.

Yes, that’s right, a $500 #XRP Institution Premium. 👍 https://t.co/bwN6cGmmZd pic.twitter.com/tHyy4fkbeK

— Chad Steingraber (@ChadSteingraber) March 27, 2024

This hefty premium, according to Steingraber, would be fueled by a surge in institutional interest in the ETF. He cites the Grayscale Litecoin Trust (LTCN) as a prime example.

Similar to his proposed XRP ETF, LTCN trades at a significant premium over Litecoin’s current market price. Despite Litecoin hovering around $95, investors in LTCN are currently paying a premium of over $250 per Litecoin equivalent within the trust.

Can Arbitrage Opportunities Emerge?

The prospect of such a high premium has sparked discussions about potential arbitrage opportunities. X user Zack, in response to Steingraber’s post, questioned whether individuals holding XRP could exploit this price disparity. Steingraber acknowledged the possibility, particularly if the issuing ETF allows for in-kind deposits, where investors can directly exchange their token for ETF shares.

XRP market cap currently at $34 billion. Chart: TradingView.com

However, he cautioned that in-kind deposits are still a rarity in the ETF market. While Steingraber expressed optimism about the future adoption of this practice, its absence presents a hurdle for immediate arbitrage opportunities.

The XRP community has long advocated for asset managers, especially industry giant BlackRock, to launch an XRP ETF. They believe such a product would significantly bolster the value of XRP by increasing its accessibility to institutional investors.

XRP up in the last seven days. Source: Coingecko

XRP up in the last seven days. Source: CoingeckoA Speculative Outlook With Underlying Uncertainties

It’s crucial to remember that Steingraber’s vision is entirely speculative. As of today, no asset manager has taken concrete steps towards applying for an XRP ETF. Furthermore, the justification for such a high premium rests heavily on the assumption of substantial institutional demand, a factor that remains uncertain.

The applicability of the Grayscale Litecoin Trust comparison also requires further scrutiny. The specific structure and features of an XRP ETF would significantly influence whether a similar premium dynamic would emerge.

A Reality Check For Investors

While Steingraber’s prediction has certainly captured the community’s imagination, investors are advised to approach it with a healthy dose of caution. The approval timeline for an XRP ETF hinges on the US Securities and Exchange Commission’s stance on cryptocurrency ETFs.

Additionally, competition from other potential ETFs could play a role in determining the premium, if any.

Featured image from Freepik, chart from TradingView

Disclaimer: The article is provided for educational purposes only. It does not represent the opinions of NewsBTC on whether to buy, sell or hold any investments and naturally investing carries risks. You are advised to conduct your own research before making any investment decisions. Use information provided on this website entirely at your own risk.

[ad_2]

Source link -

Crypto Whale Movements Accelerate, XRP Wallet Transfers 40 Million Coins

[ad_1]

Crypto bulls are back in the race with substantial transactions. On 1 April 2022, a leading XRP wallet transferred 40 million coins worth over $32 million from an unknown wallet to the digital exchange Bitstamp.

While the crypto market cap jumped by more than $100 billion in the past 24 hours, transactions with a value of at least $1 million have also increased significantly. “Both Bitcoin and Ethereum saw transaction spikes at their tops a couple of days ago. We can see whether transactions are taken while a position is in profit or at a loss. For the first time since November, there were 3x as many profitable transactions vs losing transactions,” Santiment noted.

On-chain movements of crypto whales saw an uptick during the recent market rally. In addition to the $32 million XRP transfer, several other $100 million+ crypto transactions were observed during the last 24 hours. A crypto millionaire address moved 3,000 Bitcoin worth over $138 million from Coinbase to an unknown wallet on 1 April at 16:57 UTC.

Ethereum

While the recent large crypto transfers were mainly focused on Bitcoin, USDT, and XRP, the Ethereum network also witnessed a rise in whale movements. On 31 March 2022, someone sent over 35,500 ETH worth more than $119 million from crypto trading platform Bitfinex to an unknown wallet. ETH’s price boom has played an important role in its surging whale movements. As a result of the latest developments, Ethereum’s dominance against Bitcoin is increasing.

“Ethereum has been gaining in price dominance against Bitcoin, and the ETH / BTC price ratio of 0.074762 on Friday came within millimeters of an 8-week high of 0.074878. The top 10 whale addresses remain to hold a significant percentage of supply,” Santiment added.

Yesterday, the deposit contract of Ethereum 2.0 topped 11 million ETH.

Crypto bulls are back in the race with substantial transactions. On 1 April 2022, a leading XRP wallet transferred 40 million coins worth over $32 million from an unknown wallet to the digital exchange Bitstamp.

While the crypto market cap jumped by more than $100 billion in the past 24 hours, transactions with a value of at least $1 million have also increased significantly. “Both Bitcoin and Ethereum saw transaction spikes at their tops a couple of days ago. We can see whether transactions are taken while a position is in profit or at a loss. For the first time since November, there were 3x as many profitable transactions vs losing transactions,” Santiment noted.

On-chain movements of crypto whales saw an uptick during the recent market rally. In addition to the $32 million XRP transfer, several other $100 million+ crypto transactions were observed during the last 24 hours. A crypto millionaire address moved 3,000 Bitcoin worth over $138 million from Coinbase to an unknown wallet on 1 April at 16:57 UTC.

Ethereum

While the recent large crypto transfers were mainly focused on Bitcoin, USDT, and XRP, the Ethereum network also witnessed a rise in whale movements. On 31 March 2022, someone sent over 35,500 ETH worth more than $119 million from crypto trading platform Bitfinex to an unknown wallet. ETH’s price boom has played an important role in its surging whale movements. As a result of the latest developments, Ethereum’s dominance against Bitcoin is increasing.

“Ethereum has been gaining in price dominance against Bitcoin, and the ETH / BTC price ratio of 0.074762 on Friday came within millimeters of an 8-week high of 0.074878. The top 10 whale addresses remain to hold a significant percentage of supply,” Santiment added.

Yesterday, the deposit contract of Ethereum 2.0 topped 11 million ETH.

[ad_2]

Source link -

3 reasons why XRP price could drop 25%-30% in March

[ad_1]

XRP price risks dropping by more than 25% in the coming weeks due to a multi-month bearish setup and fears surrounding excessive XRP supply.

XRP descending triangle

XRP has been consolidating inside a descending triangle pattern since topping out at its second-highest level to date — near $1.98 — in April 2021.

In doing so, the XRP/USD pair has left behind a sequence of lower highs on its upper trendline while finding a solid support level around $0.55, as shown in the chart below.

XRP/USD weekly candle price chart. Source: TradingView In the week ending March 13, XRP’s price again tested the triangle’s upper trendline as resistance, raising alarms that the coin could undergo another pullback move to the pattern’s support trendline near $0.55, amounting to a drop between 25% and 30%.

The downside outlook also takes cues from other bearish catalysts that has emerged around the triangle resistance.

For instance, XRP formed a bearish hammer on March 12, a single candlestick pattern with a small body and a long upside wick, suggesting lower buying pressure near the coin’s week-to-date top of around $0.85.

XRP/USD daily price chart featuring bearish hammer. Source: TradingView Additionally, the price turned lower after testing a confluence of resistances defined by its 20-week exponential moving average (20-week EMA; the green wave) and its 50-week EMA (the red wave), as shown in the attached image below.

XRP/USD weekly candle price chart with moving average resistances. Source: TradingView Excessive supply FUD

More downside cues for XRP come after Ripple Labs locked 800 million XRP in escrow as a part of its programmed schedule for withdrawals.

The blockchain payment company moved around 100 million XRP worth nearly $40 million to exchange wallets on March 3. Meanwhile, it kept the other 700 million XRP (worth around $550 million) in an escrow account, raising anticipations that at least 200 million XRP would be flooded into the market to generate funds for Ripple’s operational expenses, as well as to distribute XRP among Ripple’s global clientele.

Meanwhile, it kept the other 700 million XRP (worth around $550 million) in an escrow account, raising anticipations that at least 200 million XRP would enter the market to generate funds for Ripple’s operational expenses, as well as to distribute XRP among Ripple’s global clientele.

I understood there are some 800 million $XRP that are locked up and ready to be sold…someone should check the increase in circulating supply to verify this

— Shyan (@tayshyan) March 12, 2022

The selloff fears originated from the XRP price’s earlier response to unexpected supply hikes. For instance, XRP/USD fell by more than 50% to near $0.60 four months after its net supply in circulation increased from 40.46 billion to over 47 billion in just two days.

XRP circulating supply. Source: Messari Nonetheless, Ripple’s withdrawal of 800 million XRP has not yet been reflected in its net circulating supply.

Profit-taking risks mount

Another catalyst that hints XRP’s price could fall 25-30% to reach its descending triangle target is a Santiment indicator that tracks social media trends and their impact on market trends.

XRP price versus $XRPNetwork trend. Source: Santiment XRP’s price rose by over 15% week-to-date on March 12, notes Santiment, alongside a large spike in social media searches for the hashtag #XRPNetwork, suggesting that it could follow up with a potential selloff ahead. Excerpts:

“Historically, our social trends indicate that profit-taking is justified whenever the crowd makes the #XRPNetwork a top topic.”

The views and opinions expressed here are solely those of the author and do not necessarily reflect the views of Cointelegraph.com. Every investment and trading move involves risk, you should conduct your own research when making a decision.

[ad_2]

Source link -

BTC, XRP, NEAR, XMR, WAVES

[ad_1]

Bitcoin (BTC) plunged below $40,000 on March 4 and has been trading below the level throughout the weekend.

Although the crypto price action has been volatile in the past few days, Glassnode data shows that institutional investors have been gradually accumulating Bitcoin through the Grayscale Bitcoin Trust (GBTC) shares since December 2021.

Another positive sign has been that fund managers have not panicked and dumped their holdings in GBTC. This suggests that managers possibly are bullish in the long term, hence they are riding out the short term pain.

Crypto market data daily view. Source: Coin360 Bloomberg Intelligence said in their crypto market outlook report on March 4 that Bitcoin may remain under pressure if the U.S. stock markets keep falling, but eventually, they expect crypto to come out ahead. On the other hand, if the stock market recovers, then Bitcoin could “rise at a greater velocity” if past patterns repeat.

Although crypto markets are facing strong headwinds, select altcoins are showing signs of life. Let’s study the charts of the top-5 cryptocurrencies that could benefit from a rebound in Bitcoin.

BTC/USDT

Bitcoin broke below the moving averages on March 4, suggesting that bears are attempting to gain the upper hand. The bulls tried to trap the aggressive bears by pushing the price back above the moving averages on March 5 and March 6 but they failed.

BTC/USDT daily chart. Source: TradingView If the price sustains below the moving averages, the bears will try to pull the BTC/USDT pair to the support line of the ascending channel. The bulls are likely to defend this level aggressively. A strong rebound off this support will suggest that the pair could extend its stay inside the channel for a few more days.

This short-term bearish view will invalidate if the price turns up from the current level and breaks above the 20-day exponential moving average ($40,474). That will indicate strong buying at lower levels. The bulls will then attempt to push the price toward the resistance line of the channel. The next trending move is likely to begin after the pair breaks above or below the channel.

BTC/USDT 4-hour chart. Source: TradingView The 20-EMA on the 4-hour chart has turned down and the relative strength index (RSI) is in the negative zone, indicating that bears have the upper hand. If the price breaks below $38,000, the pair could drop to $37,000 and then to $35,500.

Contrary to this assumption, if the price turns up from the current level and rises above the 20-EMA, it will suggest strong buying at lower levels. The bullish momentum could pick up after the pair breaks and closes above the 50-simple moving average. That could open the doors for a possible rally to $45,000.

XRP/USDT

Ripple (XRP) has been attempting to rise above the downtrend line for the past few days but the bears have held their ground. A minor positive is that the bulls have not given up and are trying to defend the 50-day SMA ($0.72).

XRP/USDT daily chart. Source: TradingView The flattish moving averages and the RSI near the midpoint do not give a clear advantage either to the bulls or the bears. If bulls push and sustain the price above the downtrend line, the momentum is likely to pick up and the XRP/USDT pair could rally to $0.91.

A break and close above this level could clear the path for a possible retest of the psychological resistance at $1. Conversely, if the price slips and sustains below $0.69, it will suggest that bears are back in control. The pair could then drop to $0.62.

XRP/USDT 4-hour chart. Source: TradingView The 4-hour chart shows that the pair is currently range-bound between $0.80 and $0.70. If buyers push the price above the downtrend line, the pair could challenge the overhead resistance at $0.80. A break and close above this level could signal that bulls have the upper hand. The pair could first climb to $0.85 and then to $0.91.

Contrary to this assumption, if the price turns down from the moving averages, it will suggest that bears are selling on rallies. The pair could then drop to $0.70. If this level cracks, the selling could accelerate and the pair could drop to $0.62.

NEAR/USDT

NEAR Protocol (NEAR) is sandwiched between the moving averages for the past few days. This shows that bears are selling on rallies to the 50-day SMA ($11) while bulls are buying on dips to the 20-day EMA ($10).

NEAR/USDT daily chart. Source: TradingView The RSI is near the midpoint and the 20-day EMA has flattened out, indicating a status of equilibrium between the bulls and the bears. If the price rebounds off the current level and breaks above $12, it will suggest that bulls are on a comeback. The NEAR/USDT pair could then rally to $14 where it may again encounter strong resistance from the bears.

Contrary to this assumption, if the price breaks and sustains below the 20-day EMA, it will suggest that the bears have the upper hand. The pair could then drop to the strong support at $8.

NEAR/USDT 4-hour chart. Source: TradingView The pair picked up bullish momentum after breaking above the downtrend line but the relief rally is facing strong resistance at $12. The bears pulled the price below the 20-EMA but the bulls have managed to defend the 50-SMA.

If buyers push and sustain the price above the 20-EMA, the bulls will again try to clear the overhead hurdle at $12. Alternatively, if the price breaks below the 50-SMA, the selling could intensify and the pair could slide to $9.50.

Related: Bitcoin heading to 36K, analysis says amid warning global stocks ‘look expensive’

XMR/USDT

Monero (XMR) has been correcting inside a descending channel for the past several weeks. The bulls are buying the dips to $134 and attempting to form a basing pattern.

XMR/USDT daily chart. Source: TradingView This has resulted in a consolidation between $134 and $188 for the past few days. The 20-day EMA ($164) has flattened out and the RSI is close to the midpoint, indicating a balance between supply and demand.

This equilibrium will shift in favor of the buyers if they push and sustain the price above $188. That will complete a double bottom pattern, which has a target objective at $242. However, the rally is unlikely to be easy as the bears are expected to mount a strong defense at the resistance line of the channel.

Contrary to this assumption, if the price turns down and slips below $155, the bears will attempt to pull the XMR/USDT pair to $134.

XMR/USDT 4-hour chart. Source: TradingView The 4-hour chart shows that the bulls pushed the price above the downtrend line, but could not sustain the higher levels. This indicates that the bears are aggressively defending this level. The moving averages are flattening out and the RSI is just below the midpoint, indicating a balance between supply and demand.

If the price turns down and slips below $155, the short-term trend could turn in favor of the bears. Conversely, a close above the downtrend line could improve the prospects of a possible rise to the overhead resistance at $188.

WAVES/USDT

Waves (WAVES) formed a double bottom pattern at $8 and rallied sharply to $21. The moving averages have completed a bullish crossover and the RSI is in the overbought zone, indicating that bulls have the upper hand.

WAVES/USDT daily chart. Source: TradingView The bears are posing a stiff challenge near $20 but a positive point is that bulls have not given up much ground. If the price turns up from the current level, it will suggest that bulls are buying on dips. That will increase the possibility of a retest at $21.

If bulls push and sustain the price above $21, the WAVES/USDT pair could pick up momentum and rally toward $24 and then $27. This positive view will invalidate in the short term if bears pull and sustain the pair below $16.

WAVES/USDT 4-hour chart. Source: TradingView The 4-hour chart shows that the correction from $21 pulled the RSI from deeply overbought levels to just below the midpoint. The bulls purchased the dip to the 38.2% Fibonacci retracement level at $16 and have pushed the price back above the 20-EMA.

If the price sustains above the 20-EMA, the bulls will attempt to drive the pair above the overhead resistance at $21.

Contrary to this assumption, if the price turns down from the current level and breaks below the moving averages, it will suggest that the short-term traders may be rushing to the exit. That could pull the pair to $14 and then $13.

The views and opinions expressed here are solely those of the author and do not necessarily reflect the views of Cointelegraph. Every investment and trading move involves risk, you should conduct your own research when making a decision.

[ad_2]

Source link -

BTC, XRP, CRO, FTT, THETA

[ad_1]

Bitcoin (BTC) has given back some of its recent gains, but on-chain data resource Ecoinometrics said that whales are accumulating because they believe the price is attractive from a long-term perspective.

On the downside, analyst Willy Woo believes that $33,000 is a strong bottom for Bitcoin. Popular Twitter trader Credible Crypto citing data from PlanC said that the odds of Bitcoin declining below $30,000 are poor.

Crypto market data daily view. Source: Coin360 Fidelity Digital Assets Head of Research Chris Kuiper believes that Bitcoin’s downside risk could be minimal when compared to other digital assets, but it could rally substantially if it manages to replace gold as a store of value.

Could Bitcoin and altcoins stage a recovery after the recent pullback? Let’s study the charts of the top-5 cryptocurrencies that may attract investor attention in the short term.

BTC/USDT

Bitcoin turned down from the overhead resistance at $45,456 but a minor positive is that the bulls have not allowed the price to break below the 20-day exponential moving average ($41,383).

BTC/USDT daily chart. Source: TradingView If the price rebounds off the current level, the bulls will try to propel the BTC/USDT pair above $45,456. A close above this level will complete a bullish inverse head and shoulders pattern.

The pair could then rally to $52,088 where the bears are likely to mount a strong challenge. If bulls thrust the price above this level, the pair could start its northward march toward the pattern target at $56,904.

This positive view will be negated if the price breaks and sustains below $39,600. Such a move could open the doors for a possible drop to $36,250.

BTC/USDT 4-hour chart. Source: TradingView The pair turned down from $45,456 and broke below the moving averages. The bulls are currently attempting to defend the minor support at $41,688.88 but are facing stiff resistance at the moving averages.

If the price turns down from the current level and breaks below $41,688.88, the pair could slide to $39,600. If the price rebounds off this level, then the pair could remain range-bound between $39,600 and $45,456 for a few days.

On the upside, a break and close above the moving averages will be the first indication that bulls have a slight edge. The pair could then rise to $43,920 and later to $45,456.

XRP/USDT

Ripple (XRP) broke and closed above the moving averages on Feb. 7, indicating that the downtrend could be coming to an end. The bears tried to pull the price back below the breakout level at $0.75 but the bulls thwarted their attempt.

XRP/USDT daily chart. Source: TradingView The price rebounded off $0.75 and the bulls are trying to push the XRP/USDT pair toward the overhead resistance at $1. A break and close above this resistance could open the doors for a possible rally to $1.41.

The moving averages are on the verge of a bullish crossover and the relative strength index (RSI) is in the positive zone, indicating that buyers have the upper hand. This positive view will invalidate on a break and close below $0.75. Such a move will indicate that bears continue to sell on rallies.

XRP/USDT 4-hour chart. Source: TradingView The 4-hour chart shows that the bulls and the bears are battling it out near the $0.82 mark. The bulls pushed the price above this level but the bears stalled the rally at $0.85 and have pulled the pair back below $0.82.

A minor positive is that bulls are buying the dips to the 50-SMA. If the price rebounds off this support, the bulls will try to drive the pair above $0.85 and challenge the resistance at $0.91. Conversely, a break and close below the 50-SMA could pull the pair to $0.75. A break and close below this support could indicate the start of a deeper correction.

CRO/USDT

Crypto.com’s native coin (CRO) broke above the 50-day SMA ($0.47) on Feb. 7, suggesting that the corrective phase could be over. The price rallied to $0.54 on Feb. 10 where the bears are mounting a strong defense.

CRO/USDT daily chart. Source: TradingView The moving averages are on the verge of a bullish crossover and the RSI is in the positive territory, indicating that the buyers have a slight edge. If the current rebound off the moving averages sustains, it will suggest that bulls are buying on dips. The bulls will then attempt to push the price above $0.54 and resume the uptrend.

If they can pull it off, the CRO/USDT pair could rise to $0.60 and then to $0.68. Contrary to this assumption, if the price turns down and breaks below the 20-day EMA, the pair could drop to $0.39.

CRO/USDT 4-hour chart. Source: TradingView The 4-hour chart shows the pair is rising inside an ascending channel pattern. The bulls tried to push the price above the channel but the bears had other plans. They pulled the price back into the channel, trapping the aggressive bulls.

The buyers are attempting to defend the 50-SMA. If the price sustains above the 20-EMA, the bulls will again try to push the pair above the resistance line of the channel. This positive view will invalidate if the price turns down and plummets below the support line of the channel.

Related: Can XRP price reach $1 after 25% gains in one week? Watch this key support level

FTT/USDT

FTX Token (FTT) has been volatile inside a broadening formation. The failure of the buyers to propel the price above the resistance line indicates that bears are selling the rallies to this level.

FTT/USDT daily chart. Source: TradingView However, a minor positive is that bulls are buying the dips in the zone between the 20-day EMA ($43.85) and the 50-day SMA ($41.50). If the price rebounds off the current level, the buyers will make one more attempt to clear the overhead hurdle.

If they manage to do that, the FTT/USDT pair could start a new uptrend. The pair could then rally to $53.50 where the bears may again pose a strong challenge but if this resistance is crossed, the rally could extend to $65.

This bullish view will invalidate if the price turns down and plummets below the 50-day SMA. That will indicate that the pair could extend its stay inside the broadening pattern for a few more days.

FTT/USDT 4-hour chart. Source: TradingView The failure of the bulls to push the price above the $48 to $50 overhead resistance zone may have attracted profit-booking from short-term traders. The pair has broken below both moving averages and could drop to the 38.2% Fibonacci retracement levels at $41.99.

If the price rises from the current level or $41.99, it will suggest that buyers are accumulating on dips. The bulls will then again try to push the price above the 50-SMA. If they succeed, the pair could challenge the overhead resistance.

On the downside, a break and close below $41.99 could signal the start of a deeper correction to the 50% retracement level at $39.95.

THETA/USDT

Theta Network (THETA) broke and closed above the downtrend line on Feb.10, indicating that the downtrend could be coming to an end. Generally, a rally above a stiff resistance tends to turn back and retest the breakout level.

THETA/USDT daily chart. Source: TradingView If bulls succeed in flipping the breakout level into support, it suggests a change in sentiment from sell on rallies to buy on dips. The 20-day EMA ($3.49) has started to turn up and the RSI is in the positive territory, suggesting advantage to buyers.

If the price rebounds off the downtrend line, the bulls will attempt to start a new uptrend. A break and close above $4.39 could attract further buying and the THETA/USDT pair could rise toward $6.

This bullish view will invalidate if the price turns down from the current level and plummets below the downtrend line. Such a move will suggest that the break above the downtrend line could have been a bull trap.

THETA/USDT 4-hour chart. Source: TradingView The pair has been rising inside an ascending channel pattern. The bulls tried to push the price above the resistance line of the channel but the bears did not relent. This may have led to profit-booking by the short-term bears, pulling the price toward the support line.

The price has bounced off the support line on three previous occasions hence, the bulls will again try to defend it. If the price rebounds off the level and rises above the downtrend line, it will signal the resumption of the uptrend.

Alternatively, a break and close below the support line of the channel could signal a deeper correction to $3.20.

The views and opinions expressed here are solely those of the author and do not necessarily reflect the views of Cointelegraph. Every investment and trading move involves risk, you should conduct your own research when making a decision.

[ad_2]

Source link -

BTC, ETH, BNB, SOL, ADA, XRP, LUNA, DOT, AVAX, DOGE

[ad_1]

Bitcoin (BTC) and the U.S. equity markets fell sharply on Jan. 5, reacting negatively to the minutes from the Federal Reserve’s December FOMC meeting, which showed that the members expect the balance sheet reduction to start after the Fed begins hiking interest rates in early 2022.

Adding to the negative sentiment was the shutdown of the world’s second-biggest Bitcoin mining hub in Kazakhstan, where the internet has been shut down following massive protests by citizens. This caused a dip of about 13.4% in the Bitcoin network’s overall hash rate from 205,000 petahash per second (PH/s) to 177,330 PH/s.

Daily cryptocurrency market performance. Source: Coin360 According to Galaxy Digital Holdings CEO Mike Novogratz, the current decline was with low volumes and he believes that the markets will be volatile in the next few days. Novogratz suggests that a huge amount of “institutional demand” was waiting on the sidelines and he expects Bitcoin to bottom out in the $38,000 to $40,000 zone.

Could Bitcoin and major altcoins continue to face selling or will they bounce off strong support levels? Let’s study the charts of the top-10 cryptocurrencies to find out.

BTC/USDT

The range-bound action in Bitcoin resolved to the downside on Jan. 5 when bears pulled the price below the strong support at $45,456. This suggests that supply exceeds demand.

BTC/USDT daily chart. Source: TradingView There was a meek attempt to defend the $42,500 support on Jan. 6 but sustained selling has pulled the price close to the next support at $39,600. This leg down has invalidated the positive divergence that was forming on the relative strength index (RSI).

The downsloping moving averages and the RSI near the oversold zone suggest that bears are in control. If bears sink and sustain the price below $39,600, the BTC/USDT pair could nosedive to $30,000.

On the contrary, if the price rebounds off $39,600, the bulls will again try to push the pair above the 20-day exponential moving average ($46,811). Such a move will be the first indication that the downtrend could be ending.

The bullish momentum could pick up on a break and close above the 50-day simple moving average ($50,610).

ETH/USDT

Ether (ETH) turned down from the 20-day EMA ($3,756) on Jan. 5 and plunged below the Dec. 4 intraday low at $3,503.68. This suggests that bears have reasserted their supremacy.

ETH/USDT daily chart. Source: TradingView The downsloping moving averages and the RSI in the oversold zone suggest that bears are in command. If bears sustain the price below $3,250, the decline could extend to the support line of the channel.

The bulls will attempt to defend this level and push the price to the resistance line of the channel. A break and close above the channel will signal a change in trend.

Alternatively, if bears sink the price below the channel, the ETH/USDT pair could decline to the strong support at $2,652.

BNB/USDT

Binance Coin (BNB) broke below the strong psychological support at $500 on Jan. 5. Follow-up selling has pulled the price to the next support at $435.30.

BNB/USDT daily chart. Source: TradingView If the price bounces off the current level, the BNB/USDT pair could rally to $500 where the bears are likely to mount a stiff resistance. The downsloping moving averages and the RSI in the oversold zone suggest that bears are in control.

If the $435.30 support gives way, the pair could extend its decline to $392.20 and later to $320. This negative view will be negated if the price breaks and sustains above the channel. Such a move could open the doors for a possible move to $575.

SOL/USDT

Solana (SOL) plummeted below $167.88 and the Dec. 13 intraday low at $148.04 on Jan. 5. This indicated that bears have reasserted their dominance.

SOL/USDT daily chart. Source: TradingView The selling has continued and the bears will now try to pull the SOL/USDT pair to the strong support at $116. This level could attract strong buying from the bulls but the relief rally is likely to face selling near the 20-day EMA ($170).

Such a move will indicate that the sentiment remains negative and traders are selling on rallies. That could increase the likelihood of a break below $116. The next stop may be the support line of the channel.

The buyers will have to push and sustain the pair above the resistance line of the channel to signal that the downtrend could be ending.

ADA/USDT

Cardano (ADA) turned down from the 20-day EMA ($1.33) on Jan. 5 and dropped to the strong support at $1.18. The bulls have successfully defended this level but have failed to push the price above the 20-day EMA.

ADA/USDT daily chart. Source: TradingView If bears pull the price below $1.18, the ADA/USDT pair could drop to the critical support at $1. This is an important support to watch out for because if it cracks, the selling momentum could pick up and the pair could slide to $0.68.

On the contrary, if bulls drive the price above the moving averages, the pair could rise to the resistance line of the channel. A break and close above the channel will signal a possible change in trend. The pair could then rally to $1.87.

XRP/USDT

XRP broke below the $0.75 support on Jan. 5 but the long tail on the candlestick suggests that bulls purchased this dip. However, a minor negative is that the buyers have not been able to build upon the rebound.

XRP/USDT daily chart. Source: TradingView The XRP/USDT pair formed a Doji candlestick pattern on Jan. 8 and the bulls are currently attempting to sink the price below $0.75. If that happens, the downtrend could resume and the pair may drop to $0.60.

The downsloping moving averages and the RSI in the negative zone indicate that bears are in command. Contrary to this assumption, if the price rebounds off the current level, the bulls will attempt to push the pair above the moving averages.

If they succeed, it will suggest that the selling pressure may be reducing. The pair could then rise to $1.

LUNA/USDT

Terra’s LUNA token plummeted below the 20-day EMA ($81) on Jan. 5, indicating that short-term traders may have booked profits after bulls failed to clear the hurdle at $93.81.

LUNA/USDT daily chart. Source: TradingView The bears have pulled the price to the 50-day SMA ($69), which may act as a strong support. If the price rebounds off the current level, the bulls will try to push the LUNA/USDT pair to the downtrend line of the descending channel.

A break and close above the channel will indicate that the correction may be over. The bulls will then try to push the price to $93.81. On the contrary, a break and close below the 50-day SMA could intensify selling and the pair may drop to the psychological support at $50.

Related: Bitcoin and Ether heading $100K and $5K in 2022: Bloomberg Intelligence

DOT/USDT

Polkadot (DOT) is range-bound in a downtrend. The price has been oscillating between $22.66 and $32.78 for the past few days.

DOT/USDT daily chart. Source: TradingView The 20-day EMA ($28) has started to turn down and the RSI has dipped into the negative territory, suggesting that bears have the upper hand. If sellers sink and sustain the price below $22.66, the DOT/USDT pair could plunge to $16.81.

Contrary to this assumption, if the price rebounds off $22.66, the bulls will try to push the pair to $32.78. A break and close above this level could signal a possible change in trend. The pair could first rise to $40 and later to $44.

AVAX/USDT

Avalanche (AVAX) broke below the $98 support on Jan. 5 and has dropped to the uptrend line of the symmetrical triangle today. The bulls will attempt to defend this level and push the price back to the downtrend line.

AVAX/USDT daily chart. Source: TradingView The 20-day EMA ($104) has turned down and the RSI is below 38, indicating that rallies are likely to be sold into. If the bounce off the current level turns down either from $98 or from the 20-day EMA, the possibility of a break below the triangle increases.

The AVAX/USDT pair could then decline to the $75.50 support where the bulls will try to arrest the decline. This negative view will invalidate if the price turns up and breaks above the triangle. The pair could then rise to $128.

DOGE/USDT

Dogecoin (DOGE) dipped below the $0.15 support on Jan. 5 but the long tail on the candlestick shows that bulls defended this level. That was followed by a Doji candlestick pattern on Jan. 6, indicating indecision among the bulls and the bears.

DOGE/USDT daily chart. Source: TradingView The bears tried to resolve the uncertainty to the downside today but the bulls are not willing to relent. However, unless buyers quickly push the DOGE/USDT pair above the 20-day EMA ($0.17), the risk of a break and close below $0.15 increases.

If that happens, the pair could slide to $0.13 and then to $0.10. Alternatively, if bulls push the price above the 20-day EMA, it will suggest that buyers are attempting a comeback. The pair could then rise to $0.19 and if bulls clear this hurdle, the rally may extend to $0.22.

The views and opinions expressed here are solely those of the author and do not necessarily reflect the views of Cointelegraph. Every investment and trading move involves risk. You should conduct your own research when making a decision.

Market data is provided by HitBTC exchange.

[ad_2]

Source link -

XRP Accounts for 2% of the Crypto Market Cap

[ad_1]

XRP, one of the world’s most valuable digital assets, now accounts for nearly 2% of the overall market cap of cryptocurrencies. With a market cap of more than $50 billion, XRP is the 6th largest digital currency.

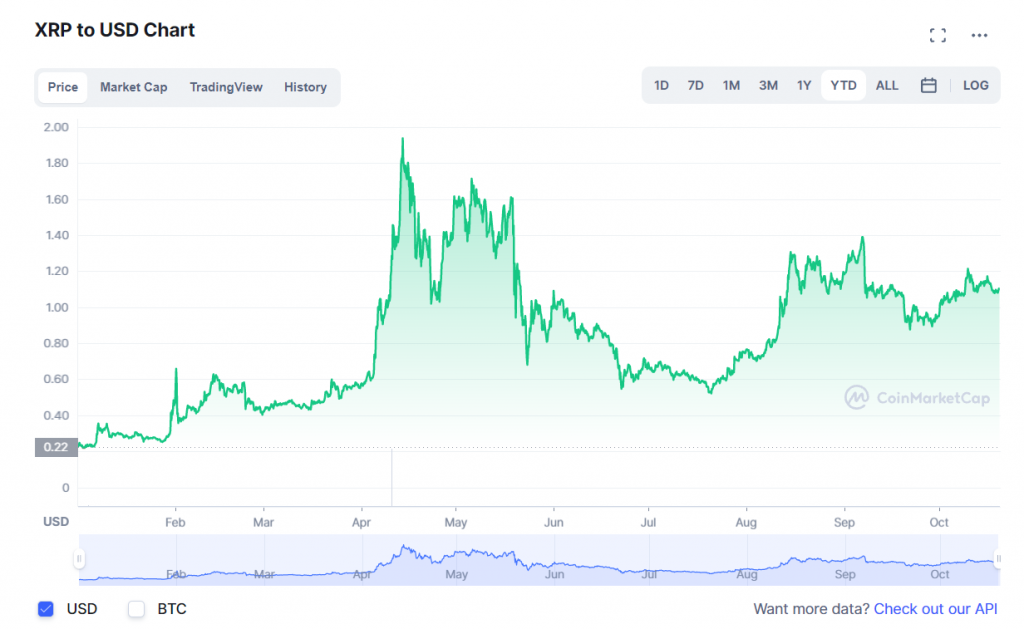

According to the latest data published by Coinmarketcap, XRP is currently trading near $1.10. The cryptocurrency has increased by more than 15% in the last 30 days. Since the beginning of this week, the digital asset has stayed above the market cap of $50 billion.

In terms of price gains, XRP has outperformed several other digital assets this year. The cryptocurrency has soared by more than 400% in 2021. In contrast, Bitcoin jumped by approximately 120% during the same period.

Suggested articles

Yotam Dor on the Use Cases of Blockchain Technology in Cyber SecurityGo to article >>

(Coinmarketcap) One of the major reasons behind the growing crypto dominance of XRP is its popularity among retail and institutional investors. Last week, Finance Magnates reported about the growing popularity of XRP among UK-based investors. According to a report released by eToro, a prominent multi-asset investment platform, UK-based retail investors preferred XRP over other cryptocurrency assets in the last quarter.

XRP in 2021

The world’s 6th largest digital asset started 2021 at a price level of just $0.22. XRP achieved a high of $1.94 on 14 April but saw a major correction in the following weeks. However, the cryptocurrency has seen stability since mid-August as the price has stayed above the important price level of $1. In the last 30 days, the digital asset has seen a consistent rise in its value. XRP has added nearly $8 billion to its market cap in the last month.

Apart from the retail interest, its institutional adoption has increased substantially in 2021. Its applications in cross-border payments have played an important role in its growing adoption. In the Q1 2021 Markets Report, Ripple, one of the leading blockchain firms in the world, highlighted a significant surge in demand for XRP. Furthermore, the company has collaborated with several financial firms to increase the adoption of XRPL.

[ad_2]

Source link -

Price analysis 10/13: BTC, ETH, BNB, ADA, XRP, SOL, DOGE, DOT, LUNA, UNI

[ad_1]

Bitcoin remains strong above its recent breakout level, but several major altcoins are still under pressure until BTC reveals its next move.

[ad_2]

Source link -

Why Is XRP Price Holding onto Yearly Gains despite Ripple’s Legal Issues?

[ad_1]

XRP as a cryptocurrency keeps catching the attention of global companies, as the firm behind the blockchain, Ripple, is broadening its business fronts within the sphere. As a digital asset, it remains in sixth place in the ranking of the largest cryptos by market capitalization, with a figure of $44.46 billion as of press time, according to Coinmarketcap.

Although it has not brought too many gains so far from a yearly perspective, XRP has managed to overcome the hurdles amid the legal issues faced by Ripple Inc. in the United States. The San Francisco-based blockchain firm recently launched a fund worth $250 million to support the creation of non-fungible tokens (NFTs) on the XRP Ledger.

Ripple and the NFT Market

Such a manoeuvre will allow the company to incentivize brands, marketplaces and creators to explore new use cases for the NFT market amid the current hype this sector has been undergoing nowadays.

“Since day one, we’ve viewed crypto and blockchain as powerful levelers, unlocking access and equity for everyone. The growth of NFTs is an important part of that vision, helping build a tokenized future that will allow new business models to prosper and people to engage more deeply with the communities and things they care most about,” Ripple noted in a blog post. This announcement propelled XRP price to test fresh highs and skyrocketed by 7.5%.

Current Status of the US SEC vs. Ripple Legal Battle

But, what had happened with the legal battle against the US Securities and Exchange Commission? It was recently revealed that the US watchdog did not always consider XRP a security, which is the hot potato of the legal tussle. Only until 2018 XRP was included within the list of securities of the SEC.

Suggested articles

BrokerTested.com Deposited Over $150K with 33 Brokers to Test ThemGo to article >>

When the news crossed the wires, XRP price skyrocketed by 10% in September because it contradicted the initial statement from the regulators that XRP cryptocurrency was a security from the beginning. Thus, the US SEC used such assertion to argue that Ripple was allegedly engaged in illicit securities sales from the early days.

Former US Treasurer Talks about XRP’s Purpose

The strain of positive news did not stop during September for Ripple and XRP, as Rosie Rios, the 43rd Treasurer of the United States from 2009 to 2016 under President Barack Obama, issued her definition of XRP, which does not align with the SEC’s assertions: “XRP’s primary purpose is facilitating cross-border payments while other #Cryptos find their value in speculation. China’s latest move brings this point home.”

XRP Price Analysis

So far, from a broad perspective based on the daily chart, XRP keeps its yearly gains at the end of September above the $0.9000 critical level. This is because XRP was hit hard by the sell-off seen at the start of September, combined with China’s tussles on the regulatory crackdown towards the crypto industry. However, losses were capped by such a psychological area.

XRP Daily Chart As a result, the 200-day simple moving average has provided dynamic support across the board, and the RSI indicator keeps trending upwards. The next critical resistance levels lie at $1.018 and $1.123. Should the lows from September give up in order to open the doors for further declines toward a critical resistance, now support, placed at around $0.7643.

[ad_2]

Source link