[ad_1]

Exploring the new world of decentralized autonomous organizations

Around the Block from Coinbase Ventures sheds light on key trends in crypto. Written by Justin Mart & Connor Dempsey.

What the internet did for communication, DAOs can do for capital.

The internet and social networks have made it easier for like minded individuals to communicate than ever before, regardless of geographic location. The advent of digitally native money and finance have now enabled a new kind of social network that allows for like minded individuals to not just communicate, but also coordinate around capital. As with their predecessors, these new networks are unconstrained by geographic borders, capable of forming at massive scale or across a small number of select participants.

The most optimistic thinkers believe that decentralized autonomous organizations can reinvent how humans organize and eventually eclipse the size and scope of the world’s largest corporations and even nation-states.

In this edition of Around The Block, we explore the current DAO landscape and big questions surrounding their future.

What is a DAO?

Simply put, DAOs are software enabled organizations. They allow people to pool resources toward a common goal and share in value creation when those goals are achieved.

Just as the LLC (limited liability corporation) was the preferred organizing primitive of the industrial revolution, DAOs can be the same for Web3. Where corporations are rooted in the legacy financial system and organized through legal contracts, DAOs run on top of open blockchain networks like Ethereum, organized by tokens with their rules encoded in smart contracts.

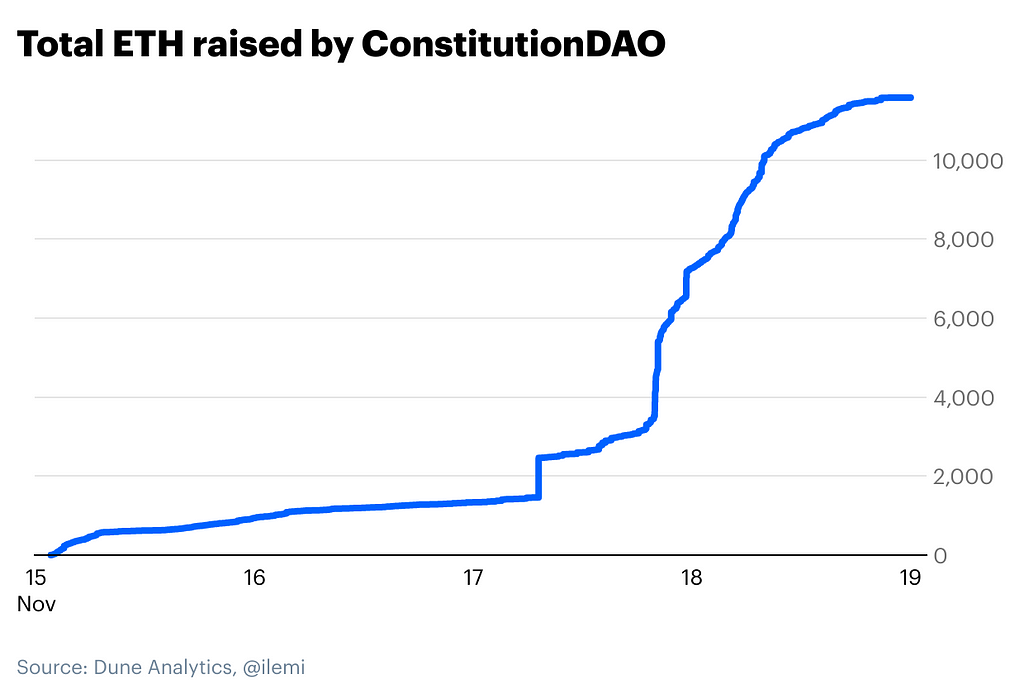

DAOs aren’t tied to a physical location, which allows them to mobilize quickly and attract talent from all over the world — a notion that was on full display when the ConstitutionDAO recently raised over $40M from 17,000 contributors in less than a week in a failed bid to buy one of the original copies of the US constitution.

But DAOs can do so much more than mobilize internet friends to collectively bid on historic documents — they can transform how we organize any manner of economic activity.

What do DAOs do?

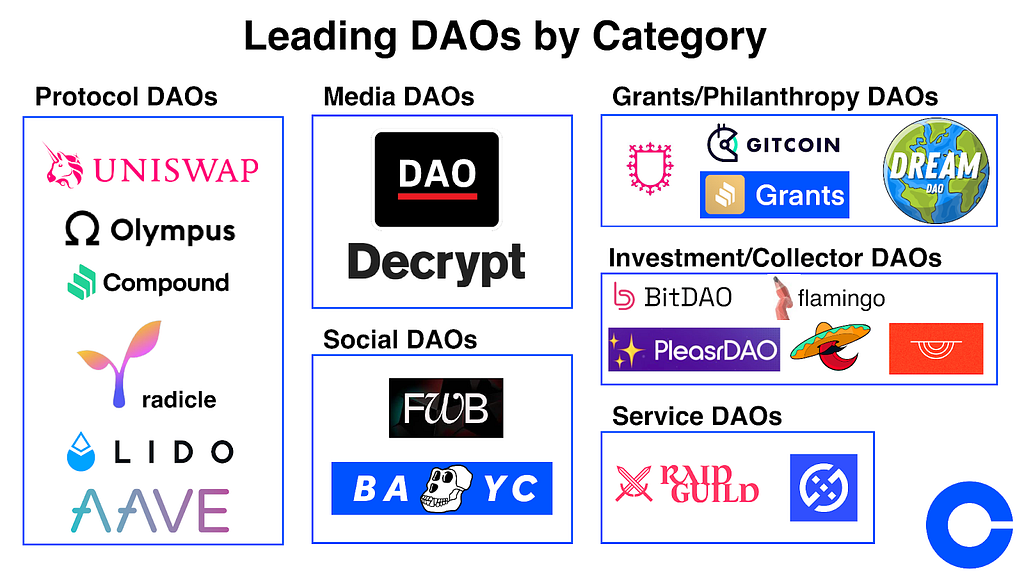

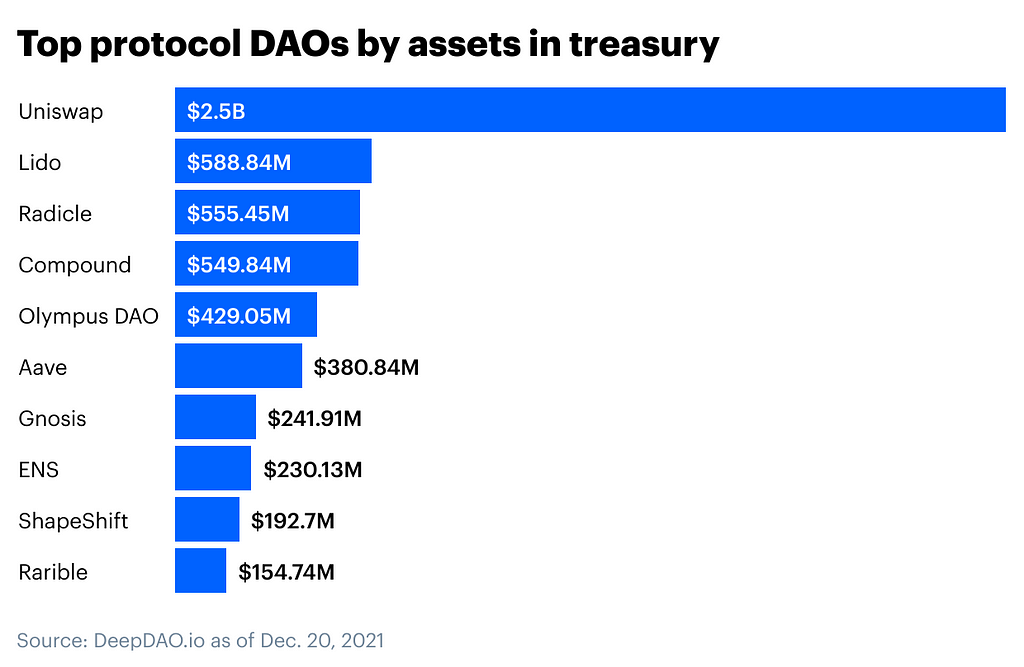

There are already over 180 DAOs (tracked by deepdao.io) with $10B+ in assets under management and nearly 2 million members. These range from DAOs that help manage some of the largest protocols in crypto, to smaller DAOs organized around investment, social communities, media, and philanthropic pursuits.

Protocol DAOs

Ethereum led to an explosion of new crypto assets. From there, developers created protocols that let people trade and lend these new assets (like Uniswap, Compound, and Aave). However these protocols were intended to be decentralized, which created a need to figure out how to govern their growth and evolution.

Rather than put every key decision in the hands of a small team of developers, protocol DAOs emerged as a way to give a protocol’s users a collective say in its future direction. Typically, users are issued governance tokens, often directly based on past usage and contributions, that convey voting rights. Any user can propose ways to improve the project, and token holders can vote on whether or not the developers should move forward with the proposal. More tokens = more voting power.

For example, Uniswap token holders are currently voting on which layer 2 networks the decentralized exchange protocol should be deployed on. Token holders also propose and vote on anything from marketing initiatives to how Uniswap’s $2B+ treasury should be managed.

Governance tokens align the community around the future success of the protocol, as they should appreciate in value as the protocol grows — or fall should it fail.

As of December 7th, the largest protocol DAOs by AUM are Uniswap, Lido, Radicle*, Compound,* Olympus, and Aave.

Investment / Collector DAOs

The second largest category is investment and collector DAOs. These let people pool capital with the aim of investing in specific assets. They range from venture investments in things like DeFi protocols or NFTs, to increasingly ambitious efforts like buying rare historic documents or even professional sports franchises.

Similar to other forms of crypto crowdfunding, these DAOs offer a fast and simple means of capital formation when compared to costly and complex legal setups associated with a typical venture capital fund. These funds are also more transparent than traditional venture funds, since members can audit all transactions on chain.

PleasrDAO, MetaCartel Ventures, Flamingo, Komerabi, are all great examples of DAOs pooling resources, collectively making investment decisions, and sharing in the upside when those investments appreciate. In a similar vein, Syndicate* is a project building a suite of tools that let anyone easily spin up their own investment DAO.

Social DAOs

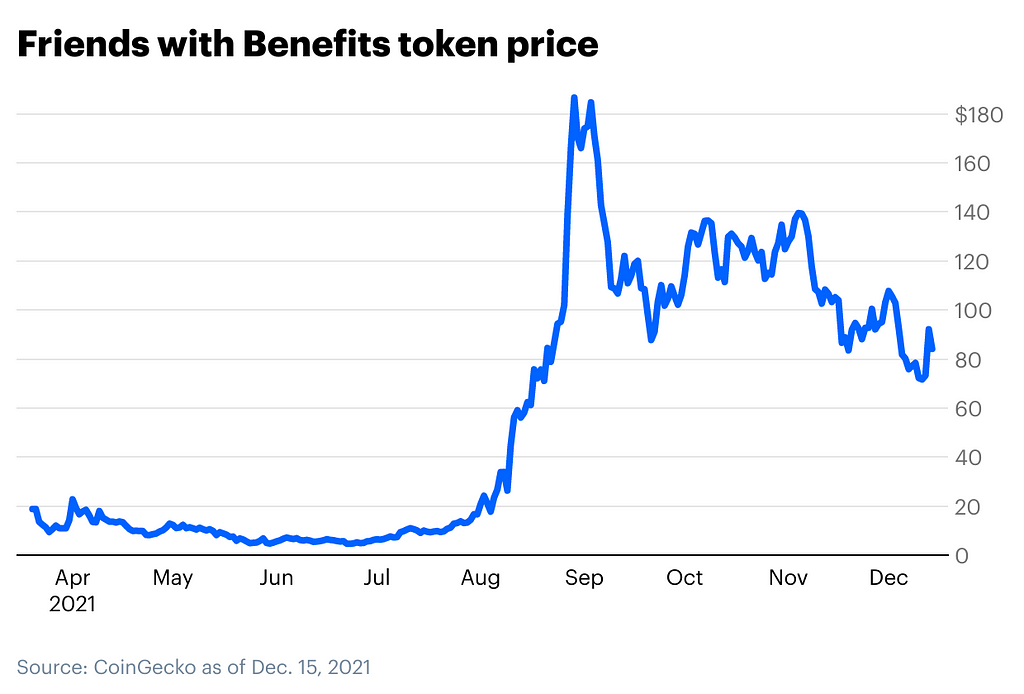

Social DAOs intend to bring like minded people together in online communities, coordinated around a token. The leading example is Friends With Benefits and its $FWB token. To join, members must submit an application and acquire 75 FWB tokens. Entry comes with access to a community full of prominent crypto builders, artists, and creatives as well as exclusive events.

By organizing around a token, members have the incentive to create a valuable community — share insights, host meetups and throw great parties etc. For example, as more people understood the benefits of joining the FWB community, the token appreciated in lockstep, sending the $FWB price from $10 to $75 and therefore membership cost from around $750 to around $6,000.

Other social DAOs use NFTs as the mechanism for unlocking access to a broader community. Owning a Bored Ape NFT for example, unlocks access to the Bored Ape Yacht Club discord, events, NFT airdrops, and merchandise. In this case, the perceived value of the community drives value to the collection of NFTs.

This category of DAOs are all still in their infancy and it will take time to learn which models work and which don’t, but the rapid rise of these communities suggest that they represent a powerful new powerful form of social organization.

Service DAOs

Service DAOs look like online talent agencies that bring strangers together from all over the world to build products and services. Perspective clients can issue bounties for specific tasks and once completed, pay the DAO treasury a portion of the fees before rewarding individual contributors. Contributors also typically receive governance tokens that convey ownership in the DAO.

Most of the early service DAOs, like DxDAO and Raid Guild, are focused on bringing talent together to build out the crypto ecosystem. Their clients consist of other crypto projects and protocols that need everything from software development to graphic design and marketing.

Service DAOs can reinvent how people work, allowing a global talent pool to work on their own time and receive ownership stakes in the networks they care about. While early service DAOs are crypto focused, one can envision a future where Uber is replaced by UberDAO that pairs drivers with riders, while paying drivers an ownership stake in the network (though it will be while before DAOs integrated beyond the purely digital realm).

Media DAOs

Media DAOs aim to reinvent how both content producers and consumers engage with media. Rather than rely on advertising based revenue models, these DAOs use token incentives to reward producers and consumers for their time with an ownership stake in a given outlet.

The idea of decentralized media dates back to 2013 with the “Let’s Talk Bitcoin” podcast, but BanklessDAO is a leading example in 2021. Bankless is an Ethereum-focused media outlet that produces a popular podcast and newsletter. Recently, the Bankless team airdropped the BANK token to its audience. With BANK acquired, readers can take an active role in the media outlet and earn additional BANK by producing content, research, graphic design, article translations, marketing services as well as vote on key decisions to direct the DAO.

At a time when many agree that the current ad-based media model is broken, media DAOs present a compelling alternative for realigning the interests between readers and producers.

Grants/Philanthropy DAOs

Grant and philosophy DAOs, similar to investment DAOs, pool capital and deploy it to various endeavors. The only difference is that allocations are made without the expectation of a financial return.

Gitcoin is a pioneer of this model, supporting grants for critical open source infrastructure that may otherwise have trouble getting funded. Similarly, large protocols like Uniswap, Compound, and Aave have specific grant DAOs that let the community vote on how their treasuries can be deployed to pay builders and developers to further the protocol.

Philanthropy DAOs are also starting to emerge to re-imagine how charitable donations can be made. Dream DAO for example, issued NFTs to raise funds before letting NFT holders vote on how those funds should be allocated towards the DAO’s mission (funding civic leaders in Gen Z).

The hurdles for DAOs

As this increasingly diverse landscape shows, DAOs can become the organizational primitive of Web3, reinventing how we govern, invest, work, create, and donate. Expect to see the categories, number, and quality of DAOs evolve dramatically in the future.

That said, they have a long way to go. Consider that DAOs are essentially tasked with reverse engineering hundreds of years of lessons learned from democracy and corporate governance! The scale of the challenge is palpable, and today we recognize 4 main deficiencies:

- Lack of legal/regulatory clarity

- Lack of efficient coordination mechanisms

- Lack of infrastructure

- Smart contract, fragmentation, & sustainability risks

Lack of Legal/Regulatory Clarity

Corporations have always been rooted in a specific place, with their right to exist bestowed first by monarchs, and eventually by cities and states. Those same municipalities have always set the rules that corporations in their jurisdiction must abide by. Given that DAOs don’t exist in any one place and don’t operate like corporations, they don’t fit cleanly into existing regulatory frameworks.

Where the rules around forming a new corporation while protecting members from certain liabilities are well defined, DAOs have to grapple with all sorts of thorny regulatory and legal issues. How are DAO tokens and treasury activities treated from a tax perspective? How should income paid to a DAO member be reported?

In the US, DAOs are currently faced with a faustian bargain of forming an LLC in a specific jurisdiction or being treated as a general partnership. The former undermines a DAOs ability to be governed by rules encoded in smart contracts in favor of standard LLC articles of incorporation (and being restricted by the constraints of existing LLC law). The latter potentially exposes members to liabilities through the partnership, which would otherwise be protected by the “limited liability company (LLC)”.

All of this uncertainty makes it difficult for DAOs to interact with non-crypto/Web3 entities, which is a major detriment. Wyoming has pushed forward legislation that will allow DAOs to operate on the same legal footing as traditional LLCs while allowing them to be governed by their own smart contracts but has been met with SEC resistance. Meanwhile, a16z, and OpenLaw have proposed clear legal frameworks for governing DAOs, but DAOs will have to continue to operate in a grey area for the foreseeable future.

All of this uncertainty underscores the notion that in the near term, DAOs growth will likely be concentrated purely in the digital realm — the legal complexity gets amplified when DAOs attempt to crossover to the physical realm (e.g UberDAO).

Lack of efficient coordination mechanisms

There’s a reason corporations and governments don’t have every employee or citizen weigh in on every decision — it’s a highly inefficient way of getting things done and not everyone is qualified to do so.

body[data-twttr-rendered=”true”] {background-color: transparent;}.twitter-tweet {margin: auto !important;}

function notifyResize(height) {height = height ? height : document.documentElement.offsetHeight; var resized = false; if (window.donkey && donkey.resize) {donkey.resize(height);resized = true;}if (parent && parent._resizeIframe) {var obj = {iframe: window.frameElement, height: height}; parent._resizeIframe(obj); resized = true;}if (window.location && window.location.hash === “#amp=1” && window.parent && window.parent.postMessage) {window.parent.postMessage({sentinel: “amp”, type: “embed-size”, height: height}, “*”);}if (window.webkit && window.webkit.messageHandlers && window.webkit.messageHandlers.resize) {window.webkit.messageHandlers.resize.postMessage(height); resized = true;}return resized;}twttr.events.bind(‘rendered’, function (event) {notifyResize();}); twttr.events.bind(‘resize’, function (event) {notifyResize();});if (parent && parent._resizeIframe) {var maxWidth = parseInt(window.frameElement.getAttribute(“width”)); if ( 500 < maxWidth) {window.frameElement.setAttribute("width", "500");}}

Corporate hierarchies exist because you often need qualified people making the hard decisions. Many DAOs today exist under somewhat crude governance structures where 1 token equates to 1 vote. In larger DAOs with thousands of token holders, this can lead to chaotic decision making processes where voting power is more a function of buying power than expertise. Similarly, unappointed but high-profile members can gain oversized influence over decision making.

Most agree that for DAOs to be truly effective, they’ll have to explore advancements in governance structures, like shifting to a delegated authority model, where token holders can vote in qualified leaders to make key decisions in a transparent manner (something Orca Protocol* is exploring). In the near term, it’s likely that DAO governance will remain messy and chaotic as they experiment with different models before ultimately figuring out what works (much like the long experimental path from monarchies to democracy).

Lack of developed infrastructure

Just as corporations enjoy clear legal frameworks and efficient decision making processes, they also benefit from highly developed infrastructure on which to operate. DAOs on the other hand, are tasked with building most of that same infrastructure from scratch.

DAO tools for governance, payroll, reporting, treasury management, communication, and every other resource at the disposal of modern day corporations are still nascent. Thankfully, the DAO tooling landscape runs deep, and there are hundreds of teams working on tackling these deficiencies across a range of approaches.

body[data-twttr-rendered=”true”] {background-color: transparent;}.twitter-tweet {margin: auto !important;}

— @balajis

function notifyResize(height) {height = height ? height : document.documentElement.offsetHeight; var resized = false; if (window.donkey && donkey.resize) {donkey.resize(height);resized = true;}if (parent && parent._resizeIframe) {var obj = {iframe: window.frameElement, height: height}; parent._resizeIframe(obj); resized = true;}if (window.location && window.location.hash === “#amp=1” && window.parent && window.parent.postMessage) {window.parent.postMessage({sentinel: “amp”, type: “embed-size”, height: height}, “*”);}if (window.webkit && window.webkit.messageHandlers && window.webkit.messageHandlers.resize) {window.webkit.messageHandlers.resize.postMessage(height); resized = true;}return resized;}twttr.events.bind(‘rendered’, function (event) {notifyResize();}); twttr.events.bind(‘resize’, function (event) {notifyResize();});if (parent && parent._resizeIframe) {var maxWidth = parseInt(window.frameElement.getAttribute(“width”)); if ( 500 < maxWidth) {window.frameElement.setAttribute("width", "500");}}

There’s too many great teams to name but on the governance tooling front, we’re excited about Messari’s* new aggregator for monitoring and participating in governance all from one interface.

Smart contract, fragmentation, & sustainability risk

It’s hard to discuss DAOs without referencing “The DAO:” The first ever DAO on Ethereum, designed around venture investing in 2015, that had 40% of its treasury hacked and drained of $60 million. As the recent $130 million exploit of BadgerDAO showcased, DAO treasuries remain vulnerable to smart contract risk.

Similarly, the largest crypto networks have a history of fragmentation caused by division from within the community. The Bitcoin/Bitcoin Cash split was caused by a technical dispute over blocksize. The Ethereum/Ethereum Classic split was caused by disagreements over how to respond to the above mentioned hack of “The DAO”. It’s reasonable to think that we’ll see the largest DAOs face similar headwinds.

On the other side of that coin, how sustainable are DAOs come another possible crypto winter? Will people continue to be excited about DAOs when token prices are continually falling, treasuries constrict, and both participation and membership dwindles?

Re-wiring the world with DAOs

While obstacles abound, DAOs represent a paradigm shift in economic organization. If Web3 is to become an internet collectively owned by its users, DAOs will be the organizational primitive in which that ownership is metered out.

2021 has seen a renaissance in new DAO experiments and models. Meanwhile, the landscape of projects and companies building out the tooling needed for DAOs to reach their true potential is among the richest in the industry. (Coinbase Ventures is actively investing in the DAO landscape, with a number of deals in the pipeline — reach out if you’re a project pushing the DAO landscape forward!)

Should these trends continue, we may one day see the biggest organizations, venture firms, media outlets, and institutions built not on legal contracts, but on open crypto networks. As crypto UX improves, DAOs may very well usurp the LLC as the preferred mode of organization in an increasingly digitized world.

PS — Look for more DAO focused products and services coming from Coinbase in the near future.

Further DAO listening from the Around The Block Podcast:

- What the heck is a DAO? with Coinbase’s Jesse Pollak

- The realities of working for a DAO, with Kinjal Shah

Previous editions of Around The Block

- Scaling Ethereum & crypto for a billion users

- Coinbase Ventures 2021-Q3 activity and takeaways

- The Coinbase Ventures Guide to NFTs

- Loot Project: the first community owned NFT gaming platform

- Axie Infinity, Yield Guild Games & the play-to-earn economy

This website does not disclose material nonpublic information pertaining to Coinbase or Coinbase Venture’s portfolio companies.

Disclaimer: The opinions expressed on this website are those of the authors who may be associated persons of Coinbase, Inc., or its affiliates (“Coinbase”) and who do not represent the views, opinions and positions of Coinbase. Information is provided for general educational purposes only and is not intended to constitute investment or other advice on financial products. Coinbase makes no representations as to the accuracy, completeness, timeliness, suitability, or validity of any information on this website and will not be liable for any errors, omissions, or delays in this information or any losses, injuries, or damages arising from its display or use. Unless otherwise noted, all images provided herein are the property of Coinbase. This website contains links to third-party websites or other content for information purposes only. Third-party websites are not under the control of Coinbase, and Coinbase is not responsible for their contents. The inclusion of any link does not imply endorsement, approval or recommendation by Coinbase of the site or any association with its operators.

DAOs: Social networks that can rewire the world was originally published in The Coinbase Blog on Medium, where people are continuing the conversation by highlighting and responding to this story.

[ad_2]

Source link