[ad_1]

In a post on X (formerly Twitter), Lucie, the marketing lead for Shiba Inu, has provided potential investors with a new set of guidelines for evaluating projects within the Shibarium ecosystem, a dedicated layer-2 blockchain aimed at enhancing the Shiba Inu network. This guidance focuses on critical factors that reflect a project’s contribution to the ecosystem’s growth and sustainability.

Five Investment Rules For Shibarium Projects

1. SHIB Token Burn: Lucie emphasized the importance of SHIB token burning as a primary metric. Token burning, or permanently removing tokens from circulation, is a strategy used to induce scarcity and potentially enhance the token’s value over time. Lucie assesses the impact of SHIB burns on the ecosystem’s overall health and price stability.

2. Metaverse Development: The second rule focuses on whether projects are planning or currently building within the Shiba Inu Metaverse. As SHIB: The Metaverse represents a burgeoning area for development, investments in this space could signal forward-thinking and innovative capabilities within the Shibarium projects.

3. Engagement with BONE Token: BONE ShibaSwap (BONE), serves as the gas token for transactions within Shibarium. Lucie queries whether a project is involved in burning BONE or creating utilities around it that increase its appeal and functional use within the ecosystem. This utility can significantly impact the token’s demand and usage patterns.

4. LEASH Token Utilization: Another crucial factor is the use of Doge Killer (LEASH), another significant token in the ecosystem. Projects’ plans for incorporating LEASH into their functionalities or governance structures reflect their integration depth within the Shibarium network.

5. Verified Contributions to Shibarium: The final criterion involves assessing the tangible, positive contributions a project has made towards improving Shibarium, with a necessity for these contributions to be verifiable on the blockchain. This transparency ensures that the projects not only promise but also deliver real value to the ecosystem.

Examples Of Shiba Inu Projects Meeting Lucie’s Criteria

Lucie named several projects that exemplify her investment rules. WoofSwap, for example, has been a proactive participant in SHIB and BONE burning through its inscription tokens and the launch of its meme coin, DAMN. This activity helps reduce the circulation of key tokens, potentially driving up their value.

Shib Dream and Shib CoOp were cited for their contributions to building within the Shiba Inu Metaverse, a significant area of development that could herald new utility and user engagement within the ecosystem. K9 Finance has been noted for enhancing liquidity and staking mechanisms for BONE, creating more robust economic incentives and utility for the token.

In terms of blockchain-verifiable contributions, projects like LumiBots, Mantra Protocol, NestX, and Shib CoOp assist in NFT adoption on Shibarium, facilitating a broader use case for digital assets within the ecosystem. DEX MARSWAP was highlighted for its role in facilitating Shiboshis staking and supporting new projects within the ecosystem.

Shib Dream responded enthusiastically to Lucie’s endorsement: “All great projects! We have burned over a Billion Shib. Invested over 30K in Shibarium Projects. Building in the Metaverse. Gave back over $60K to the community. Good Deeds – Over $10k in Donations. Not using Leash yet going to figure that out. Other things coming soon. SHIBARIUM. Keep Building. Keep Dreaming.”

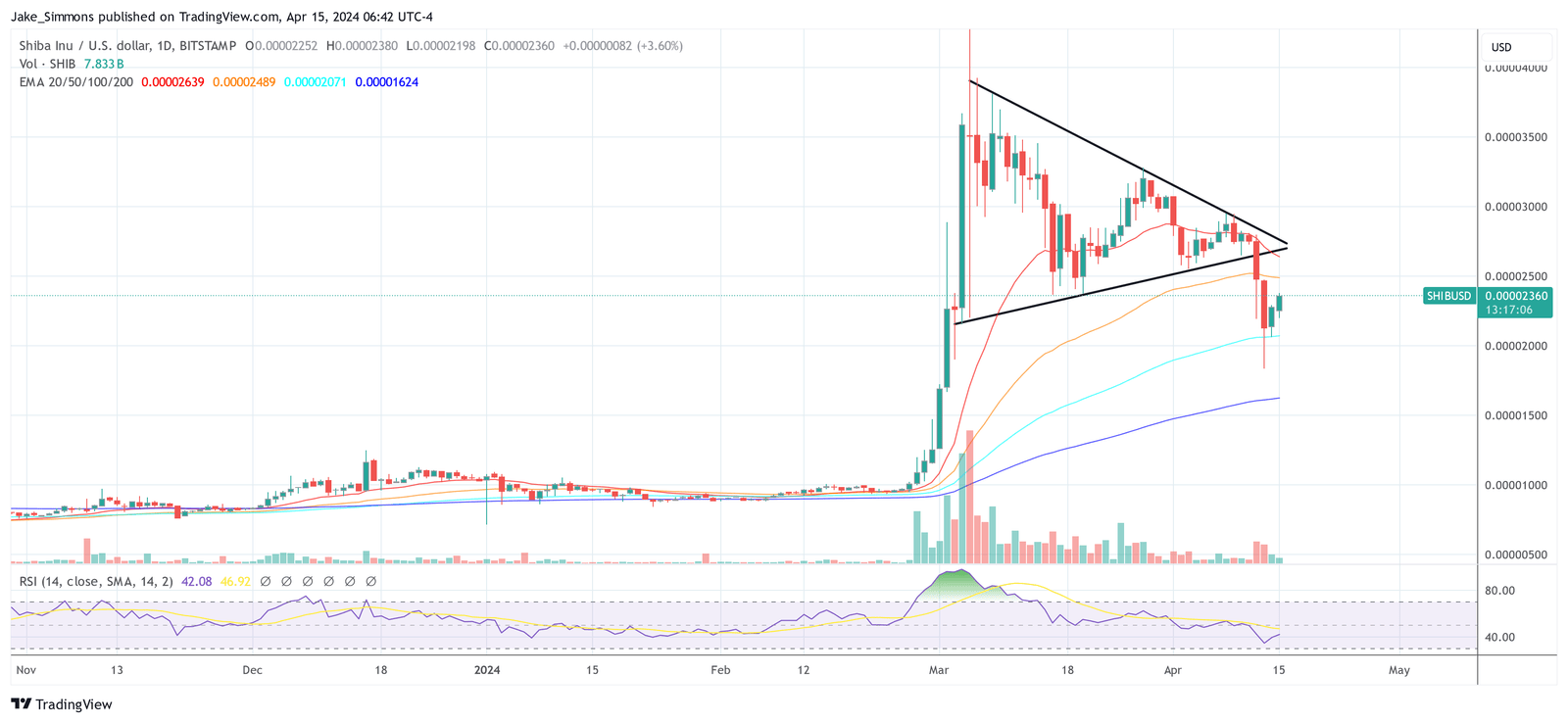

At press time, SHIB traded at $0.00002360.

Featured image created with DALL·E, chart from TradingView.com

Disclaimer: The article is provided for educational purposes only. It does not represent the opinions of NewsBTC on whether to buy, sell or hold any investments and naturally investing carries risks. You are advised to conduct your own research before making any investment decisions. Use information provided on this website entirely at your own risk.

[ad_2]

Source link