[ad_1]

The competition has notably intensified in recent months for the 2024 U.S. presidential election, as indicated by the prediction market platform Polymarket. Just two months ago, former President Donald Trump was ahead with a 52% lead, while incumbent Joe Biden was at 33%. Current figures from Polymarket still place Trump in the lead, albeit by […]

The competition has notably intensified in recent months for the 2024 U.S. presidential election, as indicated by the prediction market platform Polymarket. Just two months ago, former President Donald Trump was ahead with a 52% lead, while incumbent Joe Biden was at 33%. Current figures from Polymarket still place Trump in the lead, albeit by […]

[ad_2]

Source link

Tag: Surges

-

Presidential Election Betting Surges as Odds Tighten on Polymarket

-

Bitget’s Crypto Trading Volume Surges over 100% in Q1 2024

[ad_1]

Bitget, one of the biggest cryptocurrency exchanges by volume, has released its Q1 2024 Transparency Report, revealing visible growth across various metrics. The

report highlighted a 100% increase in both spot and futures trading volumes

compared to previous quarters, along with a significant rise in the value of

its platform native token, BGB.According

to the report, Bitget’s futures trading volume reached approximately $1.4

trillion, an escalation of 146% from the previous quarter. The exchange witnessed the

highest increase in derivatives market share, with a growth of 2.4% in March

alone. The spot trading volume also saw a substantial uplift of 113%, surpassing

$60 billion in Q1 2024.According to an independent report by Finance Magnates Intelligence, these figures coincide with the overall boost in volumes across the cryptocurrency industry.

In March, spot volumes for the largest cryptocurrency exchanges grew 119%

compared to the previous year and over 100% compared to February.Bitget’s

user base has expanded significantly, now serving over 25 million users

across 100+ countries and regions.“This

year, Bitget is doubling down on its commitment to enhance our spot market

offerings,” Gracy Chen, the Managing Director of Bitget, commented. “We aim not

only to bolster our market position but also to contribute tremendously to the

broader crypto ecosystem, supporting startups with high potential to

grow.”Thanks @CryptoSlate for featuring us.

🏆 Proud to become the world’s largest #crypto copy trading platform!

🌍 With over 25 million users globally, #Bitget now stands proudly as a Top 5 crypto exchange on various lists.

Explore our latest achievements 👇

— Bitget (@bitgetglobal) April 11, 2024

Bitget Bets on Its Crypto

TokenThe

platform’s native token, BGB, had a really good run last quarter, breaking its

all-time high and surpassing the $1 mark in February. Since the beginning of

2023, BGB has delivered gains of 434%, outperforming Bitcoin and establishing

itself as a top performer among centralized exchange tokens.Currently,

it is one of the 70 largest cryptocurrencies, with a market capitalization of

over $1.8 billion and a daily trading volume of $81 million. Binance exchange’s BNB token has a market capitalization of $89 billion.Bitget’s listing

strategy led to the introduction of 186 new tokens in the first quarter,

expanding its offerings to over 750 tokens and 820 spot trading pairs. Several

tokens, such as XAI, GPT, and PIXEL, experienced extraordinary growth, surging

over 3000%.According

to the latest exchange report, more people are trading

cryptocurrencies in Europe. In Germany alone, the number of traders has

escalated 69% over the year.In the meantime,

Bitget Wallet hired a new Chief Operating Officer, Alvin Kan, to accelerate its global

expansion.Bitget, one of the biggest cryptocurrency exchanges by volume, has released its Q1 2024 Transparency Report, revealing visible growth across various metrics. The

report highlighted a 100% increase in both spot and futures trading volumes

compared to previous quarters, along with a significant rise in the value of

its platform native token, BGB.According

to the report, Bitget’s futures trading volume reached approximately $1.4

trillion, an escalation of 146% from the previous quarter. The exchange witnessed the

highest increase in derivatives market share, with a growth of 2.4% in March

alone. The spot trading volume also saw a substantial uplift of 113%, surpassing

$60 billion in Q1 2024.According to an independent report by Finance Magnates Intelligence, these figures coincide with the overall boost in volumes across the cryptocurrency industry.

In March, spot volumes for the largest cryptocurrency exchanges grew 119%

compared to the previous year and over 100% compared to February.Bitget’s

user base has expanded significantly, now serving over 25 million users

across 100+ countries and regions.“This

year, Bitget is doubling down on its commitment to enhance our spot market

offerings,” Gracy Chen, the Managing Director of Bitget, commented. “We aim not

only to bolster our market position but also to contribute tremendously to the

broader crypto ecosystem, supporting startups with high potential to

grow.”Thanks @CryptoSlate for featuring us.

🏆 Proud to become the world’s largest #crypto copy trading platform!

🌍 With over 25 million users globally, #Bitget now stands proudly as a Top 5 crypto exchange on various lists.

Explore our latest achievements 👇

— Bitget (@bitgetglobal) April 11, 2024

Bitget Bets on Its Crypto

TokenThe

platform’s native token, BGB, had a really good run last quarter, breaking its

all-time high and surpassing the $1 mark in February. Since the beginning of

2023, BGB has delivered gains of 434%, outperforming Bitcoin and establishing

itself as a top performer among centralized exchange tokens.Currently,

it is one of the 70 largest cryptocurrencies, with a market capitalization of

over $1.8 billion and a daily trading volume of $81 million. Binance exchange’s BNB token has a market capitalization of $89 billion.Bitget’s listing

strategy led to the introduction of 186 new tokens in the first quarter,

expanding its offerings to over 750 tokens and 820 spot trading pairs. Several

tokens, such as XAI, GPT, and PIXEL, experienced extraordinary growth, surging

over 3000%.According

to the latest exchange report, more people are trading

cryptocurrencies in Europe. In Germany alone, the number of traders has

escalated 69% over the year.In the meantime,

Bitget Wallet hired a new Chief Operating Officer, Alvin Kan, to accelerate its global

expansion.

[ad_2]

Source link -

Bitcoin Surges To $40K, Why BTC Could Rally Further

[ad_1]

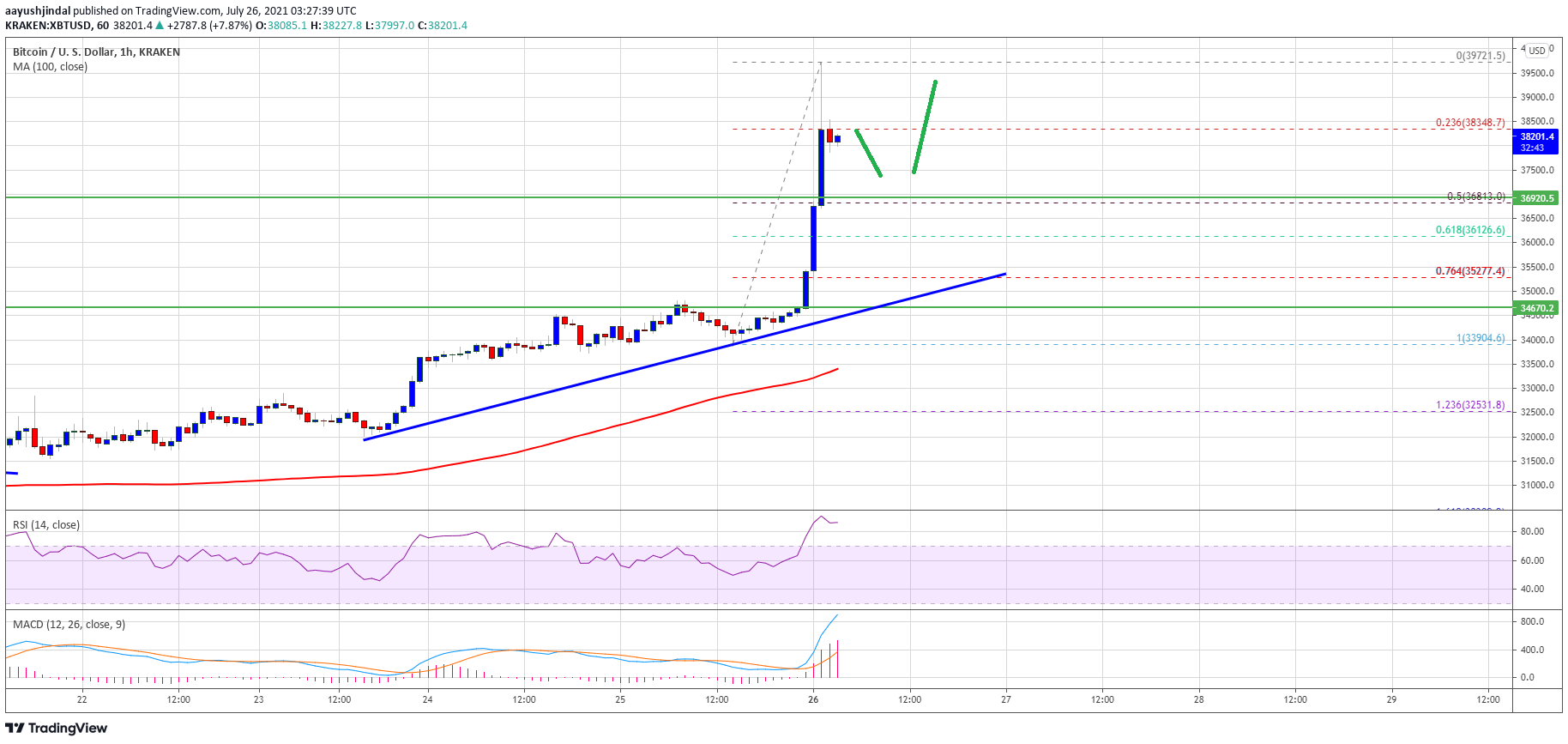

Bitcoin price started a strong upward move above the $35,000 resistance against the US Dollar. BTC is showing positive signs and it could rally further above $40,000.

- Bitcoin started a strong increase above the $33,000 and $35,000 resistance levels.

- The price is now trading well above $35,000 and the 100 hourly simple moving average.

- There is a key bullish trend line forming with support near $35,500 with resistance near $31,250 on the hourly chart of the BTC/USD pair (data feed from Kraken).

- The pair could correct gains, but the bulls are likely to remain active near $37,000.

Bitcoin Price Surges above $38,000

Bitcoin price found a strong buying interest near the $32,000 zone. BTC formed a support base near the $32,000 and it started a major upward move.

The price surged above the $32,000 and $35,500 resistance levels. There was a clear break above the $38,000 resistance level. The upward move gained strength and the price even traded close to the $40,000 resistance zone.

A high was formed near $39,721 and the price is now correcting gains. It is trading near the 23.6% Fib retracement level of the recent rally from the $33,904 swing low to $39,723 high. Bitcoin is now trading well above $35,000 and the 100 hourly simple moving average.

There is also a key bullish trend line forming with support near $35,500 with resistance near $31,250 on the hourly chart of the BTC/USD pair. It is showing a lot of positive signs near the $38,000 level. On the upside, an initial resistance is near the $39,000 level.

Source: BTCUSD on TradingView.com

The first major resistance is near the $39,500 level. The main resistance sits near $40,000. A successful break and close above the $40,000 level could initiate a fresh rally in the near term. In the stated case, the price is likely to move towards the $42,500 level in the near term.

Dip Supported in BTC?

If bitcoin fails to climb above the $39,500 and $40,000 resistance levels, it could start a downside correction. An initial support on the downside is near the $37,500 level.

The first major support is now near the $36,800 zone. A clear downside break below the $36,800 support may possibly push the price towards the $36,000 support zone in the near term.

Technical indicators:

Hourly MACD – The MACD is now losing pace in the bullish zone.

Hourly RSI (Relative Strength Index) – The RSI for BTC/USD is now well in the overbought zone.

Major Support Levels – $37,500, followed by $36,800.

Major Resistance Levels – $39,000, $39,500 and $40,000.

[ad_2]

Source link