For many people, financial technology is somewhat incidental. It is a passing part of daily life: we interact with fintech when we send money online, check our bank balances with our mobile phones, or use an app to buy cryptocurrency.

However, for much of the world fintech is so much more. Financial technology can and will play an important role in the ways that societies develop. With the advent of internet accessibility, fintech is reaching a larger group of people than ever before.

Bank Account Alternative. Business Account IBAN.

Here are some of the most important ways that fintech itself is changing, and that fintech is changing the world.

#1: Microservice Architecture Is Building More Flexible & Secure Financial Services

In the earlier days of financial technology, systems architecture was often created in a monolithic fashion: systems were built as a single unit, only alterable by making changes to the source code. In some cases, this kind of design meant that if part of a financial services system went down, the entire thing could be compromised.

Microservice architecture was designed to make digital financial services more flexible and secure. This kind of system design breaks down monolithic structures into smaller, independent services that can be deployed for specific purposes.

For example, an older system design could consist of a payments service, a credit auditing service, and an international money transfer mechanism that were all combined into a single piece of software. If the company that operated the software wanted to change the credit auditing service, it would have to update the entire system at once.

However, with a microservice architecture, the payments service, a credit auditing service, and an international money transfer mechanism could still operate within the same ecosystem as separate, independent entities. Therefore, if the system operator wanted to make changes to the credit auditing service, it could do so without disturbing any of the other pieces of the system.

While this architectural concept can be applied in the world of centralized financial services, it seems to borrow from the concept of ‘money legos’ that came from the decentralized finance (DeFi) sphere.

#2: Decentralized Finance (DeFi) Is Larger & More Diverse than Ever Before

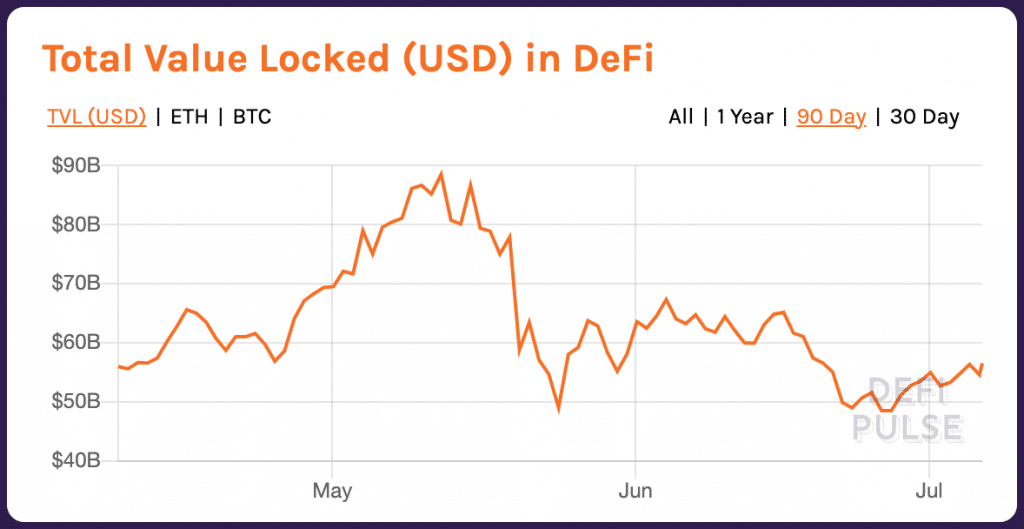

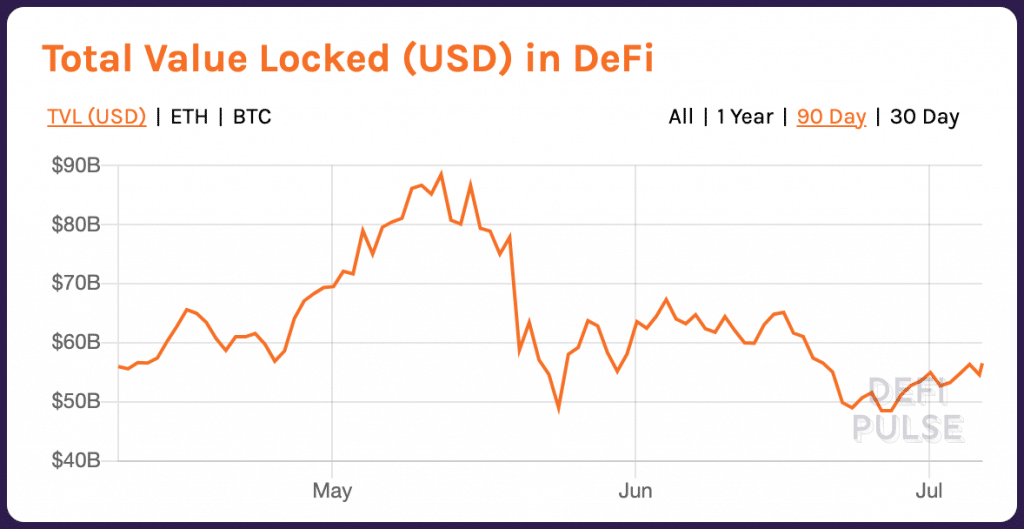

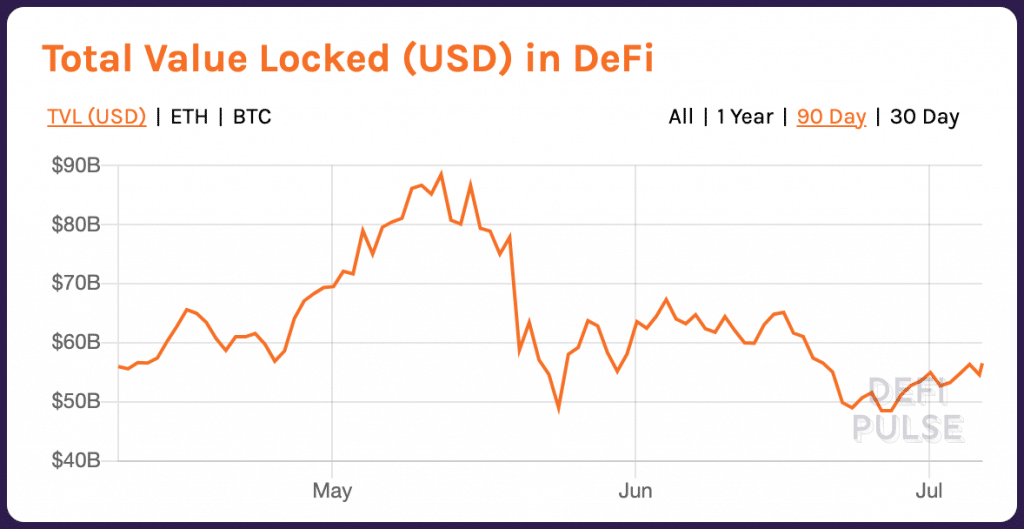

Seven months into 2021, decentralized finance is bigger than it has ever been. At the beginning of the year, the total value locked (TVL) in the DeFi ecosystem was equivalent to roughly $20 billion; today, DeFi’s TVL is roughly $56 billion. At its peak in May, the TVL was roughly $90 billion.

As the size of the DeFi ecosystem continues to grow, so too have the number of DeFi use cases. DeFi platforms have been built for asset management, digital identity, insurance, derivatives, synthetics assets, digital asset exchanges, analytics, risk management tools and more.

Because of the risks associated with many decentralized finance platforms, institutional players have largely stayed out of the DeFi world. Therefore, the vast majority of DeFi’s growth has come from retail users and investors.

However, some platforms are taking steps to create the infrastructure to support the entrance of institutional players into DeFi. For example, DeFi lending platform Aave announced earlier this week that it will be launching Aave Pro, a permissioned platform that will support institutional usage. Aave said that the launch is coming in response to ‘extensive demand from various institutions’.

#3: The Advent of Artificial Intelligence (AI), Machine Learning, and Predictive Analytics

Artificial intelligence and machine learning have a variety of use cases across financial technology. However, one of the most prominent use cases is monitoring, analyzing and predicting customer behavior. For example, AI can be used to determine how and when users of an online banking service might run into technical trouble, and then offer assistance through a chatbot.

Suggested articles

Swiss Fintech Set to Change the Landscape of Isolated Financial ServicesGo to article >>

The use of AI and machine learning is expected to continue to grow with regard to financial regulations and policy compliance, algorithmic trading and fraud detection. AI systems can also play an important role in financial institutions’ anti-money laundering and counter-terrorism operations.

According to Planet Compliance, “the sectors that are expected to be most affected include insurance, financial data, asset management, decentralized exchanges and lending.”

#4: Sustainability Is More Important to Fintech Users than Ever

The climate crisis has wreaked havoc in much of the world, and many new areas that were previously unaffected by climate change have recently undergone serious incidents. For example, the Pacific Northwest is currently in the midst of the worst heat waves in recorded history.

As a result, everyone is expected to do their part in the battle against climate catastrophe. This has touched the financial world in a fairly significant way: for example, some cryptocurrencies have been under fire this year for their heavy energy consumption.

Therefore, it is likely that financial technology companies across the board will be increasingly expected to demonstrate their sustainability initiatives.

Fintech companies and financial institutions may be held to a higher standard in terms of who they do business with. Dr Thomas Puschmann, Director Swiss FinTech Innovation Lab, said in a recent interview with Finance.Swiss that for example, in the lending sector, “[banks] need to know what firms are investing in sustainable solutions for the future.”

However, there are some significant challenges in terms of sustainability data collection that could guide the decision-making process of many fintech firms and banks.

“Take, for example, the value chain of a company. Today, we know the greenhouse gas emissions that a firm emits, these so-called Scope 1 emissions and Scope 2 emissions. Scope 1 are the ones that come out of your house; Scope 2 are the ones that you purchase in the form of energy from your energy provider; but Scope 3 emissions, which very often make up to 75 percent of all greenhouse gas emissions, come from anywhere in the supply chain that you can’t control and don’t even know it.”

“So you need data for that to decide if you want to lend money to such a firm,” he said.

#5: Fintech Companies Have More Power to Financial Inclusion

Cryptocurrency and decentralized finance have long been slated as technologies that can provide financial services and opportunities to users in developing markets. However, the opportunity to take root in emerging economies is open to fintech companies.

In 2021, there has been massive unmet demand for financial services in the developing world. At the same time, the number of smartphone holders in emerging markets is continuing to increase This presents an important opportunity for fintech companies that can provide mobile-based services to users in untapped markets.

In an article entitled “Fintech and Sustainable Development: Assessing the Implications,” authors Juan Carlos, Castilla-Rubio, Nick Robins and Simon Zadek said that financial technology can support the growth of developing markets by “[unlocking] greater financial inclusion by reducing the costs for payments and providing better access to capital domestically and internationally.”

Moreover, the paper said that fintech can “Provide financial markets with the level playing field and market integrity needed for long-term real economy investments aligned with the sustainable development agenda,” among other things.

It’s a Big, Big World out There

These are just a few of the ways that developments in financial technology are changing financial services as we know them.

What are your thoughts on the ways that fintech is impacting the world around you? Let us know in the comments below.