[ad_1]

Ethereum (ETH), the world’s second-largest cryptocurrency by market capitalization, is experiencing a surge in optimism in the cryptocurrency market. The emergence of two new whales, according to crypto tracking platform Spot On Chain, further adds to the bullish sentiment surrounding Ethereum.

These whales have collectively withdrawn a substantial amount of ETH, totaling nearly 11,700 coins, worth approximately $40 million, from leading cryptocurrency exchange Binance.

Their significant purchase, made when ETH was priced around $3,450, indicates their confidence in the potential for further price appreciation.

The $ETH price sharply rebounded by ~4% in the past 2 hours, now beyond $3,500!

During this period, our system detected two more whales, 0x666 and 0x435, that withdrew a total of 11,657 $ETH ($40.28M) from #Binance at ~$3,455!

Follow @spotonchain and set alerts for $ETH now so… https://t.co/Tz4or4Pzc0 pic.twitter.com/ZoVXTtDWZq

— Spot On Chain (@spotonchain) April 8, 2024

Ethereum Trading Volume Soars

The cryptocurrency market is experiencing a surge in optimism, fueled by a strong performance from Ethereum (ETH) and the looming Bitcoin halving event.

ETH has seen its price jump nearly 10% in the past 24 hours, reaching $3,679 as of today. This impressive gain is accompanied by a significant rise in trading volume, which has spiked by nearly 70%, surpassing $15 billion.

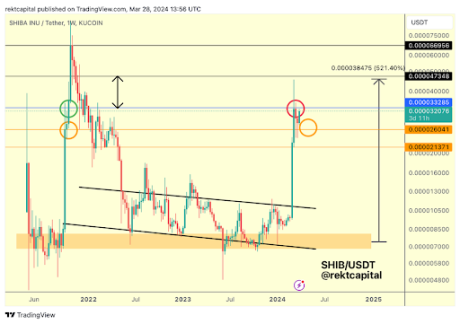

Source: Coingecko

Meanwhile, Ethereum’s impressive rally is not an isolated event. The broader cryptocurrency market is experiencing a period of bullish momentum. Bitcoin, the undisputed leader, has also witnessed a significant surge, climbing above the $72,000 mark. This upward trend is largely attributed to the anticipation surrounding the upcoming Bitcoin halving, scheduled for approximately 11 days from now.

The Bitcoin halving is a pre-programmed event that occurs roughly every four years. It reduces the number of new Bitcoins awarded to miners for verifying transactions on the network.

Historically, these halving events have been followed by substantial price increases for Bitcoin, as the reduced supply often leads to increased demand and scarcity. Investors are hoping for a similar outcome this time around, contributing to the current marketwide rally.

Renewed Optimism Grips Crypto Investors

The recent surge in prices and trading volumes across the cryptocurrency market suggests renewed optimism and bullish sentiment among investors. Analysts and experts are anticipating further price gains for both Ethereum and Bitcoin in the coming days and weeks.

Featured image from Pexels, chart from TradingView

Disclaimer: The article is provided for educational purposes only. It does not represent the opinions of NewsBTC on whether to buy, sell or hold any investments and naturally investing carries risks. You are advised to conduct your own research before making any investment decisions. Use information provided on this website entirely at your own risk.

[ad_2]

Source link