[ad_1]

Bitcoin is slowly gaining pace above $46,500 against the US Dollar. BTC must clear $47,000 to move into a positive territory in the short term.

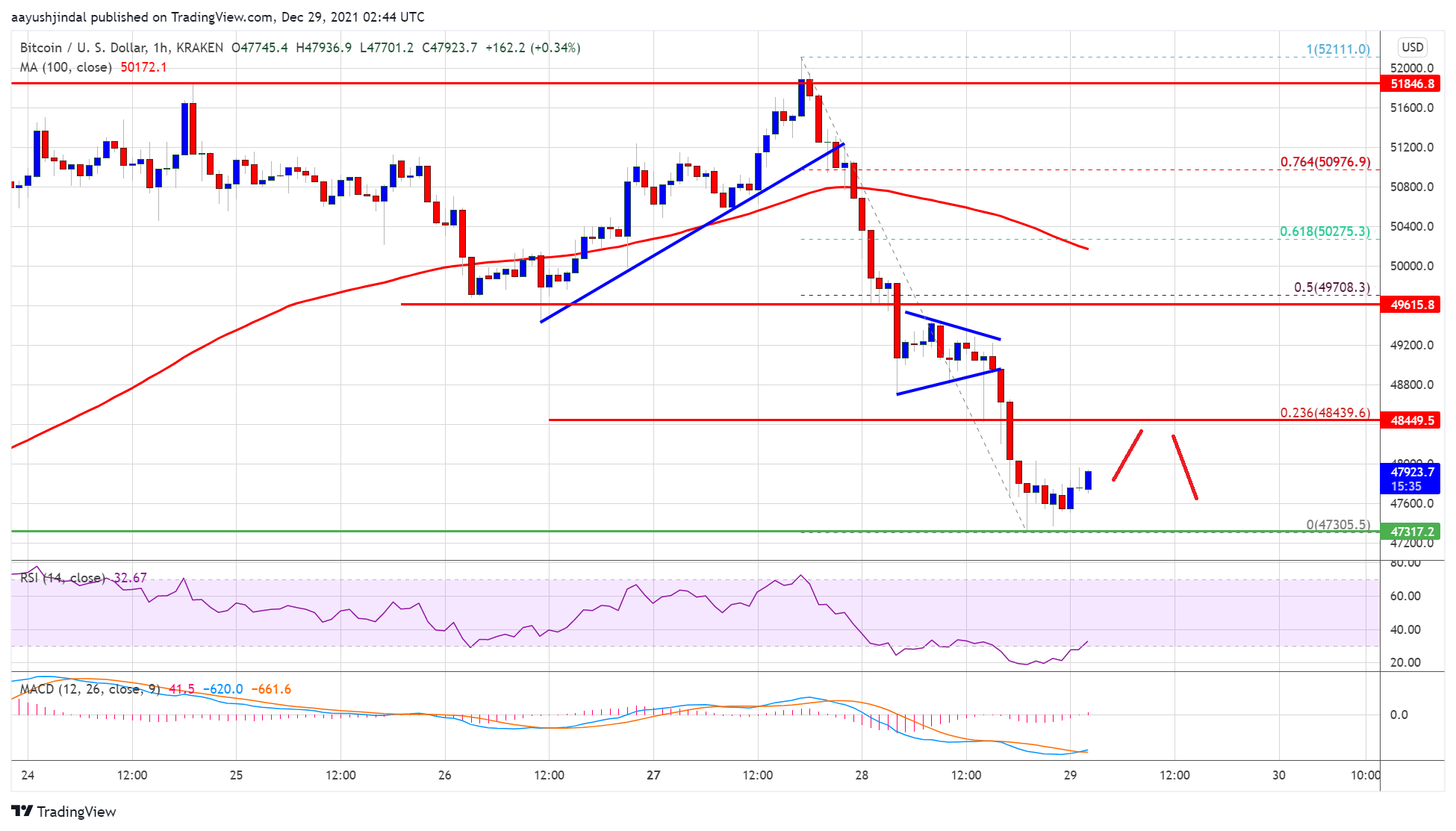

- Bitcoin is slowly moving higher above the $46,500 resistance zone.

- The price is trading above $46,200 and the 100 hourly simple moving average.

- There is a major bearish trend line forming with resistance near $46,700 on the hourly chart of the BTC/USD pair (data feed from Kraken).

- The pair could start a strong increase if there is a clear move above the $47,000 resistance.

Bitcoin Price Eyes Upside Break

Bitcoin price extended decline and tested the $45,150 zone. BTC formed a base above $45,150 and started a fresh increase. There was a break above the $45,500 and $45,800 levels.

The price was able to climb above the 50% Fib retracement level of the recent decline from the $47,444 swing low to $45,153 low. It is now trading above $46,200 and the 100 hourly simple moving average. On the upside, an immediate resistance is near the $46,700 level.

Besides, there is a major bearish trend line forming with resistance near $46,700 on the hourly chart of the BTC/USD pair. The next resistance could be near $47,000 or the 76.4% Fib retracement level of the recent decline from the $47,444 swing low to $45,153 low.

Source: BTCUSD on TradingView.com

A clear move above the $47,000 resistance could start a major increase. In the stated case, the price may perhaps rise towards the $48,000 resistance. Any more gains might send the price towards the $50,000 barrier. An intermediate resistance may possibly be near the $49,250 level.

Upsides Capped in BTC?

If bitcoin fails to clear the $47,000 resistance zone, it could start another decline. An immediate support on the downside is near the $46,200 level and the 100 hourly simple moving average.

The next major support is seen near the $45,800 level. The main support now sits near the $45,150 level. A downside break below the $45,150 support zone could start a major decline. In the stated case, the price could even decline to $44,000 in the near term.

Technical indicators:

Hourly MACD – The MACD is slowly gaining pace in the bullish zone.

Hourly RSI (Relative Strength Index) – The RSI for BTC/USD is above the 50 level.

Major Support Levels – $46,200, followed by $45,150.

Major Resistance Levels – $47,000, $48,000 and $50,000.

[ad_2]

Source link