[ad_1]

We are witnessing the birth of a digital era. Central Bank Digital Currencies (CBDC) are being developed and tested in preparation for mass adoption by global institutions.

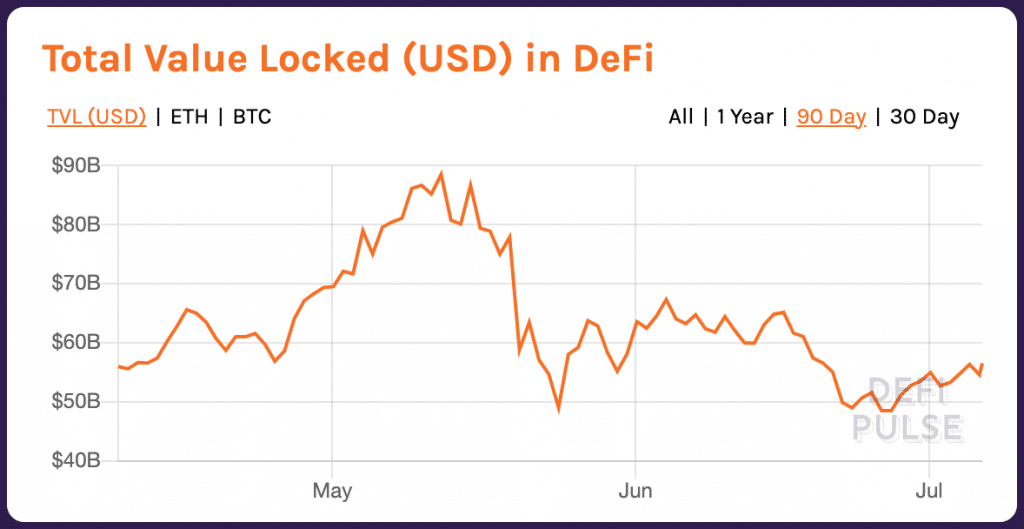

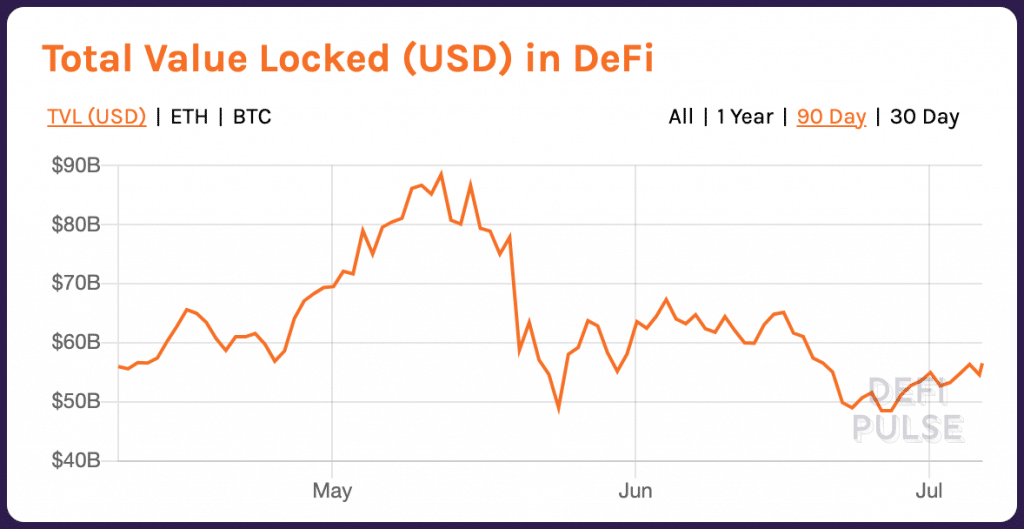

Stablecoins, particularly Tether (USDT) trading volumes are surging at the time of this writing. While it may be attributed to the war between Russia and Ukraine, stablecoins’ usage may only rise over time.

source: messari

In this article I would like to bring to discuss the concept of integrating smart contracts into traditional trading platforms that may be seen in the near future.

The concept is particularly for retail trading but parts may be is used at an institutional level. The demand for both cryptocurrencies and non-fungible tokens (NFTs) is expected to increase 2022. The concept focuses on integrating NFTs into the trading software in exchange for trading benefits.

Aside art NFT, non-fungible tokens have many possible forms of usage. NFTs can replace the traditional ticketing system, the way we vote, coupons and more.

Both forex brokers and crypto exchanges offer traders lower transaction fees based on the monthly trading volumes. This applies to spot trading and futures including perpetual futures.

What if we can enhance the commission structure, increase customer satisfaction and revenue via NFTs?

Integrating Smart Contracts

The standard form of NFTs marketplaces is buying and selling non-fungible tokens. OpenSea, Nifty Gateway and SuperRare all abide by the basic form of buying and selling.

However, NFT owners may also lend their NFTs, ‘NFT renting.’ Non-fungible tokens may be borrowed for a predetermined period of time before returning to the owner.

It is more predominant in companies that specialize in real estate NFTs in the metaverse, lending their virtual properties to other users. My concept evolves around bringing the NFT lending protocols into crypto and forex trading.

Before elaborating on the benefits of these protocols I would like to clarify how NFTs are borrowed via smart contracts. I am focusing on lending NFTs without a collateral.

The terms of the rental is embed in a smart contract such as the rental duration. If the renter agrees to the rental duration and the rental price, a wrapped version of the NFT is minted and sent to the borrower. The original NFT remains at the custody of the lender.

The wrapped NFT has an expiration, which was determined prior to renting the NFT. Once the wrapped NFT expires, the wrapped NFT is sent back to the contract, thus burning the wrapped NFT.

These protocols already exist and are being further developed, known as ‘IQ Protocol.’

IQ Protocol

IQ Protocol yellow sheet

Renting NFTs

Crypto exchanges and forex brokers may benefit from these protocols. I will take trading conditions as an example. The broker may offer its clients with better spreads via dedicated NFTs. For example, it may range from as short as 15 minutes to 24 hours.

If the trader agrees to pay the fee to receive lower spreads, a wrapped NFT is minted and allocated to the trader’s dedicated account in the trading platform. Upon depositing the wrapped NFT, the trading platform recognizes the lower-spreads wrapped NFT and automatically reduces the spreads as long as the wrapped NFT is present.

Once the wrapped NFT expires, it is sent back to the contact (which causes it to burn). Upon the removal of the wrapped NFT form the trading platform the lower-spreads privilege ends automatically.

The tokens for the renting the NFT may be pegged to the US Dollar (stablecoin) to avoid exposure to the market volatility. IQ Protocol blockchain may be used to support the fully automated renting process.

While the broker or the exchange’s commissions may be temporarily reduced, it may be compensated via a large amount of traders that are interested in lower spreads for a certain period of time.

Aside trading conditions, the financial company may award its traders with other incentives. Faster withdrawals and subscriptions to various services offered by the broker may be offered via the smart contracts.

This is a future concept of smart contracts integration to trading platforms as we know them today. A dedicated platform must be developed to allow such functionality.

Welcome to the digital era.

We are witnessing the birth of a digital era. Central Bank Digital Currencies (CBDC) are being developed and tested in preparation for mass adoption by global institutions.

Stablecoins, particularly Tether (USDT) trading volumes are surging at the time of this writing. While it may be attributed to the war between Russia and Ukraine, stablecoins’ usage may only rise over time.

source: messari

In this article I would like to bring to discuss the concept of integrating smart contracts into traditional trading platforms that may be seen in the near future.

The concept is particularly for retail trading but parts may be is used at an institutional level. The demand for both cryptocurrencies and non-fungible tokens (NFTs) is expected to increase 2022. The concept focuses on integrating NFTs into the trading software in exchange for trading benefits.

Aside art NFT, non-fungible tokens have many possible forms of usage. NFTs can replace the traditional ticketing system, the way we vote, coupons and more.

Both forex brokers and crypto exchanges offer traders lower transaction fees based on the monthly trading volumes. This applies to spot trading and futures including perpetual futures.

What if we can enhance the commission structure, increase customer satisfaction and revenue via NFTs?

Integrating Smart Contracts

The standard form of NFTs marketplaces is buying and selling non-fungible tokens. OpenSea, Nifty Gateway and SuperRare all abide by the basic form of buying and selling.

However, NFT owners may also lend their NFTs, ‘NFT renting.’ Non-fungible tokens may be borrowed for a predetermined period of time before returning to the owner.

It is more predominant in companies that specialize in real estate NFTs in the metaverse, lending their virtual properties to other users. My concept evolves around bringing the NFT lending protocols into crypto and forex trading.

Before elaborating on the benefits of these protocols I would like to clarify how NFTs are borrowed via smart contracts. I am focusing on lending NFTs without a collateral.

The terms of the rental is embed in a smart contract such as the rental duration. If the renter agrees to the rental duration and the rental price, a wrapped version of the NFT is minted and sent to the borrower. The original NFT remains at the custody of the lender.

The wrapped NFT has an expiration, which was determined prior to renting the NFT. Once the wrapped NFT expires, the wrapped NFT is sent back to the contract, thus burning the wrapped NFT.

These protocols already exist and are being further developed, known as ‘IQ Protocol.’

IQ Protocol

IQ Protocol yellow sheet

Renting NFTs

Crypto exchanges and forex brokers may benefit from these protocols. I will take trading conditions as an example. The broker may offer its clients with better spreads via dedicated NFTs. For example, it may range from as short as 15 minutes to 24 hours.

If the trader agrees to pay the fee to receive lower spreads, a wrapped NFT is minted and allocated to the trader’s dedicated account in the trading platform. Upon depositing the wrapped NFT, the trading platform recognizes the lower-spreads wrapped NFT and automatically reduces the spreads as long as the wrapped NFT is present.

Once the wrapped NFT expires, it is sent back to the contact (which causes it to burn). Upon the removal of the wrapped NFT form the trading platform the lower-spreads privilege ends automatically.

The tokens for the renting the NFT may be pegged to the US Dollar (stablecoin) to avoid exposure to the market volatility. IQ Protocol blockchain may be used to support the fully automated renting process.

While the broker or the exchange’s commissions may be temporarily reduced, it may be compensated via a large amount of traders that are interested in lower spreads for a certain period of time.

Aside trading conditions, the financial company may award its traders with other incentives. Faster withdrawals and subscriptions to various services offered by the broker may be offered via the smart contracts.

This is a future concept of smart contracts integration to trading platforms as we know them today. A dedicated platform must be developed to allow such functionality.

Welcome to the digital era.

[ad_2]

Source link