[ad_1]

India’s central bank has announced that it will enable non-bank payment system operators to offer central bank digital currency (CBDC) wallets. Noting that “necessary changes will be made to the system to facilitate this,” the Reserve Bank of India (RBI) said the initiative is expected “to enhance access and expand choices available to users.” Non-Bank […]

India’s central bank has announced that it will enable non-bank payment system operators to offer central bank digital currency (CBDC) wallets. Noting that “necessary changes will be made to the system to facilitate this,” the Reserve Bank of India (RBI) said the initiative is expected “to enhance access and expand choices available to users.” Non-Bank […]

[ad_2]

Source link

Tag: expands

-

India’s Digital Rupee Expands: Non-Banks to Offer Central Bank Digital Currency Wallets

-

ETC Group Expands Portfolio with XRP-Backed ETC on Xetra

[ad_1]

To enhance its digital assets portfolio of exchange-traded cryptocurrencies (ETCs) in Europe, ETC Group, one of the largest providers of institutional-grade digital asset-backed securities, has recently announced the listing of XRPetc (ETC Group physical XRP) on Xetra.

The product is available under the ticker symbol GXRP. ETC Group already has a broad list of institutional-grade crypto exchange-traded products, including leading digital assets like BTC, ETH, Solana, and Cardano. With the launch of XRP-backed ETC on Xetra, the Group is planning to facilitate its clients in Europe.

“Ripple is rapidly becoming a leader in global payment systems with hundreds of financial institutions choosing Ripple to provide better international payments experience for their customers, in real-time. By launching this latest ETC to our expanding portfolio of high quality, physically-backed digital assets, we’re continuing to grow our offering to investors, providing access to an increasingly wide range of digital currencies and assets – especially those amassing large market caps,” Bradley Duke, Founder and co-CEO at ETC Group, commented.

XRP

XRP is one of the most valuable cryptocurrencies in the world. According to Coinmarketcap’s recent data, XRP is the 6th largest digital currency with a market cap of more than $35 billion.

According to ETC Group, its newly launched XRP-backed ETC will be marketed and distributed by HANetf.

“We are delighted to partner with ETC Group again to offer a new ETC backed by XRP. ETC Group, in partnership with HANetf, has established itself as a market leader in offering investment products focused on crypto assets. Interest in exchange-traded cryptocurrencies has been booming, providing investors with a safer and more liquid way to gain exposure to digital assets. Ripple is a growing blockchain-based digital payment network that is gaining traction thanks to its rapid speed and reliability,” Hector McNeil, co-Founder and co-CEO at HANetf, said.

To enhance its digital assets portfolio of exchange-traded cryptocurrencies (ETCs) in Europe, ETC Group, one of the largest providers of institutional-grade digital asset-backed securities, has recently announced the listing of XRPetc (ETC Group physical XRP) on Xetra.

The product is available under the ticker symbol GXRP. ETC Group already has a broad list of institutional-grade crypto exchange-traded products, including leading digital assets like BTC, ETH, Solana, and Cardano. With the launch of XRP-backed ETC on Xetra, the Group is planning to facilitate its clients in Europe.

“Ripple is rapidly becoming a leader in global payment systems with hundreds of financial institutions choosing Ripple to provide better international payments experience for their customers, in real-time. By launching this latest ETC to our expanding portfolio of high quality, physically-backed digital assets, we’re continuing to grow our offering to investors, providing access to an increasingly wide range of digital currencies and assets – especially those amassing large market caps,” Bradley Duke, Founder and co-CEO at ETC Group, commented.

XRP

XRP is one of the most valuable cryptocurrencies in the world. According to Coinmarketcap’s recent data, XRP is the 6th largest digital currency with a market cap of more than $35 billion.

According to ETC Group, its newly launched XRP-backed ETC will be marketed and distributed by HANetf.

“We are delighted to partner with ETC Group again to offer a new ETC backed by XRP. ETC Group, in partnership with HANetf, has established itself as a market leader in offering investment products focused on crypto assets. Interest in exchange-traded cryptocurrencies has been booming, providing investors with a safer and more liquid way to gain exposure to digital assets. Ripple is a growing blockchain-based digital payment network that is gaining traction thanks to its rapid speed and reliability,” Hector McNeil, co-Founder and co-CEO at HANetf, said.

[ad_2]

Source link -

Coinbase Expands Live Customer Support

[ad_1]

By Casper Sorensen, Vice President, Customer Experience

The following is the latest update in our series of blog posts describing our commitment to continuously improving our customer experience.

In past blog posts we highlighted our ongoing journey to create more value for customers with our support experience. In 2021, we invested in providing improved support experiences by increasing our staffing, accelerating our response times, as well as adding dozens of educational resources to our help pages so customers can get the most accurate information on our products and services.

In our pursuit to provide customers with the most trusted customer service experience in crypto we are excited to highlight new live support options for our customers.

In Q4 we began offering localized phone support for retail customers in the US, UK, Ireland, Germany, and Japan. Whether the question is simple or complex, our trained professionals are ready to help. These new phone support options expand on the Coinbase One support which launched in October 2021 and is available to customers in the United States 24/7 from a dedicated team, and the fastest answer times in crypto.

In December 2021, we began providing US retail customers with live messaging via our new Help Center platform. Live messaging offers customers the flexibility to connect with us when the time is right and continue the conversation seamlessly if they have to step away. Our team of customer service experts are available via messaging 24/7 with the speed our customers expect.

The journey continues in 2022, we will provide more localized phone and messaging options for our customers globally as well as bring further enhancements to our in-app support experience for iOS and Android.

We remain deeply focused on providing our customers with intuitive support technology and appreciate patience as we continue to grow. We look forward to continuous enhancements so please stay tuned to this blog for updates on the status of our journey.

Coinbase Expands Live Customer Support was originally published in The Coinbase Blog on Medium, where people are continuing the conversation by highlighting and responding to this story.

[ad_2]

Source link -

Bitcoin mining manufacturer Canaan expands footprint in Kazakhstan

[ad_1]

Bitcoin (BTC) mining hardware manufacturer Canaan Inc is expanding its footprint in Kazakhstan after signing new strategic partnerships with multiple crypto mining firms in the country.

The Nasdaq-listed company announced Tuesday that it had deployed 10,300 AvalonMiner units in Kazakhstan as of Dec. 31, 2021, finalizing phase one of its deployment in the central Asian country. Canaan is partnering with local firms as part of its business expansion plans outside of China. However, the company declined to list any of its local partners.

Although Canaan is based in Hangzhou, China, the company is eyeing expansion outside of its home country following Beijing’s wholesale crackdown on crypto mining in 2021. Zhang Nangeng, Canaan’s CEO, spoke out against the mining ban during an earnings call in July, telling investors that crypto miners make better use of stranded electricity, and contribute positively to employment and the local economy.

With China snuffing out the crypto mining industry, neighboring Kazakhstan has rushed to fill the void, offering displaced miners cheap and plentiful coal. By June 2021, the world’s fifth-largest mining pool had set up shop in Kazakhstan. The following month, Kazakhstan accounted for nearly a fifth of the world’s Bitcoin mining output.

Related: Kazakhstan to decide whether to launch CBDC by late 2022

China’s ban on Bitcoin mining resulted in a sharp drop in network hash rate, but that has quickly reversed after displaced miners established new bases of operations. Following a six-month recovery, the Bitcoin network’s hash rate reached a new all-time high on Jan. 2.

#Bitcoin hash-rate smashed a new all-time high yesterday! pic.twitter.com/TzEGE3sNRF

— Bitcoin Archive (@BTC_Archive) January 3, 2022

As for Canaan, the company recorded stellar growth in 2021, with net revenues hitting post-IPO highs. The company’s net revenues totaled $204.5 million in the third quarter, up 708.2% over the same period a year earlier, according to unaudited financial results that were posted in November.

[ad_2]

Source link -

BBVA Switzerland Expands Crypto Services with the Addition of Ethereum

[ad_1]

BBVA Switzerland, the Swiss division of the Spanish multinational financial services provider BBVA, announced the addition of Ethereum (ETH) to its crypto custody and trading service today. The private banking clients of BBVA Switzerland will be able to manage Bitcoin and Ethereum on its platform.

Moreover, customers with a New Gen account will be able to access BTC and ETH. Ethereum and Bitcoin are available on the BBVA app along with other traditional investments. According to BBVA Switzerland, it is the first traditional bank in Europe to incorporate Ethereum into its services.

In June 2021, BBVA Switzerland opened Bitcoin trading services for all private banking clients. Since then, the company has seen a substantial increase in interest from its clients. With the addition of Ethereum, the financial services provider aims to meet the growing demand for diversified crypto offerings.

“This gradual roll-out has allowed BBVA Switzerland to test the service’s operations, strengthen security and, above all, detect that there is a significant desire among investors for crypto-assets or digital assets as a way of diversifying their portfolios, despite their volatility and high risk,” explains Alfonso Gómez, the CEO of BBVA Switzerland.

Diversified Crypto Portfolio

The market cap of digital currencies increased by almost 200% in 2021. In addition to Bitcoin, the popularity of altcoins has jumped substantially. As a result, investors are now more inclined towards a diversified crypto portfolio.

“One of the most important attractions of BBVA Switzerland’s offer is that the bitcoin management system is fully integrated into its app, where its performance can be viewed alongside that of the rest of the customers’ assets, funds or investments. This service thus represents a novel offering, as it allows investing and combining traditional and digital financial assets in the same investment portfolio. This integration also offers a great advantage in terms of simplicity when it comes to trading, account statements, tax returns, etc,” BBVA added.

BBVA Switzerland, the Swiss division of the Spanish multinational financial services provider BBVA, announced the addition of Ethereum (ETH) to its crypto custody and trading service today. The private banking clients of BBVA Switzerland will be able to manage Bitcoin and Ethereum on its platform.

Moreover, customers with a New Gen account will be able to access BTC and ETH. Ethereum and Bitcoin are available on the BBVA app along with other traditional investments. According to BBVA Switzerland, it is the first traditional bank in Europe to incorporate Ethereum into its services.

In June 2021, BBVA Switzerland opened Bitcoin trading services for all private banking clients. Since then, the company has seen a substantial increase in interest from its clients. With the addition of Ethereum, the financial services provider aims to meet the growing demand for diversified crypto offerings.

“This gradual roll-out has allowed BBVA Switzerland to test the service’s operations, strengthen security and, above all, detect that there is a significant desire among investors for crypto-assets or digital assets as a way of diversifying their portfolios, despite their volatility and high risk,” explains Alfonso Gómez, the CEO of BBVA Switzerland.

Diversified Crypto Portfolio

The market cap of digital currencies increased by almost 200% in 2021. In addition to Bitcoin, the popularity of altcoins has jumped substantially. As a result, investors are now more inclined towards a diversified crypto portfolio.

“One of the most important attractions of BBVA Switzerland’s offer is that the bitcoin management system is fully integrated into its app, where its performance can be viewed alongside that of the rest of the customers’ assets, funds or investments. This service thus represents a novel offering, as it allows investing and combining traditional and digital financial assets in the same investment portfolio. This integration also offers a great advantage in terms of simplicity when it comes to trading, account statements, tax returns, etc,” BBVA added.

[ad_2]

Source link -

MRHB DeFi Expands Asia Presence with Strategic Investment from Sinofy Group | by Bit Media Buzz | Dec, 2021

[ad_1]

Melbourne, Australia, December 2nd, 2021 — The world’s first inclusive and ethical DeFi ecosystem platform MRHB DeFi has received a strategic investment from Sinofy Group, a tech consulting management firm headquartered in Shanghai. Sinofy supports revolutionary tech companies to help them gain prominence in the world’s most digitally connected regions — China and Southeast Asia.

A Partnership that goes beyond financial investment

The investment includes a strategic partnership which sees MRHB DeFi join hands with Sinofy to fulfil the former’s vision of bringing an ethical, community-first focus to the world of decentralized finance. Sinofy Co-founder and angel investor Amirsan Roberto has taken the partnership a step further and joined the halal DeFi ecosystem startup as the Head of Investments and Partnerships.

“Joining as Head of investments and Partnerships is a reflection of my commitment to and conviction in Marhaba’s vision,” explains Amirsan Roberto. “This is the first step we are taking in establishing our group venture fund and we are honored to have MRHB DeFi as our first institutional investment.”

“We welcome Amir and Sinofy Group as part of the Marhaba family of partners and investors,” says Naquib Mohammed, CEO and founder of MRHB DeFi. “Since our early beginnings, Sinofy has actively supported our marketing efforts and aligning Marhaba with Sinofy’s deep regional expertise will bring us more visibility across Asia and beyond.”

A Technical and Intellectual Collaboration

Indeed the partnership will also see the parties collaborating on Sinofy East European Division’s upcoming We_Challenge 2021 Hackathon in Ukraine. With a gathering of 1,500 participants, 50 global media partners, 20 IT communities and 10 strategic partners, the hackathon is gearing up to be one of the most anticipated developer conventions in the region.

MRHB DeFi will be coming on as an Official Sponsor at the event, with CTO Deniz Daikilic providing a keynote address as well as engaging in a panel discussion that includes CEO Naquib Mohammed and Head of Investments & Partnerships Amirsan Roberto.

The Focus on Community and Ethics

MRHB DeFi recently closed its Pre-Public Sale 2, an open, community-focussed offering to provide pre-IDO access and pricing to its loyal community members. The rousing success of the sale is further validation of the massive interest for DeFi services rooted in ethics and inclusion.

MRHB DeFi was founded with a vision of providing excluded and crypto-cautious communities greater access to the growing opportunities and utilities of the cryptoverse. The project is underpinned by offering faith-based DeFi services which adhere to the ethical investment and financing principles rooted in Islamic Finance, many values upheld by the halal platform also align with the United Nations Sustainable Development Goals. Business practices deemed ethical include those that avoid interest, usury, social exploitation as well as support sustainability, asset or utility backed financing, transparency and equitable risk-reward sharing. These principles have universal appeal far beyond the faith conscious community.

With the Islamic Finance market sized at around USD 3 trillion of assets, bringing even a small portion of Shariah-sensitive liquidity into DeFi will represent a major boost to the total value of the DeFi sector worldwide.

Sinofy Group has now joined the host of strategic investors in MRHB DeFi who are on board to bring DeFi innovation to the Islamic finance industry. To date, investors include Sheesha Finance, Blockchain Australia, Mozaic, Contango Digital Assets, NewTribe Capital, Acreditus Partners, EMGS Group, MKD Capital and a grant from Polygon Technology.

About MRHB DeFi

MRHB DeFi is a halal, decentralized finance platform built to embody the true spirit of an “Ethical and Inclusive DeFi” by following faith-based financial and business principles, where all excluded communities can benefit from the full empowerment potential of DeFi.

The diverse team comprises researchers, technocrats, influencers, Islamic fintech experts & business entrepreneurs, who came together to ensure that MRHB DeFi prevails in a manner that will impact society as a whole, essentially bridging the gap between the faith-conscious communities and the blockchain world.

MRHB DeFi Official Channels

Website: https://marhabadefi.com

Twitter: https://twitter.com/marhabadefi

Telegram: https://t.me/mdf_official

Telegram Announcements: https://t.me/marhabadefi_ANN

YouTube: https://www.youtube.com/channel/UCHuvZG9DbS5ffeoqLX_bERg

Medium: https://medium.com/@mrhbdefi

LinkedIn: https://www.linkedin.com/company/marhabadefi

Telegram (Arabic): https://t.me/mdf_arabic

Telegram (Russian): https://t.me/marhabadefi_russia

Telegram (Turkish): https://t.me/MarhabaDefiTR

About Sinofy Group

Sinofy Group is an end-to-end tech consulting management firm headquartered in Shanghai, offering a range of services across blockchain, fintech, cybersecurity, robotics, medtech, gaming, AI/ML and AR/VR industries.

The company deals with customized solutions built to “Sinofy, Fund, and Empower” tech companies in the world`s most digitally connected region — China and Southeast Asia. To date, they have worked with innovative tech brands seeking to expand their digital reach and penetrate into new markets. Their vast global network brings a world-class blend of expertise and support.

[ad_2]

Source link -

Coinbase expands international payments options for institutional customers

[ad_1]

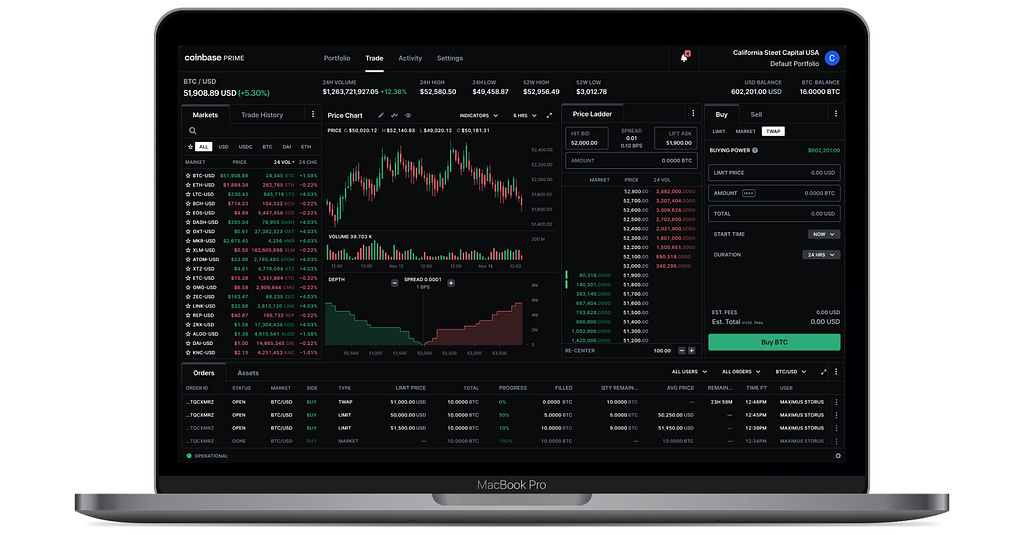

One of our top priorities at Coinbase is to be the most trusted and easy-to-use platform for accessing the broader cryptoeconomy. Coinbase currently offers our institutional clients easy access to the crypto markets through advanced trading and custody technology. But being easy-to-use also means providing a strong set of global fiat payment rails. Starting today institutional customers can access additional trading pairs and payments options through an expansion of supported fiat currencies on Coinbase Exchange.

Until now, many of our global clients have been limited to purchasing crypto in their local currency only. We now offer the fiat rails to enable deposits and withdrawals in USD, EUR, or GBP and access to the related trading pairs. This expansion of supported currencies has been a top request from international clients and has the potential to unlock billions of dollars in trading volume through improved access to major pools of liquidity. Institutional customers will now be able to trade in and out of various currencies regardless of where they are based. This is an important step in Coinbase’s journey towards creating a global trading platform.

“Access to SEN on Coinbase provides us with the flexibility to move USD quickly, keep providing liquidity in fast markets, and take advantage of opportunities” says Morgan Vincent, Head of Trading at Wintermute.

To learn more about Coinbase Prime, Exchange, Custody, our execution services, or Coinbase’s white label brokerage services click here.

Coinbase expands international payments options for institutional customers was originally published in The Coinbase Blog on Medium, where people are continuing the conversation by highlighting and responding to this story.

[ad_2]

Source link