[ad_1]

As of March 22, the bitcoin holdings of Grayscale’s Bitcoin Trust (GBTC) have diminished by 27,917.37 compared to its status three days prior, now amounting to 350,252 bitcoin valued at approximately $22.2 billion. Since evolving into an exchange-traded fund (ETF) listed on public exchanges, GBTC has shed billions in bitcoin over the preceding 71 days. […]

As of March 22, the bitcoin holdings of Grayscale’s Bitcoin Trust (GBTC) have diminished by 27,917.37 compared to its status three days prior, now amounting to 350,252 bitcoin valued at approximately $22.2 billion. Since evolving into an exchange-traded fund (ETF) listed on public exchanges, GBTC has shed billions in bitcoin over the preceding 71 days. […]

[ad_2]

Source link

Tag: Days

-

From Peak to Present: GBTC’s Bitcoin Holdings Decrease by 266,827 BTC in 71 Days

-

BONK Bonked: Price Crashes 30% In 7 Days

[ad_1]

The memecoin BONK has faced a significant setback as its prices plummeted by 30% in the last week, sparking discussions about the need to reassess predictions for this meme token. This decline in value has been accompanied by a drop in BONK’s open interest to its lowest level in the past month, signaling potential challenges ahead for the token.

Market Performance And Price Predictions

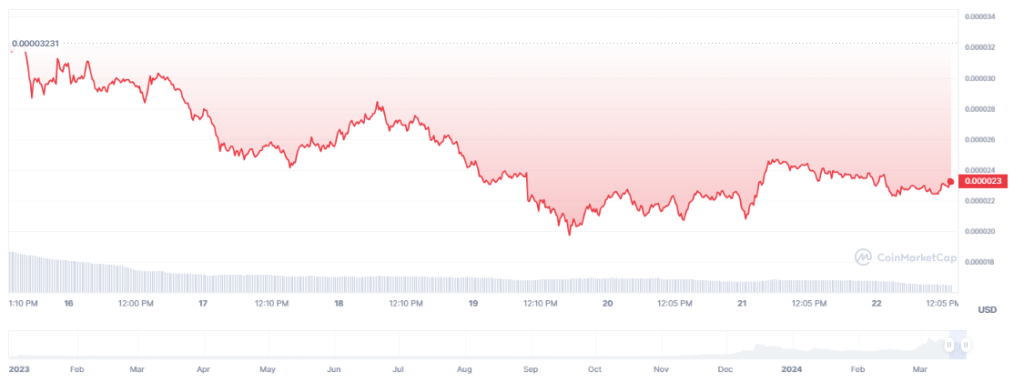

The recent slump in BONK’s prices has raised concerns among investors and traders, with key technical indicators hinting at the possibility of further declines in its value. At present, BONK is trading at $0.000023, making it one of the cryptocurrencies with the most losses over the past week. The altcoin’s future trajectory remains uncertain as market dynamics continue to evolve.

BONK price down in the last seven days. Source: Coingecko

BONK price down in the last seven days. Source: CoingeckoFollowing a rejection at $0.00004, the price of BONK lost momentum and had a 35% value adjustment. After then, there was a period of sideways trading for the memecoin. The bulls lost steam as the volatility increased and broke through the support level; the market has been trading sideways ever since.

The recent analysis of BONK’s price performance reveals a shift in sentiment towards bearish outlooks, with weighted sentiment turning negative and key technical indicators confirming the presence of bearish sentiments. This negative sentiment among market participants could potentially lead to further declines in BONK’s value unless there is a significant shift in market dynamics.

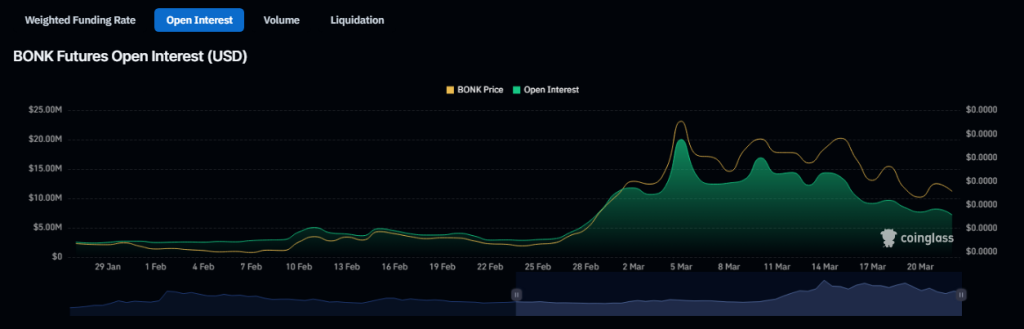

Source: Coinglass

Open Interest Plummets

Futures open interest in the cryptocurrency fell to its lowest level in one month, which led to a decrease in its price. The open interest in BONK began to fall on March 5th and has since fallen by 60%, according to statistics from Coinglass.

Traders’ interest or involvement in the derivative market for an asset declines as its open interest diminishes. This usually happens when there is a change in investor mood, leading to more people trying to cut losses or take profits.

Total crypto market cap at $2.4 trillion on the daily chart: TradingView.com

Impact On Investor Sentiment And Market Dynamics

The recent price slump in BONK has had a notable impact on investor sentiment, with many adopting a cautious approach towards the token’s future prospects. This shift in sentiment has also influenced trading volumes and market activity, as investors reassess their positions and strategies in light of BONK’s price movements.

Expert Price Predictions And Analysis

As market observers examine BONK’s price predictions, varying outlooks emerge regarding its future performance. While some forecasts suggest a bearish scenario with a price of $0.000018 in 2024, others paint a more optimistic picture, projecting an average price of $0.000067 by April 17, 2024. These contrasting predictions highlight the volatility and unpredictability inherent in the cryptocurrency market.

Featured image from Andrea Piacquadio/Pexels, chart from TradingView

Disclaimer: The article is provided for educational purposes only. It does not represent the opinions of NewsBTC on whether to buy, sell or hold any investments and naturally investing carries risks. You are advised to conduct your own research before making any investment decisions. Use information provided on this website entirely at your own risk.

[ad_2]

Source link -

Highlights from Coinbase’s First Smart Contract Hack Days | by Coinbase | Apr, 2022

[ad_1]

By Michael Li, Vice President, Data at Coinbase

Hackathons have been a long-standing and important part of Coinbase culture, as they give our engineering teams the opportunity to collaborate with one another and experiment directly with the tools that are enabling a new era of open finance.

At Coinbase, we acknowledge that Web3 unlocks a whole new realm of possibilities for developers that are largely yet to be explored. In order to pursue these possibilities confidently, engineers need to have a baseline knowledge of the ecosystem, the Web3 stack, and key smart contract concepts across different blockchain protocols.

This year, we used the time set aside for the annual Coinbase hackathon to kick off Smart Contract Hack Days to give all of our engineers a crash course in Web3 development for real-world applications.

Time to BUIDL

In December, we assigned all participants to project pods of 5–10 individuals which were led by an experienced Coinbase team member that had been through in-depth blockchain engineering training. Following a day-long crash course in Solidity (developer tools and workflow), each pod had 48 hours to build a demo that would be judged on product, engineering, and design.

Participating pods had a chance to score one of the eight awards and crypto-forward prizes. Award categories included People’s Choice (selected by the entire audience), Learning Showcase (the pod that demonstrated the most learning through working on their project), Judges Choice (overall judge favorites), Best Executed (evaluates quality, teamwork and overall execution), and Most Creative (the most exciting and creative take on hack day guidelines).

Hack Day Showstoppers

Among the 44 pods that presented on Smart Contract Hack Demo Day, the top 5 categories of project submissions spanned Web3 infrastructure, gaming, DAOs, NFTs, and event ticketing.

While there were many strong ideas presented, some of the key ones to highlight (along with their taglines) include:

- (Gas)tly: Complete gas transactions with confidence

- Concert-AMWest-2: A NFT concert ticket and a marketplace contract that can transfer funds from the buyer to the marketplace and royalty to the musician

- GenEd Labs: A charitable giving DAO that enables the ethical investor to leverage the blockchain to close the skill gap within underserved communities.

- Real-Time Shibas: Capture the yield farms with your Shiba army

- BridgeIt: Pooling deposits together for cost-efficient bridging

- Not So Bored Apes: Decentralizing and revolutionizing the casino world one step at a time

What We’ve Learned After Experiencing a Day in the Life of a Web3 Dev

We were inspired by the number of creative product ideas that were presented during this time and took many important insights away to be applied for future training and hackathons.

Some of these insights include:

- Teams need more focus time to execute — many projects felt they lacked adequate time to execute due to competing priorities from day-to-day work. We will improve by providing full dedicated time for all participants in the future.

- Participants would like more autonomy in team creation — team dynamics are important. Finding teammates who share a similar vision or vibe or may have complementary work styles and perspectives can go a long way, especially in high-pressure scenarios.

- Save room for ideation — rather than being assigned to projects, participants may feel more engaged or motivated to take an idea over the finish line if they feel more passionate about what they’re building.

What’s Next?

One of the most exciting things about Web3 is its limitless potential. It is likely that it will touch every single industry — whether that be as the infrastructure that underpins a wave of new products or as the tool for interacting with brands and businesses in a more trustless and equitable way. This year’s hackathon, in many ways, is a testament to the efforts needed to onboard developers from the world of Web2 to Web3.

At Coinbase, we remain optimistic about the future of the industry and are committed to spearheading new initiatives that will allow our teams to continue learning, creating and building together.

We are always looking for top talent to join our ever-growing team and #LiveCrypto. Learn more about open positions on our website.

[ad_2]

Source link -

How SEC Chair Gary Gensler’s Views on Crypto Have Changed Since His MIT Days

[ad_1]

Nik De, managing editor for global policy and regulation at CoinDesk, stops by Unconfirmed to discuss the current state of crypto regulation, including recent comments by SEC Chair Gary Gensler on stablecoins and why Coinbase decided to sideline its Lend product. Highlights:

- Nik’s biggest takeaway from Gary Gensler’s interview with the Washington Post

- why Nik thinks Gensler has escalated his rhetoric regarding stablecoins and DeFi

- how crypto exchanges are currently regulated and how that might change

- what it would take to convince crypto exchanges to register with the SEC

- whether the SEC has the purview to regulate stablecoins

- Nik’s thoughts on Coinbase’s Lend product and the SEC’s stance on lending products

- what the overall picture of crypto lending is in the US

- whether the SEC will go after DeFi protocols

- what to expect from the SEC going forward, especially with the end of its fiscal year coming up next week

Thank you to our sponsors!

Crypto.com: https://crypto.onelink.me/J9Lg/unconfirmedcardearnfeb2021

Digital Asset Research: https://digitalassetresearch.com

Sorare: https://sorare.com

Episode Links

Nikhilesh De

Content

- Coinbase blogs regarding Lend

- SEC Chair Gary Gensler Washington Post Q&A

- Brian Armstrong tweet storm

- BlockFi and Celsius overview

Read my latest Medium post, “The Reason Crypto Regulation Is Turning Out to Be So Difficult,” which takes take a deeper dive into some of the topics addressed in this pod 🙂

[ad_2]

Source link