[ad_1]

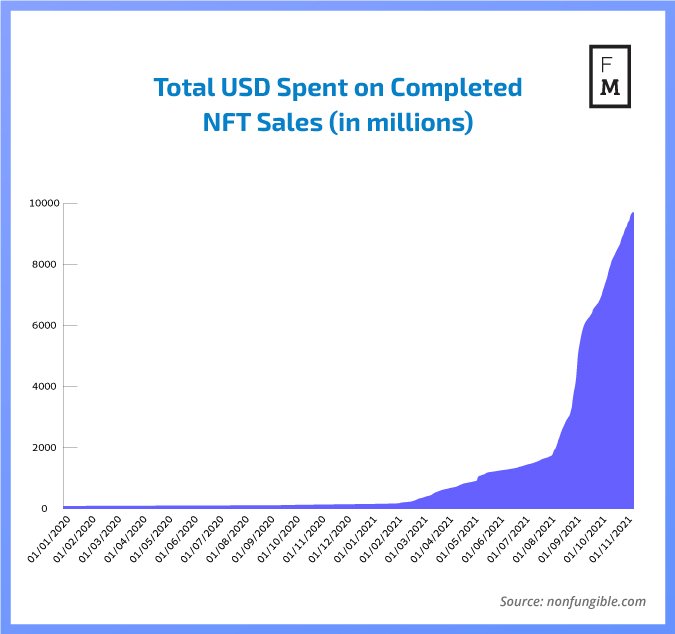

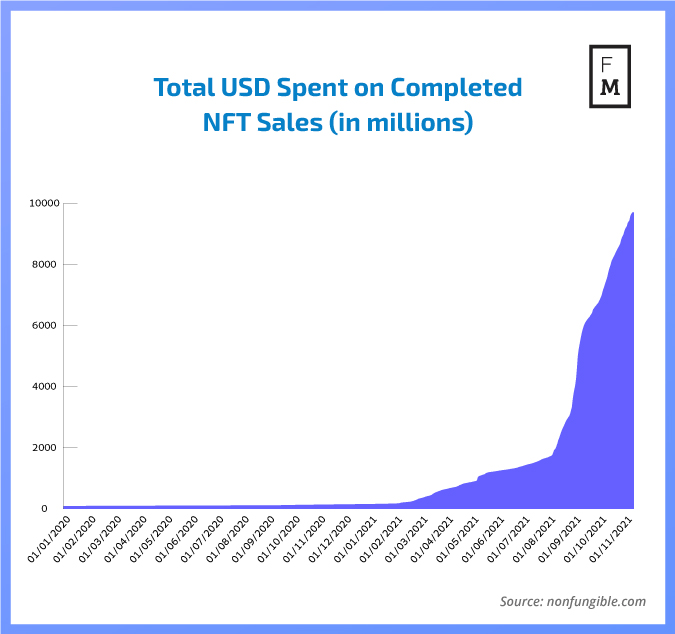

Although the first non-fungible token (NFT) was launched as early as 2015, the market fever around this exciting asset class did not kick off until 2020 when it broke all-time records. The value of NFTs sold in the third quarter of this year reached a record level of $10.7 billion, and the craze around them is no longer reserved exclusively for a narrow group of crypto and blockchain enthusiasts.

The NFT industry has embraced digital artists, celebrities, actors and large companies to look at and engage in this fast-growing industry as a way to maximize profits and build brand awareness. But, are NFTs suitable for everyone? Do they bring added value to retail investment platforms, foreign exchange (Forex) and contracts for difference (CFD) brokers?

Finance Magnates has x-rayed what stands behind the success of CryptoPunks, Bored Apes and other digital collectibles, and it has discussed the subject with industry experts asking if they see an opportunity for Forex and contracts for difference brokers to use NFTs as promotional or trading assets.

Non-Fungible Token (NFT) = An Opportunity for Your Brand?

Famous brands and large companies have quickly discovered that NFTs can be a great way to build popularity among new economy participants and take advantage of the booming trend. As experts point out, it can be a great product for advertising new products and building brand awareness.

“With NFTs, brands can create a buzz about a new product, create scarce and exclusive collectible assets to tell the brand story, or even support causes through token sales. Consumers today like to see brands driving sustainability efforts, which can be seen in the rise of ESG investments. So, brands might look to attract this demographic with NFTs,” Charlotte Day, Director of the Contentworks Agency, said.

As the pandemic months have shown, retail investors aimed trading stands not so far from gamification, and experts have repeatedly commented on the gamification of the industry (commission-free trading platforms gaining huge popularity, such as Robinhood).

Suggested articles

$100,000 Battle: PrimeXBT Debuts New Contests ModuleGo to article >>

According to Philip Gunwhy, the Chief Marketing Officer for the NFT ecosystem, Blockasset, “traditional finance (or TradFi) moves slower than crypto, but it is inevitable that more and more brokers will enter the space in the future.”

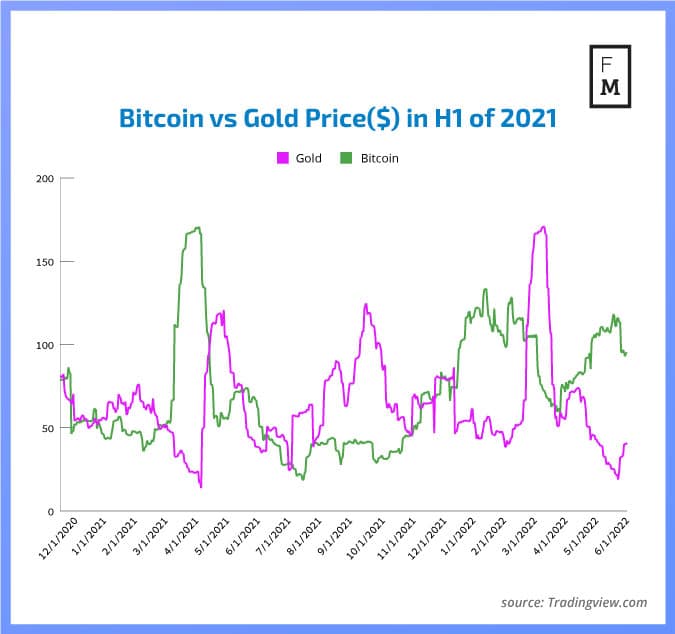

“It was only in 2020 that many institutions started to look at Bitcoin for the first time. That is still more or less the case today, save for those who are looking into Ethereum. Although NFTs have been around for around five years now, they have only really caught on in 2021. As the space matures, we can see many traditional brokers looking to break in: there is already evidence of that now, with crypto-native firms like Three Arrows Capital dropping millions of dollars on blue chips like Fidenza and Ringers,” Gunwhy commented.

CFDs for NFT-oriented Stocks?

One of the most attractive ways for CFD brokers to tap into this rapidly building market is by offering clients access to NFT-oriented stocks. This is the simplest and easiest method to implement initially. The list of companies related to the non-fungible tokens is long and among the most popular ones you can find: Cloudflare (NET), Mattel (MAT), Dolphin Entertainment (DLPN), Takung Art (TKAT), PLBY Group (PLBY), Funko (FNKO) and, of course, Twitter (TWTR).

Cloudflare’s stock price increased 350% last year, and in 2021 it has gained another 156%. In the case of Mattel, the appreciation is not as high but is also attractive for investors, amounting to over 50% since the beginning of 2020. Moreover, investors are very interested in Funko shares, which have grown by 65% YTD. Such rates of return will undoubtedly be of interest to current and new potential clients.

To get the full article and the bigger picture on NFT phenomena, get our latest Quarterly Intelligence Report.

Per Quarter

€510

1 issue per Year

–

Digital Version delivered to your email

Annual

€1,780

4 issues per Year

–

Digital Version delivered to your email

[ad_2]

Source link