[ad_1]

Despite experiencing a downturn for four straight weeks, eight blockchain networks logged $3.77 billion in non-fungible token (NFT) sales in the first quarter of 2024. Leading the charge, Ethereum-centric NFTs accounted for $1.4 billion or 37% of the NFT sales during Q1 2024. The Dual Forces of Organic NFT Sales and Wash Volume Across Several […]

Despite experiencing a downturn for four straight weeks, eight blockchain networks logged $3.77 billion in non-fungible token (NFT) sales in the first quarter of 2024. Leading the charge, Ethereum-centric NFTs accounted for $1.4 billion or 37% of the NFT sales during Q1 2024. The Dual Forces of Organic NFT Sales and Wash Volume Across Several […]

[ad_2]

Source link

Tag: Billion

-

8 Blockchain Giants Log $3.77 Billion in NFT Sales in Q1 2024

-

Bitcoin Miners’ Earnings Hit Record $2 Billion in March Ahead of Halving Event

[ad_1]

In March, bitcoin miners amassed an unprecedented level of revenue not seen in the previous 12 months, hitting a high of $2.01 billion from rewards and transfer fees. Of this total, $85.81 million was earned from transaction fees over the past month. Historic Month for Bitcoin Miners — Income Peaks at $2 Billion As we […]

In March, bitcoin miners amassed an unprecedented level of revenue not seen in the previous 12 months, hitting a high of $2.01 billion from rewards and transfer fees. Of this total, $85.81 million was earned from transaction fees over the past month. Historic Month for Bitcoin Miners — Income Peaks at $2 Billion As we […]

[ad_2]

Source link -

Dogecoin Open Interest Hits Record $2.2 Billion

[ad_1]

The Dogecoin open interest has been on the rise over the past few weeks, breaking and setting new all-time highs twice this March. Unsurprisingly, the price of the meme coin has been reflecting the growth seen by its open interest.

This recent bullish momentum pushed the price of DOGE to break the $0.22 mark, its highest point in three years. However, the question is – how far can this rally go for the foremost meme token?

Dogecoin Open Interest Breaks Above $2 Billion

According to data from CoinGlass, the Dogecoin open interest broke through the $2 billion mark on Friday, March 29. Although DOGE’s open interest stands at around 1.96 billion at press time, it rose as high as $2.21 billion on Friday, a new record for the meme coin.

Open interest is a metric that measures the total number of futures or options contracts of a particular cryptocurrency (Dogecoin, in this case) in the market at a given time. It provides insight into the amount of money investors are pouring into DOGE derivatives at this time.

The meme token’s open interest has had quite a performance since the start of March. DOGE’s open interest rose to $1.6 billion (an all-time high at the time) earlier in the month before retracing to below $1 billion by March 20.

It is worth noting that there has been a high correlation between open interest and Dogecoin’s price, with both climbing at the same time and at almost the same pace. Typically, a rising open interest can suggest a continuation of the trend around the asset’s price at the moment.

Ultimately, the current high open interest for DOGE could mean a rapid price movement for the meme coin in the near future. However, it would be difficult to tell the direction in which this spurt of volatility would take the price of Dogecoin, especially as open interest is not the most optimal indicator of trends or price action.

DOGE Price Overview

As of this writing, the Dogecoin price stands at $0.204, reflecting a 4.6% decline in the last 24 hours. While the meme token’s price has somewhat struggled since hitting the three-year high, it has managed to retain most of its profit from the past week.

According to CoinGecko data, the Dogecoin price is up by a whopping 18% in the past seven days. This positive performance has strengthened DOGE’s position as the largest meme coin in the market, with a market capitalization of $29 billion.

Dogecoin price sees slight correction on the daily timeframe | Source: DOGEUSDT chart on TradingView

Featured image from Pexels, chart from TradingView

Disclaimer: The article is provided for educational purposes only. It does not represent the opinions of NewsBTC on whether to buy, sell or hold any investments and naturally investing carries risks. You are advised to conduct your own research before making any investment decisions. Use information provided on this website entirely at your own risk.

[ad_2]

Source link -

March Sees Nearly $1 Billion In Ethereum Netflow To Centralized Exchanges

[ad_1]

The price of Ethereum has not exactly lived up to its promise as the month has gone on, despite a stellar start to the month. While this bearish pressure has been widespread in the general cryptocurrency market, regulation uncertainty has been an additional concern for ETH, igniting a negative sentiment around the “king of altcoins.”

Interestingly, the latest on-chain revelation shows a substantial amount of Ethereum has made its way to exchanges so far in March, suggesting that investors might be losing confidence in the long-term promise of the cryptocurrency.

Are Investors Losing Confidence In Ethereum?

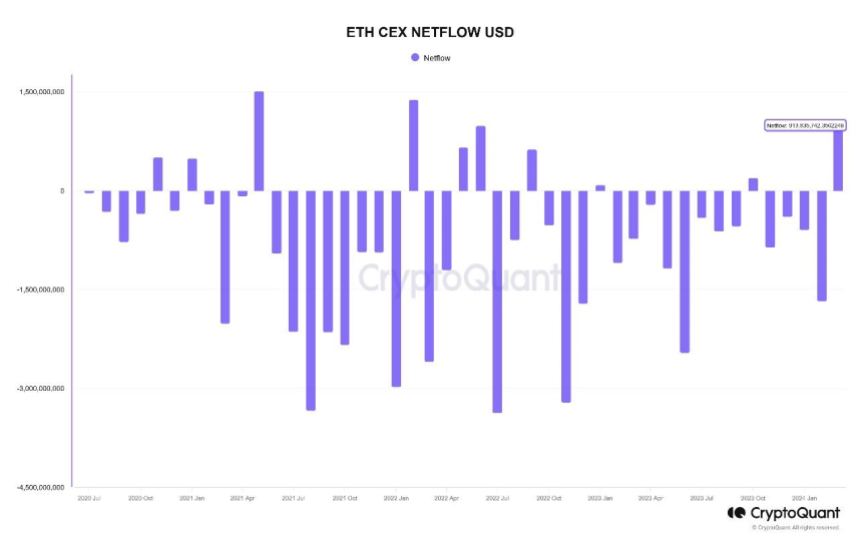

According to data from CryptoQuant, more than $913 million has been recorded in net ETH transfers to centralized exchanges so far in March. This on-chain information was revealed via a quicktake post on the data analytics platform.

This net fund movement represents the largest volume of Ethereum transferred to centralized exchanges in a single month since June 2022. Even though March is still a week from being over, this exchange inflow appears to be a complete deviation from the pattern observed over the past few months.

Chart showing total monthly netflow of ETH on centralized exchanges | Sources: CryptoQuant

As shown in the chart above, October 2023 was the last time cryptocurrency exchanges witnessed a positive net flow. It is worth noting that there was significant movement of Ethereum tokens out of the centralized platforms in subsequent months up until this month.

Meanwhile, a separate data point that supports the massive exodus of ETH to centralized exchanges has come to light. Popular crypto analyst Ali Martinez revealed on X nearly 420,000 Ethereum tokens (equivalent to $1.47 billion) have been transferred to cryptocurrency exchanges in the past three weeks.

The flow of large amounts of cryptocurrency to centralized exchanges is often considered a bearish sign, as it can be an indication that investors may be willing to sell their assets. Ultimately, this can put downward pressure on the cryptocurrency’s price.

Substantial fund movements to trading platforms could also represent a shift in investor sentiment. It could be a sign that investors are losing faith in a particular asset (ETH, in this case).

Moreover, the recent regulatory headwind surrounding Ethereum specifically accentuates this hypothesis. According to the latest report, the United States Securities and Exchange Commission is considering a probe to classify the ETH token as a security.

ETH Price

As of this writing, the Ethereum token is valued at $3,343, reflecting a 4% price decline over the past /4 hours. According to data from CoinGecko, ETH is down by 11% in the past week.

Ethereum loses the $3,400 level again on the daily timeframe | Source: ETHUSDT chart on TradingView

Featured image from Unsplash, chart from TradingView

Disclaimer: The article is provided for educational purposes only. It does not represent the opinions of NewsBTC on whether to buy, sell or hold any investments and naturally investing carries risks. You are advised to conduct your own research before making any investment decisions. Use information provided on this website entirely at your own risk.

[ad_2]

Source link -

Dogecoin Soars 25%, Crosses $20 Billion Market Cap

[ad_1]

Yesterday, Twitter confirmed its acquisition by Elon Musk in a deal worth nearly $44 billion. The announcement had a positive impact on the crypto market and specifically on Dogecoin (DOGE). The world’s largest meme coin jumped by approximately 25% within 24 hours.

Today, Dogecoin reached a high of almost $0.167, according to the data published by Coinmarketcap. With that, DOGE crossed the market cap of $20 billion for the first time in almost three weeks. The meme coin is now the 10th most valuable cryptocurrency in the world, just behind Cardano (ADA) and Terra (LUNA).

“Potentially related to the news of ElonMusk’s nearly formalized purchase of Twitter today, Dogecoin has pumped +19% over the past six hours. We have historically seen that meme coins benefit from Musk developments, & we’ll monitor this situation,” crypto analysis platform Santiment recently highlighted in a Twitter post.

Elon Musk has been one of the biggest supporters of Dogecoin. In March 2022, the CEO of Tesla confirmed that he is holding different crypto assets including Bitcoin, Ethereum and DOGE. In a Tweet last year, Elon Musk called Dogecoin “the people’s crypto.”

Meme Coins

Amid the retail frenzy in digital assets during 2021, meme coins gained significant popularity among users. DOGE and Shiba Inu witnessed monumental gains throughout last year. However, DOGE and SHIB saw consistent dips in the past 5 months. Despite the latest jump of approximately 25%, Dogecoin is still down by almost 50% compared to October 2021. A similar trend was witnessed across the Shiba Inu network. SHIB is now down by more than 60% from its all-time high in November 2021.

Despite price volatility, the adoption of DOGE and SHIB has increased in the past 12 months. Earlier this month, AMC mobile app started accepting Shiba Inu and Dogecoin for online payments.

Yesterday, Twitter confirmed its acquisition by Elon Musk in a deal worth nearly $44 billion. The announcement had a positive impact on the crypto market and specifically on Dogecoin (DOGE). The world’s largest meme coin jumped by approximately 25% within 24 hours.

Today, Dogecoin reached a high of almost $0.167, according to the data published by Coinmarketcap. With that, DOGE crossed the market cap of $20 billion for the first time in almost three weeks. The meme coin is now the 10th most valuable cryptocurrency in the world, just behind Cardano (ADA) and Terra (LUNA).

“Potentially related to the news of ElonMusk’s nearly formalized purchase of Twitter today, Dogecoin has pumped +19% over the past six hours. We have historically seen that meme coins benefit from Musk developments, & we’ll monitor this situation,” crypto analysis platform Santiment recently highlighted in a Twitter post.

Elon Musk has been one of the biggest supporters of Dogecoin. In March 2022, the CEO of Tesla confirmed that he is holding different crypto assets including Bitcoin, Ethereum and DOGE. In a Tweet last year, Elon Musk called Dogecoin “the people’s crypto.”

Meme Coins

Amid the retail frenzy in digital assets during 2021, meme coins gained significant popularity among users. DOGE and Shiba Inu witnessed monumental gains throughout last year. However, DOGE and SHIB saw consistent dips in the past 5 months. Despite the latest jump of approximately 25%, Dogecoin is still down by almost 50% compared to October 2021. A similar trend was witnessed across the Shiba Inu network. SHIB is now down by more than 60% from its all-time high in November 2021.

Despite price volatility, the adoption of DOGE and SHIB has increased in the past 12 months. Earlier this month, AMC mobile app started accepting Shiba Inu and Dogecoin for online payments.

[ad_2]

Source link -

Grayscale’s Digital AUM Drops to $32 Billion

[ad_1]

Yesterday, Grayscale published an update regarding the company’s digital assets under management. Due to the latest plunge in cryptocurrency assets, the overall value of its digital assets under management (AUM) dipped substantially in the last few weeks.

The crypto asset manager now holds approximately $32 billion worth of assets under management. In April 2021, the overall value of Grayscale’s crypto AUM topped $50 billion. Bitcoin and Ethereum remained the top 2 digital holdings of Grayscale.

According to the latest numbers published by the company, it now has over $23 billion worth of BTC assets under management. Grayscale is also holding more than $7 billion worth of ETH assets under management.

With BTC and ETH trading nearly 50% off from their respective all-time highs, the latest dip in the value of Grayscale’s digital AUM was expected. Compared to the start of 2021, the company’s crypto assets under management are still up in value. Grayscale started 2021 with approximately $20 billion worth of digital AUM.

Crypto Market

With a market cap drop of more than $1.3 trillion in the last 10 weeks, the crypto market is going through one of its worst corrections. However, the digital assets showed some signals of stability in the past week. In the last 7 days, BTC gained almost 7% while BNB and DOGE spiked by more than 10%.

“Ethereum has regained the $2,550 level to end the week. With Bitcoin ending the week with a nice push of its own, and ETH’s active address remaining stable, the number 2 crypto asset by market cap should maintain stable prices if utility continues rising,” Santiment noted.

“Chainlink’s price was cut in half between January 10th and 24th. The crowd predictably became quite negative toward the popular ETH-based asset. Today, with the FUD appearing to be at its peak, LINK has rebounded a modest +7% in the past 4 hours,” the company added.

Yesterday, Grayscale published an update regarding the company’s digital assets under management. Due to the latest plunge in cryptocurrency assets, the overall value of its digital assets under management (AUM) dipped substantially in the last few weeks.

The crypto asset manager now holds approximately $32 billion worth of assets under management. In April 2021, the overall value of Grayscale’s crypto AUM topped $50 billion. Bitcoin and Ethereum remained the top 2 digital holdings of Grayscale.

According to the latest numbers published by the company, it now has over $23 billion worth of BTC assets under management. Grayscale is also holding more than $7 billion worth of ETH assets under management.

With BTC and ETH trading nearly 50% off from their respective all-time highs, the latest dip in the value of Grayscale’s digital AUM was expected. Compared to the start of 2021, the company’s crypto assets under management are still up in value. Grayscale started 2021 with approximately $20 billion worth of digital AUM.

Crypto Market

With a market cap drop of more than $1.3 trillion in the last 10 weeks, the crypto market is going through one of its worst corrections. However, the digital assets showed some signals of stability in the past week. In the last 7 days, BTC gained almost 7% while BNB and DOGE spiked by more than 10%.

“Ethereum has regained the $2,550 level to end the week. With Bitcoin ending the week with a nice push of its own, and ETH’s active address remaining stable, the number 2 crypto asset by market cap should maintain stable prices if utility continues rising,” Santiment noted.

“Chainlink’s price was cut in half between January 10th and 24th. The crowd predictably became quite negative toward the popular ETH-based asset. Today, with the FUD appearing to be at its peak, LINK has rebounded a modest +7% in the past 4 hours,” the company added.

[ad_2]

Source link -

FTX Launches $2 Billion VC Fund to Invest in Crypto Startups

[ad_1]

On January 14, FTX, a popular Bahamian-based

cryptocurrency exchange led by Sam Bankman-Fried, announced a launch of a new venture capital business unit called FTX Ventures. According to the Wall Street Journal media outlets, the exchange has pumped $2 billion fund into the new capital unit to focus on investing in crypto-industry startups. The allocation makes the FTX Ventures’ fund as one of the largest venture capitals in the crypto industry. FTX exchange disclosed that the $2 billion venture fund will be led by Amy Wu, a former General Partner at $10 billion venture capital firm Lightspeed.As per FTX exchange, the FTX Ventures will majorly focus on

blockchain and cryptocurrency investments. Wu talked about the development and stated that the fund will make strategic concentrated bets into companies in the crypto market, from Latin America, Africa, and beyond. She said that FTX Ventures is especially excited about consumer and social web3 as well as Web3 gaming applications. She further mentioned that the venture firm also targets layer-1 and layer-2 blockchain platforms, blockchain infrastructure, cross-chain protocols, crypto-fueled and NFT-powered video games, and wallet payment applications.“It’s not necessarily tied to the strategy of FTX. The objective is more to accelerate the adoption of blockchain technology. We want to be known for the value add that we bring, leveraging the resources, the expertise and the global network of FTX,” Wu elaborated.

Why Crypto Startups Are Attracting Venture Capital Money

The development by FTX cryptocurrency exchange to have launched its FTX Ventures’ fund comes at a time when the crypto and blockchain space sees a lot of interest from venture capital companies. Such interests translated into a significant amount of investments made in the space during the year 2021. Startups in the crypto and blockchain sector have become winners in the category of record-breaking fundraising. Venture capitalists bet big in cryptocurrency in the previous year, investing more cash than ever into emerging companies in the sector. Startups in the blockchain and crypto space were powered by a record $33 billion in ventral capital funding last year. That can be compared with the year 2020, which saw venture funding of about $3.1 billion.

In 2021, about 43% of crypto funding went into firms involved in lending, investing, exchange services, and trading of cryptocurrencies. Meanwhile, 17% was channeled towards startups in Metaverse (a network of 3D virtual worlds), Web3 (a decentralized online ecosystem based on the blockchain), DAOs (decentralized autonomous organizations), and FTs (non-fungible tokens). Other categories that also attracted significant venture capital interest include decentralized finance, infrastructure, and custody.

Crypto startups have become so profitable that they have begun attracting growth-stage capital. In the previous year, major crypto funds such as Hivemind, a16z, and Paradigm managed to raise billions of dollars to bet in crypto and blockchain startups.

On January 14, FTX, a popular Bahamian-based

cryptocurrency exchange led by Sam Bankman-Fried, announced a launch of a new venture capital business unit called FTX Ventures. According to the Wall Street Journal media outlets, the exchange has pumped $2 billion fund into the new capital unit to focus on investing in crypto-industry startups. The allocation makes the FTX Ventures’ fund as one of the largest venture capitals in the crypto industry. FTX exchange disclosed that the $2 billion venture fund will be led by Amy Wu, a former General Partner at $10 billion venture capital firm Lightspeed.As per FTX exchange, the FTX Ventures will majorly focus on

blockchain and cryptocurrency investments. Wu talked about the development and stated that the fund will make strategic concentrated bets into companies in the crypto market, from Latin America, Africa, and beyond. She said that FTX Ventures is especially excited about consumer and social web3 as well as Web3 gaming applications. She further mentioned that the venture firm also targets layer-1 and layer-2 blockchain platforms, blockchain infrastructure, cross-chain protocols, crypto-fueled and NFT-powered video games, and wallet payment applications.“It’s not necessarily tied to the strategy of FTX. The objective is more to accelerate the adoption of blockchain technology. We want to be known for the value add that we bring, leveraging the resources, the expertise and the global network of FTX,” Wu elaborated.

Why Crypto Startups Are Attracting Venture Capital Money

The development by FTX cryptocurrency exchange to have launched its FTX Ventures’ fund comes at a time when the crypto and blockchain space sees a lot of interest from venture capital companies. Such interests translated into a significant amount of investments made in the space during the year 2021. Startups in the crypto and blockchain sector have become winners in the category of record-breaking fundraising. Venture capitalists bet big in cryptocurrency in the previous year, investing more cash than ever into emerging companies in the sector. Startups in the blockchain and crypto space were powered by a record $33 billion in ventral capital funding last year. That can be compared with the year 2020, which saw venture funding of about $3.1 billion.

In 2021, about 43% of crypto funding went into firms involved in lending, investing, exchange services, and trading of cryptocurrencies. Meanwhile, 17% was channeled towards startups in Metaverse (a network of 3D virtual worlds), Web3 (a decentralized online ecosystem based on the blockchain), DAOs (decentralized autonomous organizations), and FTs (non-fungible tokens). Other categories that also attracted significant venture capital interest include decentralized finance, infrastructure, and custody.

Crypto startups have become so profitable that they have begun attracting growth-stage capital. In the previous year, major crypto funds such as Hivemind, a16z, and Paradigm managed to raise billions of dollars to bet in crypto and blockchain startups.

[ad_2]

Source link -

Bitcoin Struggles near $800 Billion Market Cap

[ad_1]

Since the start of 2022, the crypto market cap has been shrinking. Bitcoin is leading the latest market dump. The crypto asset lost nearly 20% of its value in the last 10 days as its market cap dipped below $800 billion.

Bitcoin is not the only digital asset facing a market correction these days. Ethereum’s performance is even worst. ETH plunged heavily over the weekend and reached a low of $3,035 on Saturday. The digital asset has lost almost a quarter of its value since the start of 2022.

Crypto analysts across the market called the correction a natural portfolio adjustment after a substantial bullish rally in 2021. However, some short-term investors are worried about Bitcoin’s lackluster network activity this year.

“With one week of 2022 in the books, crypto market caps have been shrinking quite rapidly. Whale behaviors and on-chain fundamentals haven’t been looking so hot. But during these times, it’s often easy to forget that social sentiment plays a major role in how and when things will turn around,” Santiment noted in its report.

Bitcoin and Institutions

2021 was a remarkable year for Bitcoin in terms of institutional adoption. With technology giants like Tesla announcing multi-billion dollar investment in the crypto asset, existing BTC holders increased their crypto holdings. In 2022, leading crypto investors are optimistic about the wider adoption of Bitcoin. In a discussion with CNBC last week, Mike Novogratz, CEO of Galaxy Digital, said that many institutions are planning to add Bitcoin to their balance sheets.

“We see a tremendous amount of institutional demand on the sidelines. I’m not nervous in the medium-term. I know big institutions that are going through their process to put positions on. They’re going to see those as attractive levels to buy. On the charts, $38,000, $40,000 feel like where we should bottom,” Novogratz explained.

Since the start of 2022, the crypto market cap has been shrinking. Bitcoin is leading the latest market dump. The crypto asset lost nearly 20% of its value in the last 10 days as its market cap dipped below $800 billion.

Bitcoin is not the only digital asset facing a market correction these days. Ethereum’s performance is even worst. ETH plunged heavily over the weekend and reached a low of $3,035 on Saturday. The digital asset has lost almost a quarter of its value since the start of 2022.

Crypto analysts across the market called the correction a natural portfolio adjustment after a substantial bullish rally in 2021. However, some short-term investors are worried about Bitcoin’s lackluster network activity this year.

“With one week of 2022 in the books, crypto market caps have been shrinking quite rapidly. Whale behaviors and on-chain fundamentals haven’t been looking so hot. But during these times, it’s often easy to forget that social sentiment plays a major role in how and when things will turn around,” Santiment noted in its report.

Bitcoin and Institutions

2021 was a remarkable year for Bitcoin in terms of institutional adoption. With technology giants like Tesla announcing multi-billion dollar investment in the crypto asset, existing BTC holders increased their crypto holdings. In 2022, leading crypto investors are optimistic about the wider adoption of Bitcoin. In a discussion with CNBC last week, Mike Novogratz, CEO of Galaxy Digital, said that many institutions are planning to add Bitcoin to their balance sheets.

“We see a tremendous amount of institutional demand on the sidelines. I’m not nervous in the medium-term. I know big institutions that are going through their process to put positions on. They’re going to see those as attractive levels to buy. On the charts, $38,000, $40,000 feel like where we should bottom,” Novogratz explained.

[ad_2]

Source link -

Scaling Ethereum & crypto for a billion users

[ad_1]

A guide to the multi-chain future, sidechains, and layer-2 solutions

Around the Block from Coinbase Ventures sheds light on key trends in crypto. Written by Justin Mart & Connor Dempsey.

As of late 2021, Ethereum has grown to support thousands of applications from decentralized finance, NFTs, gaming and more. The entire network settles trillions of dollars in transactions annually, with over $170 billion locked on the platform.

But as the saying goes, more money, more problems. Ethereum’s decentralized design ends up limiting the amount of transactions it can process to just 15 per second. Since Ethereum’s popularity far exceeds 15 transactions per second, the result is long waits and fees as high as $200 per transaction. Ultimately, this prices out many users and limits the types of applications Ethereum can handle today.

If smart-contract based blockchains are to ever grow to support finance and Web 3 applications for billions of users, scaling solutions are needed. Thankfully, the cavalry is beginning to arrive, with many proposed solutions coming online recently.

In this edition of Around The Block, we explore the crypto world’s collective quest to scale.*

To compete or to complement?

The goal is to increase the number of transactions that openly accessible smart contract platforms can handle, while retaining sufficient decentralization. Remember, it would be trivial to scale smart contract platforms through a centralized solution managed by a single entity (Visa can handle 45,000 transactions per second), but then we’d be right back to where we started: a world owned by a handful of powerful centralized actors.

The approaches being taken to fix this problem come twofold: (1) build brand new networks competitive to Ethereum that can handle more activity, or (2) build complementary networks that can handle Ethereum’s excess capacity.

Broadly, they break out across a few categories:

- Layer 1 blockchains (competitive to Ethereum)

- Sidechains (somewhat complementary to Ethereum)

- Layer 2 networks (complementary to Ethereum)

While each differs in architecture and approach, the goal is the same: let users actually use the networks (eg, interact with DeFi, NFTs, etc) without paying exorbitant fees or experiencing long wait times.

Layer 1s

Ethereum is considered a layer 1 blockchain — an independent network that secures user funds and executes transactions all in one place. Want to swap 100 USDC for DAI using a DeFi application like Uniswap? Ethereum is where it all happens.

Competing layer 1s do everything Ethereum does, but in a brand new network, soup to nuts. They’re differentiated by new system designs that enable higher throughput, leading to lower transaction fees, but usually at the cost of increased centralization.

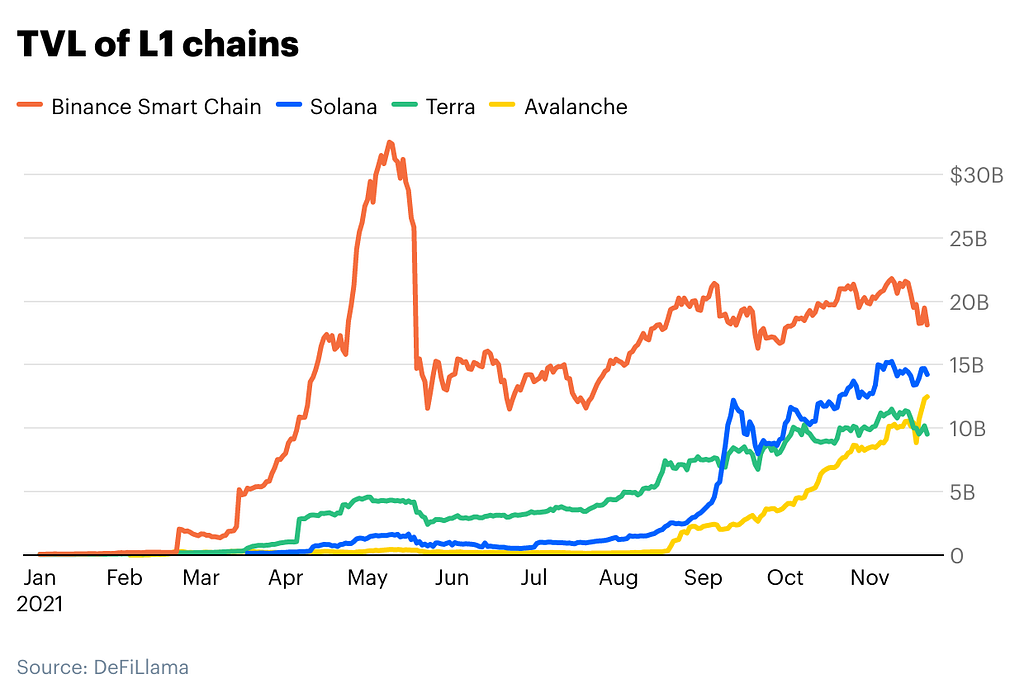

New layer 1s have come online in droves over the last 10 months, with the aggregate value on these networks rocketing from $0 to ~$75B over the same time period. This field is currently led by Solana, Avalanche, Terra, and Binance Smart Chain, each with growing ecosystems that have reached over $10 billion in value.

Leading non-ETH L1s by TVL All layer 1s are in competition to attract both developers and users. Doing so without any of Ethereum’s tooling and infrastructure that make it easy to build and use applications, is difficult. To bridge this gap, many layer 1s employ a tactic called EVM compatibility.

EVM stands for the Ethereum Virtual Machine, and it’s essentially the brain that performs computation to make transactions happen. By making their networks compatible with the EVM, Ethereum developers can easily deploy their existing Ethereum applications to a new layer 1 by essentially copying and pasting their code. Users can also easily access EVM compatible layer 1s with their existing wallets, making it simple for them to migrate.

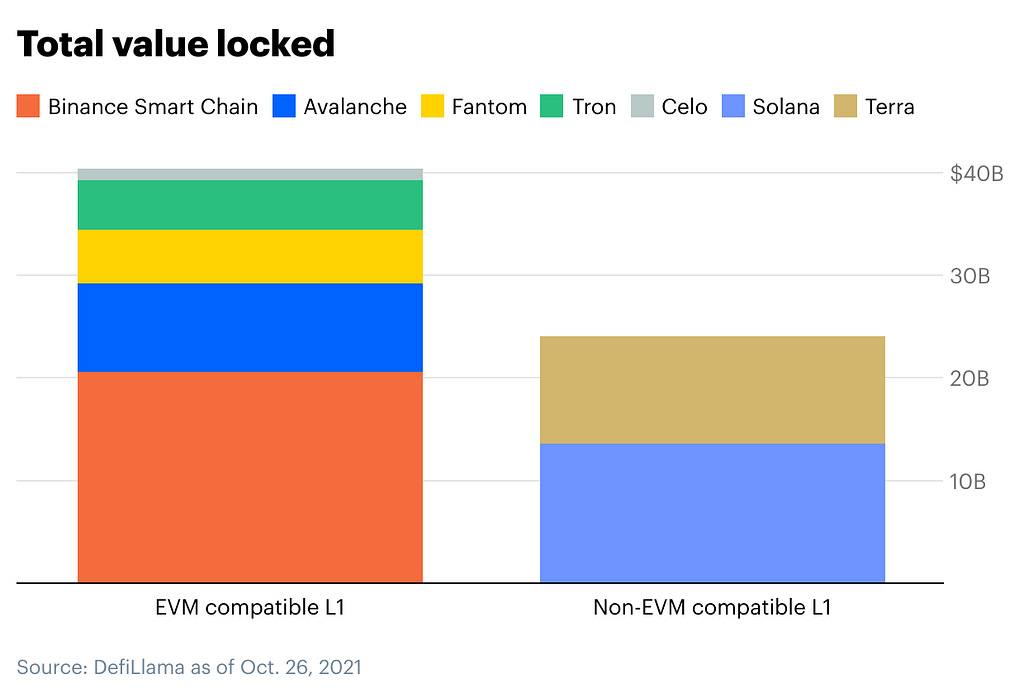

Take Binance Smart Chain (BSC) as an example. By launching an EVM compatible network and tweaking the consensus design to enable higher throughput and cheaper transactions, BSC saw usage explode last summer across dozens of DeFi applications all resembling popular Ethereum apps like Uniswap and Curve. Avalanche, Fantom, Tron, and Celo have also taken the same approach.

Conversely, Terra and Solana do not currently support EVM compatibility.

TVL of EVM compatible vs non-EVM compatible L1s Interoperable Chains

In a slightly different layer 1 bucket are blockchain ecosystems like Cosmos and Polkadot. Rather than build new stand-alone blockchains, these projects built standards that let developers create application specific blockchains capable of talking to each other. This can allow, for example, tokens from a gaming blockchain to be used within applications built on a separate blockchain for social networking.

There is currently over $100B+ sitting on chains built using Cosmos’ standard that can eventually interoperate. Meanwhile, Polkadot recently reached a milestone that will similarly unite its ecosystem of blockchains.

In short, there’s now a diverse landscape of direct Ethereum competitors, with more on the way.

Sidechains

The distinction between sidechains and new layer 1s is admittedly a fuzzy one. Sidechains are very similar to EVM-compatible layer 1s, except that they’ve been purpose built to handle Ethereum’s excess capacity, rather than compete with Ethereum as a whole. These ecosystems are closely aligned with the Ethereum community and host Ethereum apps in a complementary fashion.

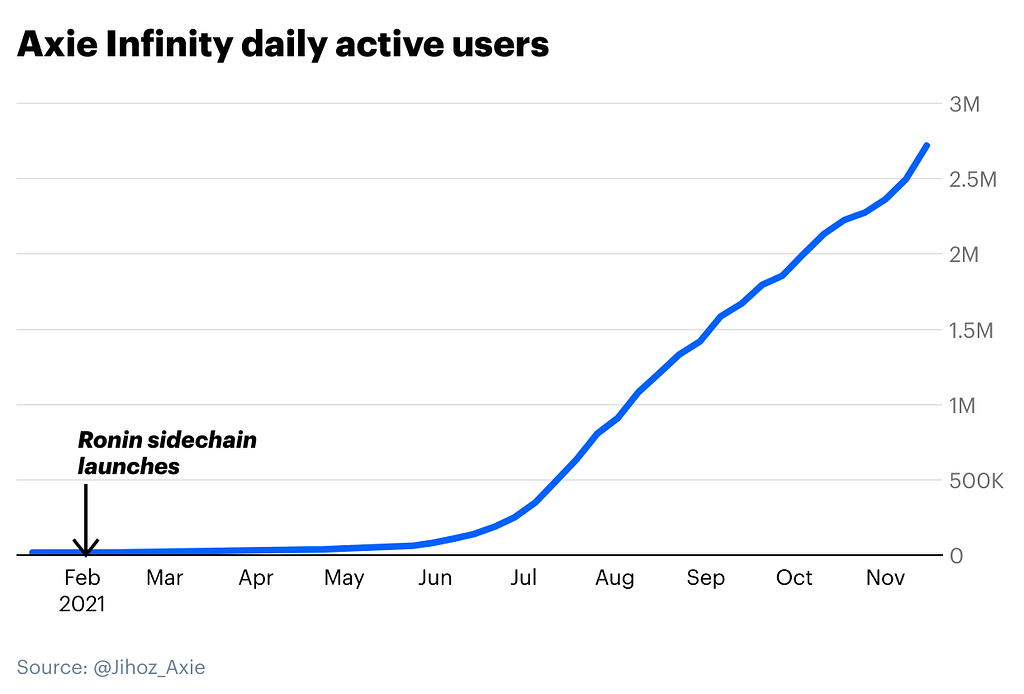

Axie Infinity’s Ronin sidechain is a prime example. Axie Infinity is an NFT game originally built on Ethereum. Since Ethereum fees made playing the game prohibitively expensive, the Ronin sidechain was built to allow users to move their NFTs and tokens from Ethereum to a low fee environment. This made the game affordable to more users, and preceded an explosion in the game’s popularity.

As of this writing, users have moved over $7.5B from Ethereum to Ronin to play Axie Infinity.

Polygon POS

Where sidechains like Ronin are application specific, others are suited for more general purpose applications. Right now, Polygon’s proof-of-stake (POS) sidechain is the industry leader with nearly $5B in value deployed over 100 DeFi and gaming applications including familiar names like Aave and Sushiswap, as well as a Uniswap clone called Quickswap.

Again, Polygon POS really doesn’t look that different from an EVM compatible layer-1. However, it’s been built as part of a framework to scale Ethereum rather than compete with it. The Polygon team sees a future where Ethereum remains the dominant blockchain for high value transactions and value storage, while everyday transactions move to Polygon’s lower-cost blockchains. (Polygon POS also maintains a special relationship with Ethereum through a process known as checkpointing).

With transaction fees of less than a penny, Polygon’s vision of the future looks plausible. And with the help of incentive programs, users have flocked to Polygon POS with daily transactions surpassing Ethereum (though spam transactions inflate this number).

Layer 2s (Rollups)

Layer 1s and sidechains both have a distinct challenge: securing their blockchains. To do so, they must pay a new cohort of miners or proof of stake validators to verify and secure transactions, usually in the form of inflation from a base token (e.g. Polygon’s $MATIC, Avalanche’s $AVAX).

However, this brings notable downsides:

- Having a base token naturally makes your ecosystem more competitive rather than complementary to Ethereum

- Validating and securing transactions is a complex and challenging task that your network is responsible for indefinitely

Wouldn’t it be nice if we could create scalable ecosystems that borrowed from Ethereum’s security? Enter layer 2 networks, and “rollups” in particular. In a nutshell, layer 2s are independent ecosystems that sit on top of Ethereum in such a way that relies on Ethereum for security.

Critically, this means that layer 2s do not need to have a native token — so not only are they more complementary to Ethereum, they are essentially part of Ethereum. The Ethereum roadmap even pays homage to this idea by signaling that Ethereum 2.0 will be “rollup centric.”

How rollups work

Layer 2s are commonly called rollups because they “rollup” or bundle transactions together and execute them in a new environment, before sending the updated transaction data back to Ethereum. Rather than have the Ethereum network process 1,000 Uniswap transactions individually (expensive!), the computation is offloaded on a layer 2 rollup before submitting the results back to Ethereum (cheap!).

However, when results are posted back to Ethereum, how does Ethereum know that the data is correct and valid? And how can Ethereum prevent anyone from posting incorrect information? These are critical questions that differentiate the two types of rollups: Optimistic rollups, and Zero Knowledge rollups (ZK rollups).

Optimistic Rollups

When submitting results back to Ethereum, optimistic rollups “optimistically” assume that they’re valid. In other words, they let the operators of the rollup post any data they want (including potentially incorrect / fraudulent data), and just assume it’s correct — an optimistic outlook no doubt! But there are ways to fight fraud. As a check and balance, there is a window of time after any withdrawal where anyone watching can call out fraud (remember blockchains are transparent, anyone can watch what’s happening). In the event that one of these watchers can mathematically prove that fraud occurred (by submitting a fraud proof), the rollup reverts any fraudulent transactions and penalizes the bad actor and rewards the watcher (a clever incentive system!).

The drawback is a brief delay when you move funds between the rollup and Ethereum, waiting to see if any watchers catch any fraud. In some cases this can be up to a week, but we expect these delays to come down over time.

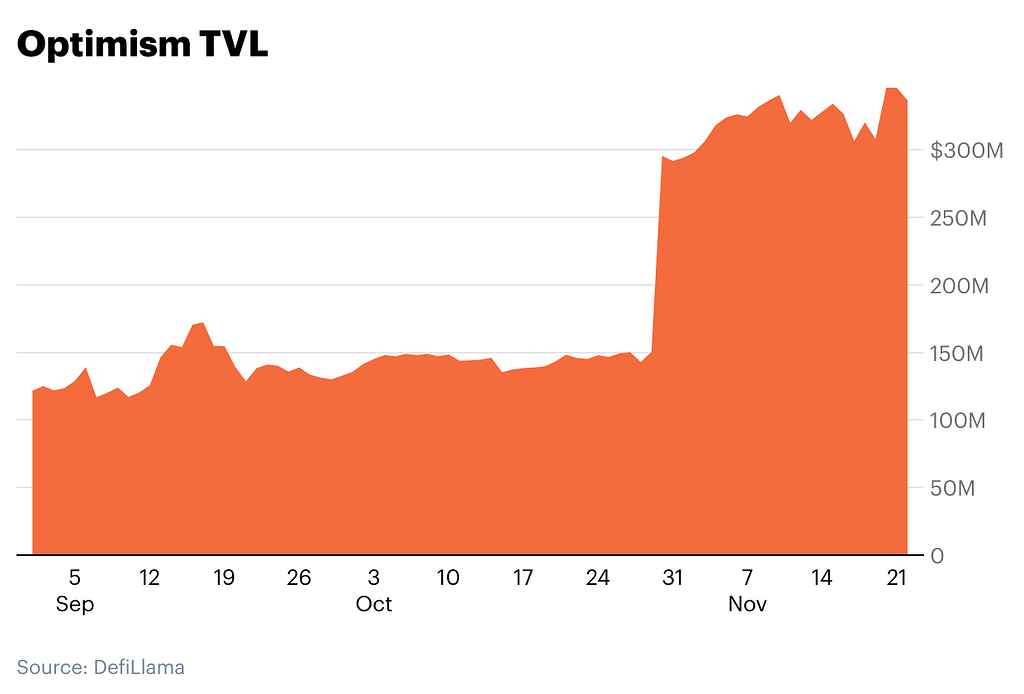

The key point is that optimistic rollups are intrinsically tied to Ethereum and ready to help Ethereum scale today. Accordingly, we’ve seen strong nascent growth with many leading DeFi projects moving to the leading optimistic rollups — Arbitrum and Optimistic Ethereum.

Arbitrum & Optimistic Ethereum

Arbitrum (by Off-chain Labs) and Optimistic Ethereum (by Optimism) are the two main projects implementing optimistic rollups today. Notably, both are still in their early stages, with both companies maintaining levels of centralized control but with plans to decentralize over time.

It’s estimated that once mature, optimistic roll ups can offer anywhere from a 10–100x improvement in scalability. Even in their early days, DeFi applications on Arbitrum and Optimism have already accrued billions in network value.

Optimism is earlier in its adoption curve with over $300M in TVL deployed across 7 DeFi applications, most notably Uniswap, Synthetix, and 1inch.

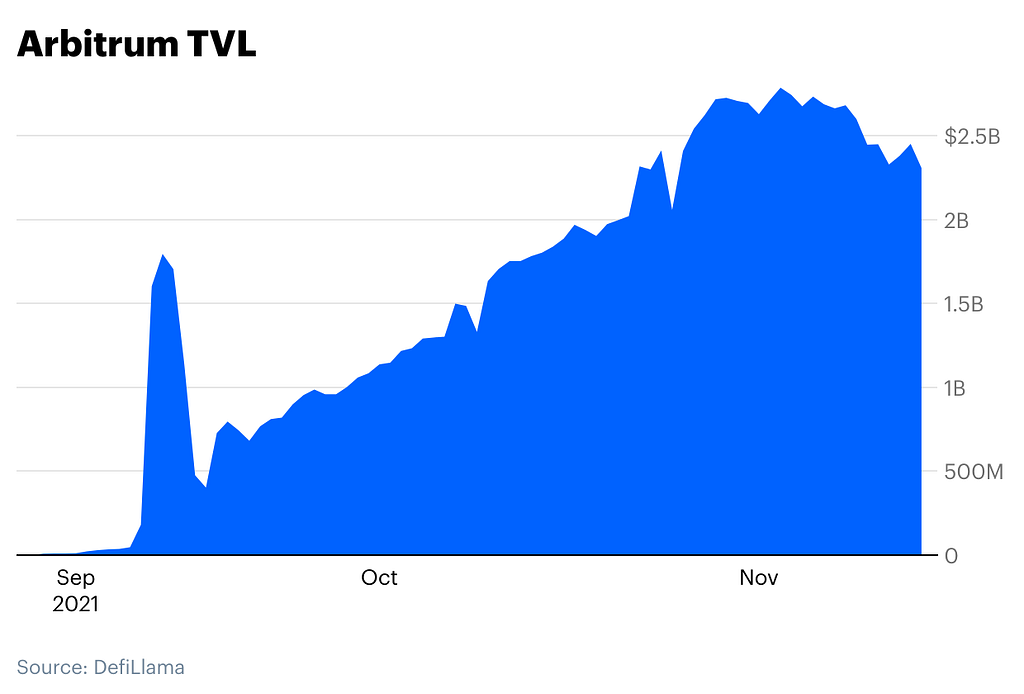

Arbitrum is further along, with around $2.5B in TVL across 60+ applications including familiar DeFi protocols like Curve, Sushiswap, and Balancer.

Aribtrum has also been selected as Reddit’s scaling solution of choice for their long awaited efforts to tokenize community points for the social media platform’s 500 million monthly active users.

ZK Rollups

Where optimistic rollups assume the transactions are valid and leave room for others to prove fraud, ZK rollups do the work of actually proving to the Ethereum network that transactions are valid.

Along with the results of the bundled transactions, they submit what’s called a validity proof to an Ethereum smart contract. As the name suggests, validity proofs let the Ethereum network verify that the transactions are valid, making it impossible for the relayer to cheat the system. This eliminates the need for a fraud proof window, so moving funds between Ethereum and ZK-rollups is effectively instant.

While instant settlement and no withdrawal times sound great, ZK rollups are not without tradeoffs. First, generating validity proofs is computationally intensive, so you need high powered machines to make them work. Second, the complexity surrounding validity proofs makes it more difficult to support EVM compatibility, limiting the types of smart contracts that can be deployed to ZK-rollups. As such, optimistic rollups have been first to market and are more capable of addressing Ethereum’s scaling woes today, but ZK-rollups may become a better technical solution in the long run.

ZK Rollup Adoption

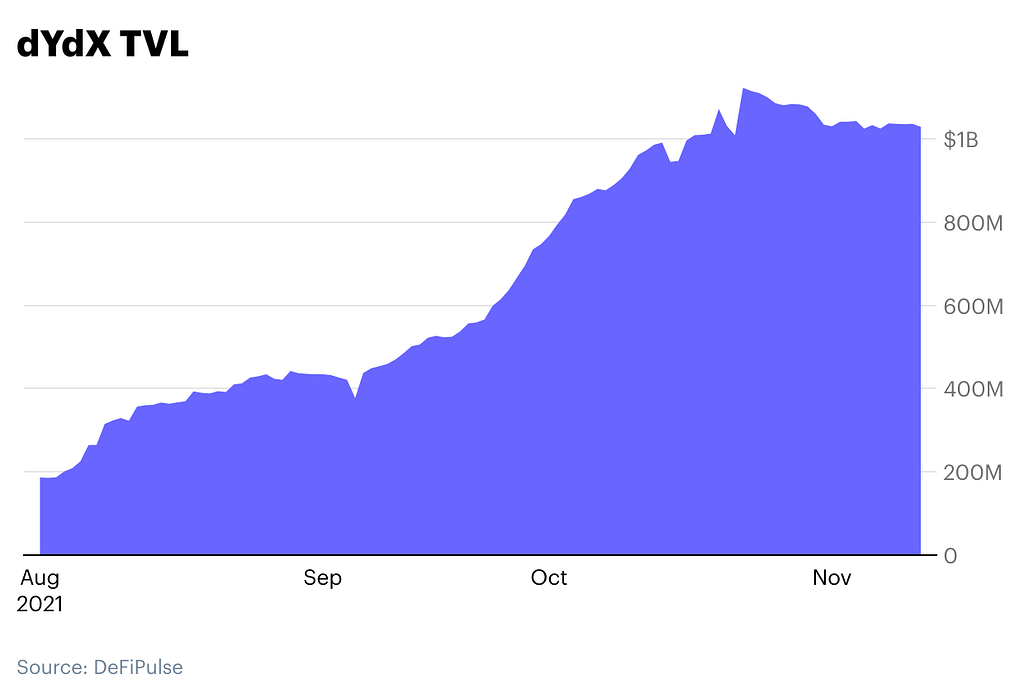

The ZK rollup landscape runs deep, with multiple teams and implementations in the works and in production. Some prominent players include Starkware, Matter Labs, Hermez, and Aztec. Today, ZK-rollups mainly support relatively simple applications such as payments or exchanges (owing to limitations on what types of applications ZK-rollups can support today). For example, derivatives exchange dYdX employs a ZK rollup solution from Starkware (StarkEx) to support nearly 5 million weekly transactions and $1B+ in TVL.

The real prize however, is ZK rollup solutions that are fully EVM compatible and thus capable of supporting popular general applications (like the full suite of DeFi apps) without the withdrawal delays of optimistic rollups. The main players in this realm are MatterLab’s zkSync 2.0, Starkware’s Starknet, Polygon Hermez’s zkEVM, and Polygon Miden, which are all currently working towards mainnet launch. (Aztec, meanwhile, is focused on applying zk proofs to privacy).

Many in the industry (Vitalik included) are looking at ZK rollups in conjunction with Ethereum 2.0 as the long term solution to scaling Ethereum, mainly stemming from their ability to fundamentally handle hundreds of thousands of transactions per second without compromising on security or decentralization.The upcoming rollouts of fully EVM compatible ZK rollups will be one of the key things to watch as the quest to scale Ethereum progresses.

A fragmenting world

In the long run, these scaling solutions are necessary if smart contract platforms are to scale to billions of users. In the near term, these solutions, however, may present significant challenges for users and crypto operators alike. Navigating from Ethereum to these networks requires using cross-chain bridges, which is complex for users and carries latent risk. For example, several cross-chain bridges have already been the target of $100+ million dollar exploits.

More importantly, the multi-chain world fragments composability and liquidity. Consider that Sushiswap is currently implemented on Ethereum, Binance Smart Chain, Avalanche, Polygon, and Arbitrum. Where Sushiswap’s liquidity was once concentrated on one network (Ethereum), it’s now spread across five different networks.

Ethereum applications have long benefited from composability — i.e. Sushiswap on Ethereum is plug-and-play with other Ethereum apps like Aave or Compound. As applications spread out to new networks, an application implemented on one layer 1/sidechain/layer 2 is no longer composable with apps implemented on another, limiting usability and creating challenges for users and developers.

An uncertain future

Will new layer 1s like Avalanche or Solana continue to grow to compete with Ethereum? Will blockchain ecosystems like Cosmos or Polkadot proliferate? Will sidechains continue to run in harmony with Ethereum, taking on its excess capacity? Or will rollups in conjunction with Ethereum 2.0 win out? No one can say for sure.

While the future is uncertain, everyone can take solace in the knowledge that there are so many smart teams dedicated to tackling the most challenging problems that open, permissionless networks face. Just as broadband ultimately helped the internet support a host of revolutionary applications like YouTube and Uber, we believe that we’ll eventually look at the winning scaling solutions in the same light.

* This post focuses on scaling smart-contract based blockchains. Bitcoin scaling is best saved for a future post.

Scaling Ethereum & crypto for a billion users was originally published in The Coinbase Blog on Medium, where people are continuing the conversation by highlighting and responding to this story.

[ad_2]

Source link