[ad_1]

The litigation funding provider is offering token holders the ability to earn up to 9% APY without having to lock up their funds.

Continue reading on Medium »

[ad_2]

Source link

[ad_1]

The litigation funding provider is offering token holders the ability to earn up to 9% APY without having to lock up their funds.

Continue reading on Medium »

[ad_2]

Source link

[ad_1]

In the last 24-hours, Terra (LUNA), a blockchain protocol focused on building a global payments system powered by the UST stablecoin, rallied to a new all-time high at $45.

Data from Cointelegraph Markets Pro and TradingView shows that since bottoming at a low of $5.61 on July 20, the price of LUNA has ripped 720% higher to a record high at $45 on Sept. 10.

The swift rally also lifted the total value locked (TVL) on the Terra protocol to a new all-time high at $7.83 billion on Sept. 5, making Terra the fourth-ranked blockchain platform by TVL according to Defi Llama.

Related: Altcoin Roundup: Layer-one protocols chip away at Ethereum’s dominance.

A scroll through the project’s Twitter feed shows that the surge in price followed the announcement of ‘Project Dawn’, a new funding initiative for the Terra ecosystem meant to help improve critical infrastructure and accelerate the growth of the ecosystem.

1/ TFL is announcing Project Dawn, a new funding initiative for critical infrastructure improvements and core technologies to supplement the accelerating growth of the Terra ecosystem.

Details: https://t.co/Viv9VkAApT

— Do Kwon (@stablekwon) September 9, 2021

According to Terra co-founder Do Kwon, Project Dawn has allocated $150 million to “build a core Cosmos contributor organization, invest in the ecosystem’s node infrastructure, and diversify the validator and oracle infrastructure.”

Another source of excitement for the Terra community is the upcoming launch of its Colombus-5 mainnet upgrade on Sept. 29, which is “Terra’s most significant mainnet upgrade” according to the project.

1/ The Columbus-5 mainnet deployment will be delayed ~3 weeks until a new block height of 4,724,000, roughly equivalent to the following times:

9/29 at 20:30 PST

9/30 at 03:30 UTC

9/30 at 12:30 KST— Terra (UST) Powered by LUNA (@terra_money) September 1, 2021

On top of developments to the main protocol, LUNA price has also benefited from the expansion of the Terra ecosystem which has seen new DeFi protocols like AlphaDeFi launch and begin to attract liquidity.

The views and opinions expressed here are solely those of the author and do not necessarily reflect the views of Cointelegraph.com. Every investment and trading move involves risk, you should conduct your own research when making a decision.

[ad_2]

Source link

[ad_1]

Some Bitcoin indicators show similarities between the post-ATH price action and current trend, implying that there will be one last push up before a bigger drop.

As explained by a CryptoQuant analyst, there seem to be many similarities between the Bitcoin indicators of the post all-time-high (ATH) period and that of present day.

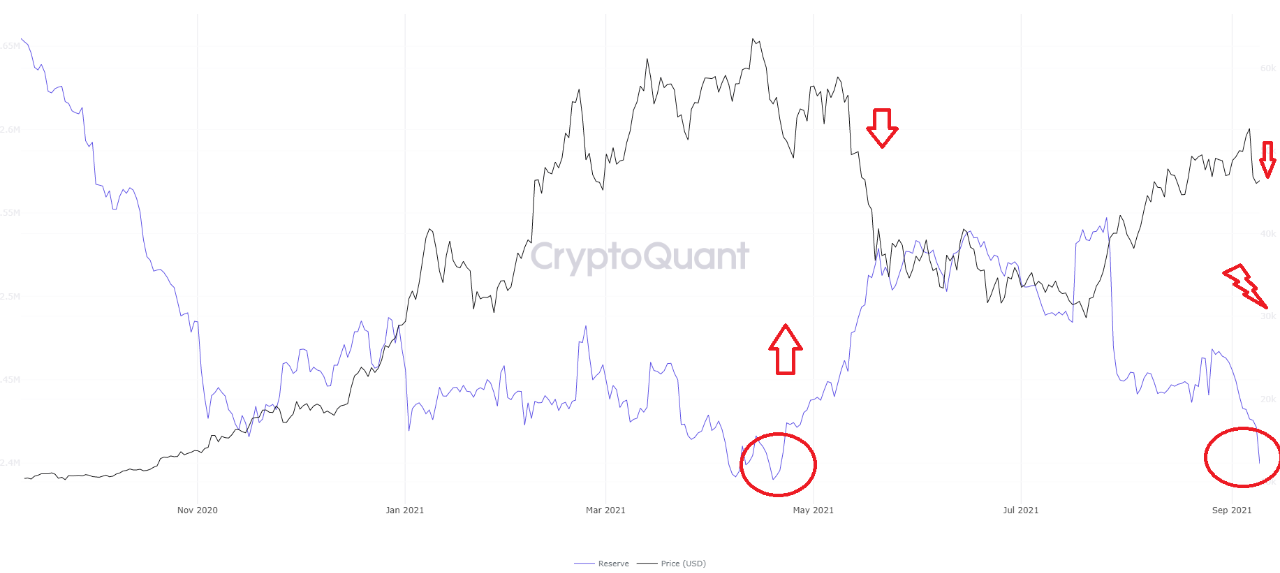

There are three main metrics of relevance here. The first is the exchange reserve, which shows the amount of BTC currently being held on centralized exchange wallets.

Here is how this indicator’s value has changed during the past year:

The BTC exchange reserve after the ATH vs today

Looking at the above graph, there does seem to be a similarity between the two periods. Both had declining prices as well as declining exchange reserves.

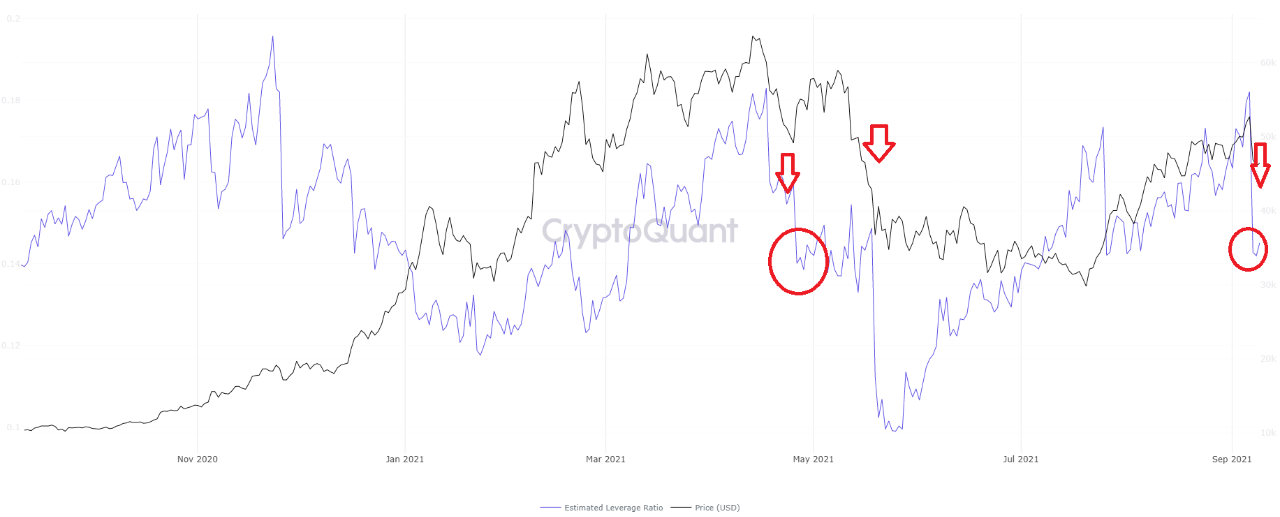

Next is the estimated leverage ratio, an indicator that shows how much leverage is used by traders on average. It’s calculated by taking the open interest divided by the exchange reserve.

The leverage ratio seems to be plunging down

Here too a similarity can be seen as the indicator seems to have sharply dropped down during both present day and the post-ATH period.

Related Reading | Why This Investor Fled His Bitcoin Position, Should You Do The Same?

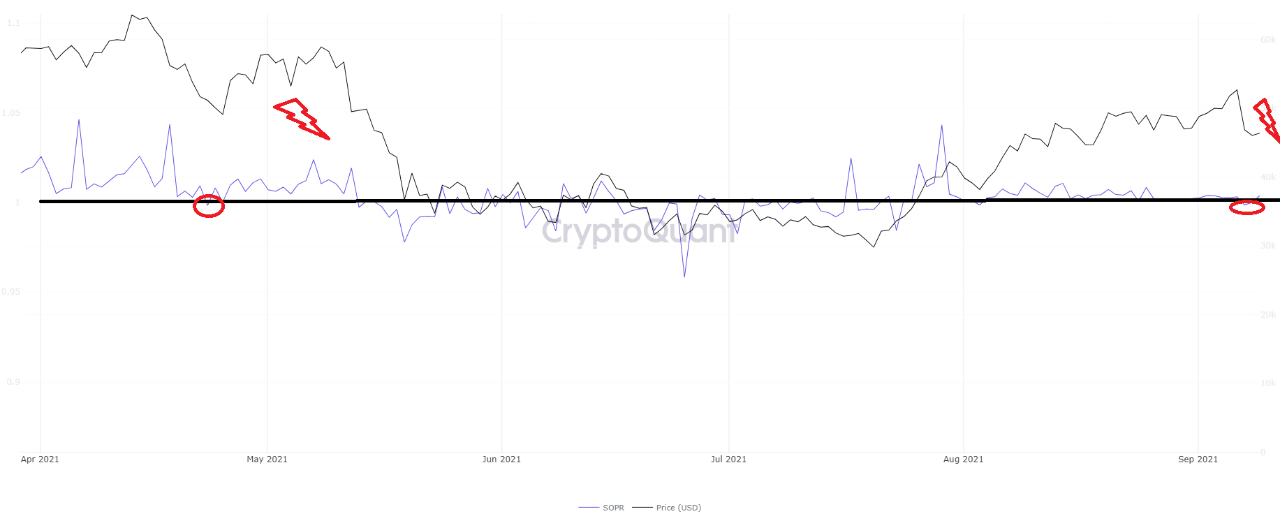

Finally, there is the Spent Output Profit Ratio (SOPR), which is calculated by taking the ratio of realized value (in USD) to the value of creation of a spent output.

In simpler terms, the indicator shows whether Bitcoin wallets are selling their coins at a profit or a loss. The below chart shows the trends for this metric.

The BTC SOPR over the past six months

Looks like the value of the SOPR dropped down below 1 during both these periods. Such a value indicates that investors have been selling BTC at a loss (while values above 1 would imply the opposite).

Related Reading | Bitcoin Price “Pitchfork Channel” Could Pin-Point The Last Dip Ever

If the current trend really is similar to the post-ATH one as these indicators would seem to imply, then it means BTC’s price might move up soon and make a local peak. And just like last time, a big drop could happen after that which takes the price to lower levels. So that this uptrend could turn out to be the last move up for a while.

At the time of writing, Bitcoin’s price floats around $45.7k, down 10% in the last 7 days. Over the past month, the cryptocurrency has dropped 1% in value.

Here is a chart showing the trend in the price of the coin over the last three months:

Bitcoin's price moves sideways after a big plunge downwards | Source: BTCUSD on TradingView

Featured image from Unsplash.com, charts from TradingView.com, CryptoQuant

[ad_2]

Source link

[ad_1]

Starting today, Rari Governance Token (RGT) and XYO Network (XYO) are available on Coinbase.com and in the Coinbase Android and iOS apps. Coinbase customers can now trade, send, receive, or store RGT and XYO in most Coinbase-supported regions, with certain exceptions indicated in each asset page here. Trading for these assets is also supported on Coinbase Pro.

Rari Governance Token (RGT) is an Ethereum token that powers Rari Capital, a decentralized protocol for lending and borrowing. The Rari Governance Token is used for fee discounts and protocol governance.

XYO Network (XYO) is an Ethereum token that powers XYO Network, a decentralized network of devices that anonymously collect and validate geospatial data. On the XYO World platform, XYO tokens can be traded for and staked against unique ERC-721 tokens representing real-world locations.

One of the most common requests we hear from customers is to be able to buy and sell more cryptocurrencies on Coinbase. We announced a process for listing assets, designed in part to accelerate the addition of more cryptocurrencies. We are also investing in new tools to help people understand and explore cryptocurrencies. We launched informational asset pages (see RGT, XYO), as well as a new section of the Coinbase website to answer common questions about crypto.

Customers can sign up for a Coinbase account here to buy, sell, convert, send, receive, or store e Coinbase Android and iOS apps. Coinbase customers can now trade, send, receive, or store RGT and XYO today.

###

Please note: Coinbase Ventures may be an investor in the crypto projects mentioned here, and additionally, Coinbase may hold such tokens on its balance sheet for operational purposes. A list of Coinbase Ventures investments is available at https://ventures.coinbase.com/. Coinbase intends to maintain its investment in these entities for the foreseeable future and maintains internal policies that address the timing of permissible disposition of any related digital assets, if applicable. All assets, regardless of whether Coinbase Ventures holds an investor or Coinbase holds for operational purposes, are subject to the same strict review guidelines and review process.

This website contains links to third-party websites or other content for information purposes only (“Third-Party Sites”). The Third-Party Sites are not under the control of Coinbase, Inc., and its affiliates (“Coinbase”), and Coinbase is not responsible for the content of any Third-Party Site, including without limitation any link contained in a Third-Party Site, or any changes or updates to a Third-Party Site. Coinbase is not responsible for webcasting or any other form of transmission received from any Third-Party Site. Coinbase is providing these links to you only as a convenience, and the inclusion of any link does not imply endorsement, approval or recommendation by Coinbase of the site or any association with its operators.

Crypto is a new type of asset. Besides potential day to day or hour to hour volatility, each crypto asset has unique features. Make sure you research and understand individual assets before you transact.

All images provided herein are by Coinbase.

Rari Governance Token (RGT) and XYO Network (XYO) are now available on Coinbase was originally published in The Coinbase Blog on Medium, where people are continuing the conversation by highlighting and responding to this story.

[ad_2]

Source link

[ad_1]

Singapore, Sep 10, 2021 — Bitkub Capital Group Holdings, a leading Thai blockchain & cryptocurrency company has officially partnered with Miss Universe Thailand 2021 as the world’s first blockchain & cryptocurrency firm to bring NFT and Digital Asset solutions, as well as other cryptocurrency trends to beauty pageants.

[ad_2]

Source link

[ad_1]

Ephrat Livni, a DealBook business and policy reporter at the New York Times, discusses Coinbase’s fight with the SEC over its Lend product and El Salvador’s adoption of Bitcoin as legal tender. Show highlights:

Crypto.com: https://crypto.onelink.me/J9Lg/unconfirmedcardearnfeb2021

Digital Asset Research: https://digitalassetresearch.com

Sorare: https://sorare.com

Ephrat Livni

Coinbase

Bitcoin and El Salvador

[ad_2]

Source link

[ad_1]

Global Shipping Business Network (GSBN) has launched a new blockchain-based platform that could potentially track one-third of shipping containers across the globe.

The GSBN was founded in October 2020 by eight global national freight maritime cargo companies to build a blockchain platform that digitizes shipping processes such as document issuance, clearance and logistics data.

Members of the Hong-Kong-based non-profit consortium GSBN are said to “account for one in every three containers handled in the world,” and this may soon be verifiable on the blockchain once the platform is fully utilized.

The GSBN announced the launch of the new blockchain platform on Sept. 8 in partnership with Oracle, Microsoft Azure, AntChain and Alibaba Cloud.

“As an independent consortium, it chose a best-of-breed approach to technology to ensure the infrastructure is strong, reliable and highly scalable,” the announcement read.

GSBN noted that the partnerships were sought out for geostrategic purposes such as Oracle’s global trade operating system and Azure’s service reliability in southeast Asia. Ant Group and Alibaba Cloud will be used for deployment in China.

To ensure information control by GSBN, the data will be encrypted before being sent to the blockchain platform which means the members cannot access the data without authorization. The consortium also emphasized that blockchain technology enables it to collaborate with “disparate and often competing market participants.”

In July the GSBN launched its first blockchain-based application in China dubbed “Cargo Release,” which was designed to speed up processing time by removing paper and storing data on the blockchain.

Related: Fruits of the land: Blockchain traceability gives farmers a competitive advantage

Around the same time the GSBN was formed in October last year, two of the world’s largest container carriers in CMA CGM and MSC Mediterranean Shipping Company announced a full integration onto IBM and Maersk’s TradeLens blockchain platform.

The competing platform offers supply-chain digitizing services, and the integration with CMA CGM and MSC brought data from nearly half of the world’s ocean container cargo to the TradeLens network.

[ad_2]

Source link

[ad_1]

Cardano’s developer IOHK has now confirmed smart contracts capability is set to launch on the network on September 12th. The long-awaited upgrade to the Cardano Mainnet will see the addition of smart contracts capability to the network, which would open the door to both developers and investors alike on the network. The launch is scheduled for Sunday, only four days away.

LAUNCH CONFIRMED: Today, around 17:26 UTC we successfully submitted an update proposal to the #Cardano mainnet, to trigger a hard fork combinator event on Sunday 💪🙌 #Cardano $ADA 1/6 pic.twitter.com/rEtjrdGiBV

— Input Output (@InputOutputHK) September 7, 2021

Related Reading | Analyst Lays Out Theory That Suggests A 290% Move In Cardano (ADA) Before Rally Is Over

Taking to Twitter, the developer shared with the wider community that they had successfully submitted an upgrade proposal to the Cardano Mainnet. This would trigger the hard fork combinator (HFC) event that would take place on Sunday. “The Alonzo HFC event will be the most significant upgrade yet, laying the firmest of foundations for an exciting new era of smart contracts on Cardano,” said the developer.

Using the HFC technology will enable the deployment of smart contracts capability with the core Plutus, which will come will all compatibility upgrades across the entire software stack. Testing has already been underway for the smart contracts capability with trusted testers from previous upgrade iterations. So far, the smart contracts are processing transactions accordingly and developers have taken to building their DApps on the platform.

The final deployment will see Cardano competing with other networks successfully operating in the space. Going up against well-known smart contracts platforms like Ethereum, and a new contender that has taken the market by storm, Solana.

Alonzo Hard Fork will bring decentralized finance (DeFi) and decentralized exchanges (DEX) to the ecosystem, as well as capabilities like being able to mint NFTs on the Cardano blockchain. Effectively expanding the scope of use cases of the network.

Related Reading | New To Bitcoin? Learn To Trade Crypto With The NewsBTC Trading Course

The network ran into some problems earlier when rumors started making the rounds on social media that the smart contracts could only handle one transaction at a time. But this was soon after cleared up by the developers, who showed that the problem was not with the network, but rather with the DApp Minswap. IOHK further encouraged developers to keep testing on the network, adding that “this is what a testnet is for.”

Cardano, like the rest of the market, is still reeling from the flash crash which it experienced yesterday. Although it has recovered from the lows of the flash crash, the digital asset continues to struggle to find footing back to positions before the crash. The announcement from Cardano’s developer did not do much to push the price upwards, which has left the asset trading around the $2.3 range. Putting it back down below highs from May.

ADA price struggles as market reels from crash | Source: ADAUSD on TradingView.com

At the time of writing, the asset is trading at $2.38, down more than 9% in the last 24 hours. The crash in its value has brought the total market cap of the asset down to $76 billion. Although remaining the third-largest cryptocurrency by market cap.

Featured image from Ethereum World News, chart from TradingView.com

[ad_2]

Source link

[ad_1]

Melbourne, Australia, Sep 8, 2021 — On the heels of the strategic investment received from UAE-based Sheesha Finance last week, the world’s first halal decentralized finance (DeFi) ecosystem MRHB DeFi is pleased to announce yet another strategic investment — this time…

[ad_2]

Source link

[ad_1]

By Paul Grewal, Chief Legal Officer

Last Wednesday, after months of effort by Coinbase to engage productively, the SEC gave us what’s called a Wells notice about our planned Coinbase Lend program. A Wells notice is the official way a regulator tells a company that it intends to sue the company in court. As surprised as we were at the SEC’s threat to sue without ever telling us why, we want to be transparent with you about the course of events leading up to it.

Coinbase has been proactively engaging with the SEC about Lend for nearly six months. We’ve been eager to hear their perspective as we explore innovative ways for our customers to gain more financial empowerment on Coinbase. Specifically for Lend, we’re seeking to allow eligible customers to earn interest on select assets on Coinbase, starting with 4% APY on USD Coin (USDC). We could have simply launched the product but we chose not to. This is far from the norm in our industry. Other crypto companies have had lending products on the market for years, and new lending products continue to launch as recently as last month. But Coinbase believes in the value of open and substantive dialogue with our regulators. So we took Lend to the SEC first.

Coinbase’s Lend program doesn’t qualify as a security — or to use more specific legal terms, it’s not an investment contract or a note. Customers won’t be “investing” in the program, but rather lending the USDC they hold on Coinbase’s platform in connection with their existing relationship. And although Lend customers will earn interest from their participation in the program, we have an obligation to pay this interest regardless of Coinbase’s broader business activities. What’s more, participating customers’ principal is secure and we’re obligated to repay their USDC on request.

We shared this view and the details of Lend with the SEC. After our initial meeting, we answered all of the SEC’s questions in writing and then again in person. But we didn’t get much of a response. The SEC told us they consider Lend to involve a security, but wouldn’t say why or how they’d reached that conclusion. Rather than get discouraged, we chose to continue taking things slowly. In June, we announced our Lend program publicly and opened a waitlist but did not set a public launch date. But once again, we got no explanation from the SEC. Instead, they opened a formal investigation. They asked for documents and written responses, and we willingly provided them. They also asked for us to provide a corporate witness to give sworn testimony about the program. As a result, one of our employees spent a full day in August providing complete and transparent testimony about Lend. They also asked for the name and contact information of every single person on our Lend waitlist. We have not agreed to provide that because we take a very cautious approach to requests for customers’ personal information. We also don’t believe it is relevant to any particular questions the SEC might have about Lend involving a security, especially when the SEC won’t share any of those questions with us.

Despite Coinbase keeping Lend off the market and providing detailed information, the SEC still won’t explain why they see a problem. Rather they have now told us that if we launch Lend they intend to sue. Yet again, we asked if the SEC would share their reasoning with us, and yet again they refused. They have only told us that they are assessing our Lend product through the prism of decades-old Supreme Court cases called Howey and Reves. The SEC won’t share the assessment itself, only the fact that they have done it. These two cases are from 1946 and 1990. Formal guidance from the SEC about how they intend to apply Howey and Reves tests to products like Lend would be a big help to regulating our industry in a responsible way. Instead, last week’s Wells notice tells us that the SEC would rather skip those basic regulatory steps and go right to litigation. They’ve offered us the chance to submit a written defense of Lend, but that would be futile when we don’t know the reasons behind the SEC’s concerns.

The SEC has repeatedly asked our industry to “talk to us, come in.” We did that here. But today all we know is that we can either keep Lend off the market indefinitely without knowing why or we can be sued. A healthy regulatory relationship should never leave the industry in that kind of bind without explanation. Dialogue is at the heart of good regulation.

The net result of all this is that we will not be launching Lend until at least October. Coinbase continues to welcome additional regulatory clarity; mystery and ambiguity only serve to unnecessarily stifle new products that customers want and that Coinbase and others can safely deliver.

We will keep our customers informed at every step as things progress.

The SEC has told us it wants to sue us over Lend. We don’t know why. was originally published in The Coinbase Blog on Medium, where people are continuing the conversation by highlighting and responding to this story.

[ad_2]

Source link