[ad_1]

Skybridge Capital founder Anthony Scaramucci has advised bitcoin investors to act like they are dead with their coins and not sell them. “Don’t do anything with it,” he recommended, emphasizing: “The dead people at Charles Schwab do far better than the living people.” Anthony Scaramucci’s Bitcoin Investing Advice Skybridge Capital founder Anthony Scaramucci offered some […]

Skybridge Capital founder Anthony Scaramucci has advised bitcoin investors to act like they are dead with their coins and not sell them. “Don’t do anything with it,” he recommended, emphasizing: “The dead people at Charles Schwab do far better than the living people.” Anthony Scaramucci’s Bitcoin Investing Advice Skybridge Capital founder Anthony Scaramucci offered some […]

[ad_2]

Source link

Category: ICO’s

-

Skybridge Capital Founder Advises ‘Act Like You’re Dead With Your Bitcoin and Don’t Sell’

-

March Sees Nearly $1 Billion In Ethereum Netflow To Centralized Exchanges

[ad_1]

The price of Ethereum has not exactly lived up to its promise as the month has gone on, despite a stellar start to the month. While this bearish pressure has been widespread in the general cryptocurrency market, regulation uncertainty has been an additional concern for ETH, igniting a negative sentiment around the “king of altcoins.”

Interestingly, the latest on-chain revelation shows a substantial amount of Ethereum has made its way to exchanges so far in March, suggesting that investors might be losing confidence in the long-term promise of the cryptocurrency.

Are Investors Losing Confidence In Ethereum?

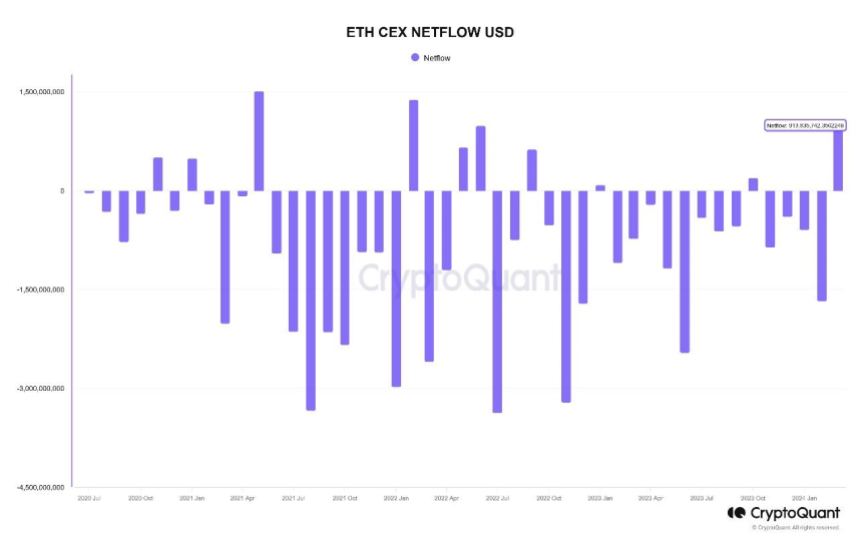

According to data from CryptoQuant, more than $913 million has been recorded in net ETH transfers to centralized exchanges so far in March. This on-chain information was revealed via a quicktake post on the data analytics platform.

This net fund movement represents the largest volume of Ethereum transferred to centralized exchanges in a single month since June 2022. Even though March is still a week from being over, this exchange inflow appears to be a complete deviation from the pattern observed over the past few months.

Chart showing total monthly netflow of ETH on centralized exchanges | Sources: CryptoQuant

As shown in the chart above, October 2023 was the last time cryptocurrency exchanges witnessed a positive net flow. It is worth noting that there was significant movement of Ethereum tokens out of the centralized platforms in subsequent months up until this month.

Meanwhile, a separate data point that supports the massive exodus of ETH to centralized exchanges has come to light. Popular crypto analyst Ali Martinez revealed on X nearly 420,000 Ethereum tokens (equivalent to $1.47 billion) have been transferred to cryptocurrency exchanges in the past three weeks.

The flow of large amounts of cryptocurrency to centralized exchanges is often considered a bearish sign, as it can be an indication that investors may be willing to sell their assets. Ultimately, this can put downward pressure on the cryptocurrency’s price.

Substantial fund movements to trading platforms could also represent a shift in investor sentiment. It could be a sign that investors are losing faith in a particular asset (ETH, in this case).

Moreover, the recent regulatory headwind surrounding Ethereum specifically accentuates this hypothesis. According to the latest report, the United States Securities and Exchange Commission is considering a probe to classify the ETH token as a security.

ETH Price

As of this writing, the Ethereum token is valued at $3,343, reflecting a 4% price decline over the past /4 hours. According to data from CoinGecko, ETH is down by 11% in the past week.

Ethereum loses the $3,400 level again on the daily timeframe | Source: ETHUSDT chart on TradingView

Featured image from Unsplash, chart from TradingView

Disclaimer: The article is provided for educational purposes only. It does not represent the opinions of NewsBTC on whether to buy, sell or hold any investments and naturally investing carries risks. You are advised to conduct your own research before making any investment decisions. Use information provided on this website entirely at your own risk.

[ad_2]

Source link -

From Peak to Present: GBTC’s Bitcoin Holdings Decrease by 266,827 BTC in 71 Days

[ad_1]

As of March 22, the bitcoin holdings of Grayscale’s Bitcoin Trust (GBTC) have diminished by 27,917.37 compared to its status three days prior, now amounting to 350,252 bitcoin valued at approximately $22.2 billion. Since evolving into an exchange-traded fund (ETF) listed on public exchanges, GBTC has shed billions in bitcoin over the preceding 71 days. […]

As of March 22, the bitcoin holdings of Grayscale’s Bitcoin Trust (GBTC) have diminished by 27,917.37 compared to its status three days prior, now amounting to 350,252 bitcoin valued at approximately $22.2 billion. Since evolving into an exchange-traded fund (ETF) listed on public exchanges, GBTC has shed billions in bitcoin over the preceding 71 days. […]

[ad_2]

Source link -

Extradition of Terraform Labs’ Do Kwon to South Korea Stalls

[ad_1]

The extradition of Terraform Labs’ Co-Founder, Do Kwon, to South Korea has hit a roadblock as Montenegro’s Office of the Supreme State Prosecutor challenged against the court order yesterday (Thursday).

The country’s top prosecutor argued that the High Court’s decision to extradite Kwon to South Korea instead of the United States was done in an “abbreviated proceeding” and exceeded the limits of the court’s reach. Interestingly, when hearing an appeal from Kwon’s lawyers, an appellate court subsequently confirmed the decision to the High Court.

The Balkan country’s prosecutors requested protection of legality before the Supreme Court to stop the extradition of Kwon to South Korea. The prosecutors argued that only the Supreme Court can decide in this case.

“The court, contrary to the law, conducted abbreviated, instead of regular proceedings and by exceeding the limits of its powers, made a decision on the extradition permit, which is the exclusive competence of the Minister of Justice,” the translated letter by the prosecutor stated.

The tussle came only a day after an appeal court rejected the plea to block the extradition of Kwon to South Korea where he would face “several criminal offenses.”

The US or South Korea?

However, the United States wants to extradite Kwon from Montenegro. The US prosecutors have filed eight charges against him and might proceed with prosecuting him even in his absence. Additionally, the US Securities and Exchange Commission has filed civil charges against both Terraform Labs and Kwon.

Following the collapse of the two Terraform Labs’ cryptocurrencies, TerraUSD and Luna, in 2022, Kwon disappeared from public view. The US and South Korean authorities blamed him for the wipeout of the crypto market, which reached almost $37 billion and later caused the collapse and bankruptcy of several other projects. Kwon was arrested last year in Montenegro while traveling with false documents.

Interestingly, other top associates from Terraform Labs, including the Co-Founder, Hyun-seong Shin, and the Chief Financial Officer, Han Chang-joon, were arrested with Kwon and were extradited to South Korea last month.

The extradition of Terraform Labs’ Co-Founder, Do Kwon, to South Korea has hit a roadblock as Montenegro’s Office of the Supreme State Prosecutor challenged against the court order yesterday (Thursday).

The country’s top prosecutor argued that the High Court’s decision to extradite Kwon to South Korea instead of the United States was done in an “abbreviated proceeding” and exceeded the limits of the court’s reach. Interestingly, when hearing an appeal from Kwon’s lawyers, an appellate court subsequently confirmed the decision to the High Court.

The Balkan country’s prosecutors requested protection of legality before the Supreme Court to stop the extradition of Kwon to South Korea. The prosecutors argued that only the Supreme Court can decide in this case.

“The court, contrary to the law, conducted abbreviated, instead of regular proceedings and by exceeding the limits of its powers, made a decision on the extradition permit, which is the exclusive competence of the Minister of Justice,” the translated letter by the prosecutor stated.

The tussle came only a day after an appeal court rejected the plea to block the extradition of Kwon to South Korea where he would face “several criminal offenses.”

The US or South Korea?

However, the United States wants to extradite Kwon from Montenegro. The US prosecutors have filed eight charges against him and might proceed with prosecuting him even in his absence. Additionally, the US Securities and Exchange Commission has filed civil charges against both Terraform Labs and Kwon.

Following the collapse of the two Terraform Labs’ cryptocurrencies, TerraUSD and Luna, in 2022, Kwon disappeared from public view. The US and South Korean authorities blamed him for the wipeout of the crypto market, which reached almost $37 billion and later caused the collapse and bankruptcy of several other projects. Kwon was arrested last year in Montenegro while traveling with false documents.

Interestingly, other top associates from Terraform Labs, including the Co-Founder, Hyun-seong Shin, and the Chief Financial Officer, Han Chang-joon, were arrested with Kwon and were extradited to South Korea last month.

[ad_2]

Source link -

BONK Bonked: Price Crashes 30% In 7 Days

[ad_1]

The memecoin BONK has faced a significant setback as its prices plummeted by 30% in the last week, sparking discussions about the need to reassess predictions for this meme token. This decline in value has been accompanied by a drop in BONK’s open interest to its lowest level in the past month, signaling potential challenges ahead for the token.

Market Performance And Price Predictions

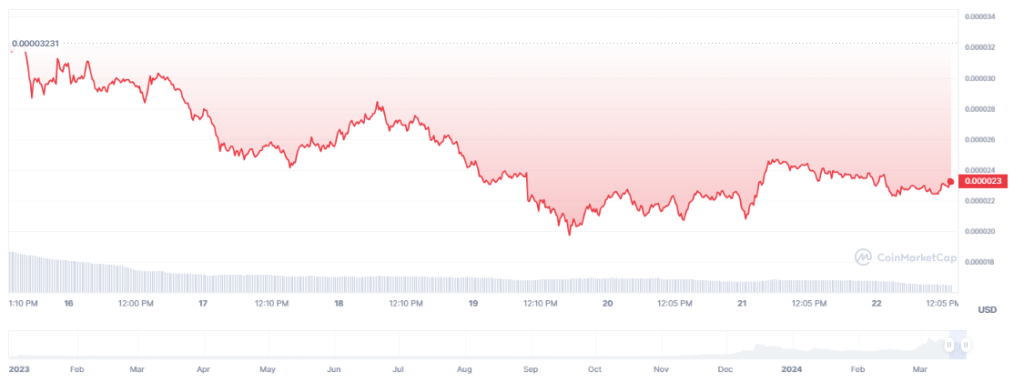

The recent slump in BONK’s prices has raised concerns among investors and traders, with key technical indicators hinting at the possibility of further declines in its value. At present, BONK is trading at $0.000023, making it one of the cryptocurrencies with the most losses over the past week. The altcoin’s future trajectory remains uncertain as market dynamics continue to evolve.

BONK price down in the last seven days. Source: Coingecko

BONK price down in the last seven days. Source: CoingeckoFollowing a rejection at $0.00004, the price of BONK lost momentum and had a 35% value adjustment. After then, there was a period of sideways trading for the memecoin. The bulls lost steam as the volatility increased and broke through the support level; the market has been trading sideways ever since.

The recent analysis of BONK’s price performance reveals a shift in sentiment towards bearish outlooks, with weighted sentiment turning negative and key technical indicators confirming the presence of bearish sentiments. This negative sentiment among market participants could potentially lead to further declines in BONK’s value unless there is a significant shift in market dynamics.

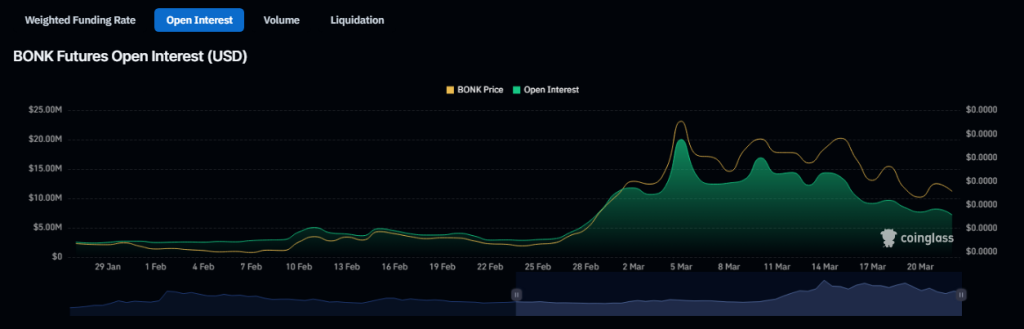

Source: Coinglass

Open Interest Plummets

Futures open interest in the cryptocurrency fell to its lowest level in one month, which led to a decrease in its price. The open interest in BONK began to fall on March 5th and has since fallen by 60%, according to statistics from Coinglass.

Traders’ interest or involvement in the derivative market for an asset declines as its open interest diminishes. This usually happens when there is a change in investor mood, leading to more people trying to cut losses or take profits.

Total crypto market cap at $2.4 trillion on the daily chart: TradingView.com

Impact On Investor Sentiment And Market Dynamics

The recent price slump in BONK has had a notable impact on investor sentiment, with many adopting a cautious approach towards the token’s future prospects. This shift in sentiment has also influenced trading volumes and market activity, as investors reassess their positions and strategies in light of BONK’s price movements.

Expert Price Predictions And Analysis

As market observers examine BONK’s price predictions, varying outlooks emerge regarding its future performance. While some forecasts suggest a bearish scenario with a price of $0.000018 in 2024, others paint a more optimistic picture, projecting an average price of $0.000067 by April 17, 2024. These contrasting predictions highlight the volatility and unpredictability inherent in the cryptocurrency market.

Featured image from Andrea Piacquadio/Pexels, chart from TradingView

Disclaimer: The article is provided for educational purposes only. It does not represent the opinions of NewsBTC on whether to buy, sell or hold any investments and naturally investing carries risks. You are advised to conduct your own research before making any investment decisions. Use information provided on this website entirely at your own risk.

[ad_2]

Source link -

Club Satoshi Brings Together Bitcoin and Blockchain Enthusiasts in Asia | by BitMedia Buzz | Mar, 2024

[ad_1]

Our PR partner, yourPRstrategist, is a proud event partner of Club Satoshi and is pleased to share an exclusive code for our community. Sign up on Meetup and use promo code ‘YPRBRC101’ for free entry!

For Bitcoin fans everywhere looking for like-minded people who believe in the transformative power of blockchain technology, crypto enthusiast community Club Satoshi is dedicated to

embodying the principles of the original Satoshi Nakamoto whitepaper, the Bitcoin standard and the decentralized spirit of cryptocurrency.Club Satoshi — A Blockchain Community and Educational Initiative

Club Satoshi supports blockchain education and fosters discussions about all aspects of blockchain building solutions, new economic models, and new blockchain technologies. Club events and meetups often incorporate initiatives that promote blockchain innovation and mass adoption of blockchain industry standards.

Founded in 2016, the Satoshi Club currently boasts over 3,000 members spread out over Singapore, South Korea, Thailand and the Philippines, with more Asian countries being planned. It is free to join for anyone interested in blockchain technology. Members enjoy free access to Club Satoshi meetup events as well as community discounts for partnered events with established blockchain, Web3 and crypto conferences such as Blockshow & Blockdown, Global Blockchain Show amongst others, including invitations to Web3 networking events in various Asian cities.

As an active supporter of industry blockchain events and conferences, Club Satoshi opens up access to an active Web3 community and brings early brand awareness and promotion via community engagement and participation. Community members of the Satoshi Club are cryptocurrency and blockchain enthusiasts, developers, investors, and advocates who bring high-value networking opportunities to partnered events, often leading to new business collaborations and investment opportunities for attendees, speakers, sponsors, and exhibitors.

The next Club Satoshi event will be happening this week in Singapore titled “Bitcoin Impact: Unlocking the Future — Exploring the BRC-20 Standard” with keynote and panel formats for Bitcoiners interested in learning more about the new Bitcoin Network standards. For members who are interested in attending, please sign up via Meetup or lu.ma.

For more information about Club Satoshi, visit clubsatoshi.io

[ad_2]

Source link -

ICC Camp S1 Officially Launched, First Batch of Signed Projects Announced | by BitMedia Buzz | Antaeus AR | Mar, 2024

[ad_1]

Outlook: Web3 Games — Breaking into the Mainstream Market

As the Web3 industry moves into mainstream markets, the development of Web3 games continues to captivate the public’s attention, bringing in a significant influx of non-industry players and user traffic to the Web3 sector. The progress of Web3 games is a sector consistently followed and researched by Web3 native professionals and also considered a breakthrough eagerly anticipated by many traditional game entrepreneurs.

Despite the industry winter in the past two years, with many resilient entrepreneurs striving to survive and continuously improving game products and their operations in a subdued market, high-quality Web3 game projects consistently stood out in the cold spell. With the rapid rise of blockchain technology, an increasing number of Web2 game developers have joined Web3 gaming, injecting fresh and outstanding productivity. Today, the global Web3 game market has gained increasing attention and continues to grow, with a market value reaching several billion dollars.

With the bull market already beginning, the market is set to thrive again. Entrepreneurs and investors will have more opportunities for benefits, ushering in a new wave of entrepreneurial and investment enthusiasm in the Web3 gaming industry, a prime time for entrepreneurs to enter the scene.

ICC Camp — A Guiding Light for Entrepreneurs

As an accelerator focused on Web3 gaming entrepreneurship, ICC Camp is committed to cultivating and supporting outstanding entrepreneurs in the Web3 gaming industry, providing students with systematic high-quality offline courses, introducing rich industry resources, and offering substantial financial support.

In the current industry opportunity, ICC Camp will also invite numerous mentors from well-known institutions within the industry to interpret industry trends, share successful experiences, provide in-depth insights, and open up new perspectives on the Web3 gaming ecosystem for ICC Camp S1 entrepreneurs, assisting entrepreneurs on their innovative journeys.

ICC Camp has assigned a full-time dedicated mentor to each student from the first day of their enrollment, providing them with personalized and professional guidance throughout their journeys in ICC Camp. These five full-time dedicated mentors possess extensive experience in the Web3 industry and will share deeper industry insights during one-on-one coaching sessions with students. The five full-time mentors are:

- Kevin Shao — Bitrise Capital Co-Founder, ABGA Executive President, ICC GROUP Advisor

- Simon Li — Chain Capital Co-Founder, Kirin Fund Co-Founder, ABGA Executive Vice-President

- Alex Yang — Blockhive Capital Founder

- James Fang — PangaCapital Partner

- Byrn — Senior investor in GameFi, DeFi, Web3

List of mentors for ICC Camp S1:

In addition, ICC Camp S1 has received support and recognition from many well-known institutions in the Web3 industry, including but not limited to prominent exchanges, VCs, Public Chains, Cloud Service Providers, Infrastructure Partners, Gaming Distribution Platforms, Launchpads, Traffic Platforms, Wallets, Media, Communities, KOL, Guilds, Daos, etc. ICC Camp have strategically partnered with institutions such as Gate Labs, Foresight Ventures, KuCoin Ventures, SlowMist, GSR, Bing Ventures, dtcpay, Alchemy Pay, TokenPocket, MixMarvel, Yeeha, Google Cloud, imToke, ABCDE, TZ APAC, RootData, Chain Catcher, PA News, Jinse Finance, BlockTempo, DeThings, among others. By integrating the strengths of various parties, ICC Camp aims to jointly build a robust global Web3 game ecosystem, supporting the vibrant development of outstanding startup teams in the future Web3 gaming.

Among these partnerships, the world’s leading blockchain content incubation platform, MixMarvel, will provide ICC Camp with a series of ecological support, scholarships for outstanding students, special investment project support, blockchain grants for gaming, and assistance with game publishing through Upchain. The premier content distribution platform, Yeeha, will enhance ICC Camp’s visibility by providing student platform traffic support. The leading Asia-based blockchain adoption entity, TZ APAC, will offer substantial grants and ecological support for ICC Camp, strongly supporting outstanding start-up projects. The top auditing institution SlowMist will provide exclusive discounts for outstanding projects of ICC Camp, while Google Cloud will offer up to $100,000 in credits and additional support within the Google ecosystem.

ICC Camp has selected 29 outstanding Web3 game projects from hundreds of applications to officially join the camp, covering various sub-sectors including GameFi, Fully On-Chain Game, Metaverse, SpotiFy, Rental-Based Gaming Platforms, Traffic Platforms, etc.

The official announcement list of the first batch of signed projects for ICC Camp S1 is as follows (in alphabetical order, without specific ranking):

Start-up projects are still in the process of being signed, so stay tuned for more updates from ICC Camp.

Official Channels

Official Website: www.iccombinator.com

X (Twitter): https://twitter.com/ICCombinator

Telegram: https://t.me/iccombinator_official

E-mail: camp@iccombinator.com

Source: https://twitter.com/ICCombinator/status/1767373326316683298

[ad_2]

Source link -

Bybit x Mavia: 1,250,000 MAVIA Airdrop Extravaganza | by BitMedia Buzz | Feb, 2024

[ad_1]

To celebrate the $MAVIA token listing, Bybit crypto exchange has announced a massive airdrop extravaganza for all traders and users.

Mavia is a Web3 mobile strategy game developed by Skrice Studios, with backing by Binance Labs, Delphi Digital, KickStreaming and Mechanism Capital.

Airdrop details

Total prize pool: 1,250,000 MAVIA and 30,000 USDT

Event Period: Feb 5, 2024 — Feb 26, 2024, 10AM UTC

Perk 1: 1,200,000 MAVIA Airdrop

To participate in the MAVIA airdrop, just follow these steps:

- Follow the Bybit @Bybit_Official and Mavia @MaviaGame X accounts.

- Quote/Re-tweet this post and attach a screenshot of your player base.

Here’s an example of the screenshot:

- Complete Identity Verification Lv. 1 on Bybit.

- Deposit 100 USDT and trade MAVIA, or deposit at least $100 worth of MAVIA before the event ends.

- Answer the questions in the form when you register.

30,000 participants will be randomly selected to win 40 MAVIA!

New to Bybit? Signing up for a Bybit account is quick and easy.

Perk 2: Invite New Users, Unlock 5 MAVIA Each!

Invite new users to join Bybit via this referral link, and participate in Perk 1. Both you and your qualified referee will receive 5 MAVIA. Rewards will be distributed on a first-come, first served basis.

[Affiliate Special] Perk 3: Invite New Users, Unlock 5 USDT Each

For Affiliates and new referees of Affiliates: If you invite new users to join Bybit via this referral link and participate in Perk 1, both you and your qualified referee will each receive 5 USDT. Rewards will be distributed on a first-come, first-served basis.

Terms and Conditions:

Perk 1

- Institutional users or Market Makers are not eligible for this event.

- Only deposits and trades made within the event period will be considered in the reward calculation.

- Users will still be eligible for the event even if they withdraw USDT during the event.

- Deposits made using a Sub Account will not be counted toward this event.

- The rewards will be credited to their Bybit Funding Account, Spot Account or Unified Trading Account within 14 days after the event ends.

Perk 2

- New users must sign up using a referral code or link from their referral during the event period to be eligible for this event.

- Rewards from this event can be combined with the existing Referral Program. Both referrals and referees can enjoy all associated perks.

- The rewards will be credited to their Spot Account within 14 days after the event ends.

- Users who signed up for their Bybit accounts via Affiliate referral are not eligible for rewards from Perk 2.

Perk 3

- This perk is only available for Affiliates and new referees of Affiliates.

- Users who are eligible for Perk 3 are excluded from Perk 2.

General

- Users must complete Identity Verification Lv.1 during the event period to participate in the event.

- Bybit reserves the right to disqualify any participants who engage in dishonest or abusive activities during the event, including bulk-account registrations to farm additional bonuses and any other activities in connection with unlawful, fraudulent, or harmful purposes.

- Bybit reserves the right to modify the terms of this event without notifying users in advance.

- Bybit reserves the right of final interpretation of this event. If you have any questions, please contact our Customer Support.

[ad_2]

Source link

Rich Dad Poor Dad author Robert Kiyosaki has advised investors to buy as many bitcoins as they can afford, noting that China is in trouble and this is not the time to buy stocks and bonds. “This is the time to buy real gold, real silver, and as many bitcoin as you can afford,” he […]

Rich Dad Poor Dad author Robert Kiyosaki has advised investors to buy as many bitcoins as they can afford, noting that China is in trouble and this is not the time to buy stocks and bonds. “This is the time to buy real gold, real silver, and as many bitcoin as you can afford,” he […]