[ad_1]

According to Wells Fargo estimations, U.S.-based retailer Costco runs a $200 million gold business monthly. Consumer trust in the organization and its aggressive pricing have made Costco’s one-ounce bars of 24-karat gold a popular choice for investors, who take advantage of 2% over market spot prices. Costco Might Be Selling $200 Million in Gold Every […]

According to Wells Fargo estimations, U.S.-based retailer Costco runs a $200 million gold business monthly. Consumer trust in the organization and its aggressive pricing have made Costco’s one-ounce bars of 24-karat gold a popular choice for investors, who take advantage of 2% over market spot prices. Costco Might Be Selling $200 Million in Gold Every […]

[ad_2]

Source link

Category: Currency Market

-

Costco Gold Business Booming: Estimations Put Monthly Sales Close to $200 Million

-

Cryfi Releases V1 of Blockchain-Verified Signal Trading App on Telegram, with Founder Pass NFT Sale to Launch May 3 | by BitMedia Buzz | Apr, 2024

[ad_1]

Providing Proof-of-Signal, Cryfi’s trading signal platform features blockchain-verified signals and a leaderboard of top signal providers. Offering the perfect combination of control and automation, Cryfi users will be able to easily copy and adjust signals and then automatically implement these signals on CEXs and DEXs via API integration.

SINGAPORE, April 11, 2024 — Cryfi, a blockchain-verified trading signal platform, has released its Alpha version as a Telegram Mini App that goes beyond basic copy-trading to make it easier to not only share but adjust and implement trading signals. Cryfi’s Founder Pass NFT collection that grants users numerous perks on the platform will also be made available for early Cryfi supporters on May 3rd. The full-featured web-app launches later this year with the world’s first blockchain-verified trading signals and leaderboard.

“We’re developing Cryfi’s on-chain verification to bring trust and transparency to crypto trading and remove the scam-traders that the space has become famous for,” said Cryfi founder and CEO Yura Mizin. “As we enter crypto’s next bull run, more and more people are keen to start trading. There is no better way to learn how than to follow and listen to the best traders on the market today. However, since it’s currently impossible to verify someone’s trading skills, too many people end up following fakers who claim to be pros.”

Cryfi addresses these problems and more.Providing Proof-of-Signal, Cryfi’s trading signal platform features blockchain-verified signals and a leaderboard of top signal providers. Offering the perfect combination of control and automation, Cryfi users will be able to easily copy and adjust signals and then automatically implement these signals on CEXs and DEXs via API integration.

Trading channel subscriptions, member management and promotions will be automatically handled for signal providers, so they can focus on trading and building their reputations. Meanwhile, traders can learn all the best trading strategies together via trading courses and a closed discussion group with top-performing signal providers on the platform.

“Cryfi will be like a passport — a blockchain-verified certificate that showcases your trading capabilities. In addition, Cryfi will offer plenty of other features to help traders and signal providers trade more quickly and efficiently.”

Available now, Cryfi’s Alpha version is a Telegram Mini App that allows signal providers more efficiently share their signals in their own existing communities, with automatic integration with Binance via API. The full-featured web-app platform is scheduled for launch in Q3 2024, with Cryfi’s $CRFY token scheduled to launch in early 2025. The whitelist for their Founder Pass NFTs is already open, with an official Cryfi Galxe campaign ongoing until May 3rd with USD 6,000 worth of NFTs to give away. Stay tuned to their social media channels for the launchpad reveals.

Founder Pass NFTs Available May 3: Numerous Perks for Early Supporters

The Founder Pass is a limited edition collection of 430 utility NFTs that give early supporters many distinct benefits on the Cryfi platform — such as a membership in a closed group with pro traders and lifetime subscriptions to trading courses and Cryfi Pro, which will allow traders to copy and adjust signals and technical analysis on the live chart. There are two tiers of NFTs: the Shark Pass, which caters to novice traders, and the Whale Pass, which grants additional perks such as profit sharing, larger discounts and forever access to signal channels to Cryfi’s top ambassadors. Both tiers have plenty of other perks, too. See the official Cryfi Medium blog for more information about all the benefits of owning a Cryfi Founder Pass NFT.

Founder Pass NFT Details

- Shark Pass: $300 each, 404 NFTs in total

- Whale Pass: $3000 each, 26 NFTs in total

To earn a spot on the Founder Pass whitelist prior to the NFT launch, supporters should visit the Galxe campaign page linked below and complete the social tasks listed there. The top 50 participants will earn a guaranteed chance to purchase Founder Pass NFTs. All participants will also receive a free Early Supporter badge and be entered into raffles, with prizes coming from a pool of NFTs worth USD 6,000.

Participate in the Galxe campaign here: https://app.galxe.com/quest/Cryfi/GCFddtTagR

Top Partners to Bring Further Value to the Cryfi Platform

Cryfi is also forging a number of important partnerships that will bring new features to the platform. One key partner is Analog, a company which is developing a suite of multi-chain protocols. Analog’s interoperability technology will help Cryfi query other blockchains to seamlessly compare signal prices with real prices, and trade signals across chains without having to deal with smart contracts.

“One of our visions is to help move traders from Web2 to Web3. While most people are familiar with the big names in the crypto space — Bitcoin, Binance, Ethereum and so forth — a lot of traders are not actually Web3 users. We want to change that,” Mizin said. “Lucky for us, Analog has all the tools we need to achieve this.”

Other partnerships will add new capabilities to the Cryfi platform post-launch. Copin will bring their on-chain traders to Cryfi as signal providers, Yoki Finance will bring crypto payments for channel subscriptions, and the quant trading platform Crypto Arsenal will onboard Cryfi’s signal providers as additional analytics sources. Further big features coming up include copytrading, algorithm trading, trading bots and AI bots.

Cryfi’s team of experts boasts more than 50 years experience in product development, 30 years in blockchain, and 10 years in trading combined. Team members have worked with a number of leading brands, including Equifax, HTX and other fintech leaders in the Web2 and Web3 spaces.

See how Cryfi works in this video:

Cryfi is More Than Just Another Trading Platform — It’s a Trading Community

By providing a fair and transparent social space where traders and signal providers can share ideas, Cryfi is building a real community of people with similar goals. Anyone can submit trading signals on Cryfi — their blockchain-verified track record will speak for itself on Cryfi’s leaderboard. This removes a huge barrier of entry for new signal providers, while ensuring Cryfi is represented by some of the best traders on the market.

Supporters who join early will enjoy the benefit of utilizing the first blockchain-verified trading signals on the market, giving them increased trust in the validity of their trading strategies that most other trading communities cannot offer. Founder Pass NFT holders will also be the first to try out all new features Cryfi adds to its platform, giving them a distinct advantage when compared to members who join the platform later on.

About Cryfi

Launched in 2024, Cryfi is a crypto trading app that connects traders with blockchain-verified signal providers. The newly released MVP is available as a Telegram Mini App that allows for easy creation and implementation of trading signals. A future version is being developed that will include a mobile app, signal channel subscriptions, a leaderboard for top-performing signal providers, API integration with more centralized exchanges and DEXs, a trading school, and more.

Official Channels

Cryfi Website: https://cryfi.app/

Cryfi Twitter: https://twitter.com/Cryfi_app_

Cryfi Medium Blog: https://medium.com/@cryfi_app

Cryfi Telegram (Announcements): https://t.me/+GggbNqo8GLcwNTVi

Cryfi Telegram (Chat): https://t.me/cryfi_official

Cryfi V1 (MVP): https://t.me/CryfiBot

Cryfi LinkedIn: https://www.linkedin.com/company/cryfi/

Cryfi Whitepaper: https://cryfi.gitbook.io/cryfi

Cryfi Video: https://www.youtube.com/watch?v=6Q3gpqiqVp0

Cryfi Whitelist Galxe Campaign: https://app.galxe.com/quest/Cryfi/GCFddtTagR

[ad_2]

Source link -

Bitget’s Crypto Trading Volume Surges over 100% in Q1 2024

[ad_1]

Bitget, one of the biggest cryptocurrency exchanges by volume, has released its Q1 2024 Transparency Report, revealing visible growth across various metrics. The

report highlighted a 100% increase in both spot and futures trading volumes

compared to previous quarters, along with a significant rise in the value of

its platform native token, BGB.According

to the report, Bitget’s futures trading volume reached approximately $1.4

trillion, an escalation of 146% from the previous quarter. The exchange witnessed the

highest increase in derivatives market share, with a growth of 2.4% in March

alone. The spot trading volume also saw a substantial uplift of 113%, surpassing

$60 billion in Q1 2024.According to an independent report by Finance Magnates Intelligence, these figures coincide with the overall boost in volumes across the cryptocurrency industry.

In March, spot volumes for the largest cryptocurrency exchanges grew 119%

compared to the previous year and over 100% compared to February.Bitget’s

user base has expanded significantly, now serving over 25 million users

across 100+ countries and regions.“This

year, Bitget is doubling down on its commitment to enhance our spot market

offerings,” Gracy Chen, the Managing Director of Bitget, commented. “We aim not

only to bolster our market position but also to contribute tremendously to the

broader crypto ecosystem, supporting startups with high potential to

grow.”Thanks @CryptoSlate for featuring us.

🏆 Proud to become the world’s largest #crypto copy trading platform!

🌍 With over 25 million users globally, #Bitget now stands proudly as a Top 5 crypto exchange on various lists.

Explore our latest achievements 👇

— Bitget (@bitgetglobal) April 11, 2024

Bitget Bets on Its Crypto

TokenThe

platform’s native token, BGB, had a really good run last quarter, breaking its

all-time high and surpassing the $1 mark in February. Since the beginning of

2023, BGB has delivered gains of 434%, outperforming Bitcoin and establishing

itself as a top performer among centralized exchange tokens.Currently,

it is one of the 70 largest cryptocurrencies, with a market capitalization of

over $1.8 billion and a daily trading volume of $81 million. Binance exchange’s BNB token has a market capitalization of $89 billion.Bitget’s listing

strategy led to the introduction of 186 new tokens in the first quarter,

expanding its offerings to over 750 tokens and 820 spot trading pairs. Several

tokens, such as XAI, GPT, and PIXEL, experienced extraordinary growth, surging

over 3000%.According

to the latest exchange report, more people are trading

cryptocurrencies in Europe. In Germany alone, the number of traders has

escalated 69% over the year.In the meantime,

Bitget Wallet hired a new Chief Operating Officer, Alvin Kan, to accelerate its global

expansion.Bitget, one of the biggest cryptocurrency exchanges by volume, has released its Q1 2024 Transparency Report, revealing visible growth across various metrics. The

report highlighted a 100% increase in both spot and futures trading volumes

compared to previous quarters, along with a significant rise in the value of

its platform native token, BGB.According

to the report, Bitget’s futures trading volume reached approximately $1.4

trillion, an escalation of 146% from the previous quarter. The exchange witnessed the

highest increase in derivatives market share, with a growth of 2.4% in March

alone. The spot trading volume also saw a substantial uplift of 113%, surpassing

$60 billion in Q1 2024.According to an independent report by Finance Magnates Intelligence, these figures coincide with the overall boost in volumes across the cryptocurrency industry.

In March, spot volumes for the largest cryptocurrency exchanges grew 119%

compared to the previous year and over 100% compared to February.Bitget’s

user base has expanded significantly, now serving over 25 million users

across 100+ countries and regions.“This

year, Bitget is doubling down on its commitment to enhance our spot market

offerings,” Gracy Chen, the Managing Director of Bitget, commented. “We aim not

only to bolster our market position but also to contribute tremendously to the

broader crypto ecosystem, supporting startups with high potential to

grow.”Thanks @CryptoSlate for featuring us.

🏆 Proud to become the world’s largest #crypto copy trading platform!

🌍 With over 25 million users globally, #Bitget now stands proudly as a Top 5 crypto exchange on various lists.

Explore our latest achievements 👇

— Bitget (@bitgetglobal) April 11, 2024

Bitget Bets on Its Crypto

TokenThe

platform’s native token, BGB, had a really good run last quarter, breaking its

all-time high and surpassing the $1 mark in February. Since the beginning of

2023, BGB has delivered gains of 434%, outperforming Bitcoin and establishing

itself as a top performer among centralized exchange tokens.Currently,

it is one of the 70 largest cryptocurrencies, with a market capitalization of

over $1.8 billion and a daily trading volume of $81 million. Binance exchange’s BNB token has a market capitalization of $89 billion.Bitget’s listing

strategy led to the introduction of 186 new tokens in the first quarter,

expanding its offerings to over 750 tokens and 820 spot trading pairs. Several

tokens, such as XAI, GPT, and PIXEL, experienced extraordinary growth, surging

over 3000%.According

to the latest exchange report, more people are trading

cryptocurrencies in Europe. In Germany alone, the number of traders has

escalated 69% over the year.In the meantime,

Bitget Wallet hired a new Chief Operating Officer, Alvin Kan, to accelerate its global

expansion.

[ad_2]

Source link -

Restaking Takes Center Stage In Ethereum (ETH) Staking Landscape

[ad_1]

In recent months, the Ethereum staking landscape has witnessed significant transformations, prompting a shift in investor preferences and reshaping the sector’s dynamics.

According to on-chain data researcher and strategist at 21Shares, Tom Wan, key metrics indicate a notable change in the approach towards Ethereum staking, with restaking gaining prominence as a preferred method.

Ethereum Restaking Landscape

Wan’s observations, shared on the social media platform X (formerly Twitter), highlight a steady increase in ETH staking deposits from restaking, rising from 10% to 60% since 2024.

Restaking can be accomplished in two primary ways: through ETH natively restaked or by utilizing a liquid staking token (LST). By staking their ETH, users secure additional applications known as Actively Validated Services (AVS), which yield additional staking rewards.

A significant player in the staking landscape is EigenLayer, which has emerged as the second-largest decentralized finance (DeFi) protocol on the Ethereum network.

EigenLayer has achieved a significant milestone with the release of EigenDA, its data availability Actively Validated Service (AVS), on the mainnet.

According to a research report by Kairos, this launch marks the beginning of a new era in restaking, where liquid restaking tokens (LRTs) will become the dominant way for restakers to do business.

Currently, 73% of all deposits on EigenLayer are made through liquid restaking tokens. The report highlights that the growth rate of LRT deposits has been significant, increasing by over 13,800% in less than four months, from approximately $71.74 million on December 1, 2023, to $10 billion on April 9, 2024, demonstrating the growing confidence in EigenLayer’s approach to restaking and contributing to the shifting tides in Ethereum’s staking landscape.

According to Wan, the rise of liquid restaking protocols has also contributed to a decline in the dominance of Lido (LDO), a staking service solution for Solana (SOL), Ethereum, and Terra (LUNC).

On the other hand, Etherfi has emerged as the second-largest stETH withdrawer, with 108,000 stETH withdrawn through the first quarter of 2024. This trend exemplifies the increasing popularity of liquid restaking protocols, allowing stakers to withdraw and actively utilize their staked assets while still earning rewards.

Ether.fi Set To Surpass Binance In ETH Staking

Data provided by Wan also shows a decline in the dominance of centralized exchanges (CEXs) in ETH staking. Since 2024, CEXs have seen their share of staking decline from 29.7% to 25.8%, a significant drop of 3.7%.

As a result, the decentralized staking provider Kiln Finance has surpassed Binance and become the third-largest entity in terms of ETH staking. With Ether.fi poised to follow suit, it is expected to surpass Binance’s position shortly, according to the researcher.

In short, these developments signify a paradigm shift in the Ethereum staking landscape, with re-staking methodologies gaining traction and decentralized protocols like EigenLayer and Ether.fi challenging the dominance of established players.

The 1-D chart shows ETH’s price volatility for the past few days. Source: ETHUSD on TradingView.com As of this writing, ETH’s price stands at $3,500. It has been exhibiting a sideways trading pattern over the past 24 hours, remaining relatively stable compared to yesterday.

Featured image from Shutterstock, chart from TradingView.com

Disclaimer: The article is provided for educational purposes only. It does not represent the opinions of NewsBTC on whether to buy, sell or hold any investments and naturally investing carries risks. You are advised to conduct your own research before making any investment decisions. Use information provided on this website entirely at your own risk.

[ad_2]

Source link -

Anticipation Builds as Bitcoin Stands Less Than 1,400 Blocks From Monumental Halving

[ad_1]

According to the latest data, we are now less than 1,400 blocks away from the anticipated Bitcoin halving event, which will decrease the block reward from 6.25 bitcoin to 3.125 bitcoin. Bitcoin’s value soared to a new all-time high on March 14, reaching $73,794 per bitcoin, but has since seen a 6.5% decline. Observers are […]

According to the latest data, we are now less than 1,400 blocks away from the anticipated Bitcoin halving event, which will decrease the block reward from 6.25 bitcoin to 3.125 bitcoin. Bitcoin’s value soared to a new all-time high on March 14, reaching $73,794 per bitcoin, but has since seen a 6.5% decline. Observers are […]

[ad_2]

Source link -

Crypto.com’s Dubai Entity Cleared for Full Operations in Institutional Trading

[ad_1]

Crypto.com has received full operational approval from

the Virtual Assets Regulatory Authority (VARA) for its Dubai entity, CRO

DAX Middle East FZE. This approval paves the way for the launch of the

Crypto.com Exchange, a platform targeting institutional investors in the region.The VARA’s approval signifies Crypto.com’s

compliance with the pre-operational conditions outlined in the Virtual Asset

Service Provider license granted to CRO DAX Middle East FZE in November

2023. The license allows the crypto exchange to operate in the region with fiat

capabilities.Stuart Isted, the General Manager for Middle East and

Africa at Crypto.com, mentioned: “We are incredibly supportive of the

steps Dubai is taking to progress the crypto industry, both in-market and

abroad. But this is still just the beginning, and we

look forward to continuing to work closely with VARA in our collective efforts

to effectively and responsibly advance the sector.”We’re excited to announce our full operational approval from Dubai’s Virtual Assets Regulatory Authority 🇦🇪

Crypto․com Exchange will be available for institutional investors as our first launch in the region 🙌 pic.twitter.com/6ZhHDdzPcT

— Crypto.com (@cryptocom) April 9, 2024

Crypto.com Exchange is

designed for institutions and qualified retail investors. It

offers a range of services, including spot trading, staking brokerage, and

over-the-counter offerings in settlements for selected markets.According to the press release, the crypto firm plans

to expand its offerings in the region in the coming months. The expansion

includes a rollout of the Crypto.com app and other products for retail investors. Last year, Crypto.com secured a Minimal Viable Product

(MVP) Preparatory license from the VARA. This license followed a provisional

approval previously obtained by the crypto exchange.We’re proud to announce our latest milestone in global regulatory compliance and licensure.https://t.co/vCNztATSCO has secured its MVP Preparatory License from the Virtual Asset Regulatory Authority in Dubai. 🇦🇪

Learn more:https://t.co/ApmdXpUBI3 pic.twitter.com/iwYCznyYXQ

— Crypto.com (@cryptocom) March 20, 2023

Dubai’s Crypto Regulatory Landscape

Established under the Dubai Virtual Asset Regulation

Law, VARA has been instrumental in positioning Dubai as a burgeoning global

crypto hub. The authority aims to foster a robust ecosystem for virtual assets,

attracting key players into the region.With the issuance of the MVP Preparatory license,

Crypto.com joins the ranks of prominent crypto exchanges with the capability to

offer a spectrum of crypto products and services, including spot and

derivatives instruments for virtual assets. Besides that, Crypto.com has obtained licenses in

major markets, including the United Kingdom, France, Italy, and Brazil.Meanwhile, Crypto.com recently unveiled plans to launch a specialized trading platform exclusively for Korean users. Scheduled for release on April 29, 2024, the platform aims to cater to the unique preferences and needs of Korean investors. The firm emphasized Korea’s cultural influence and the adoption of new technologies as key factors driving this initiative.

Crypto.com has received full operational approval from

the Virtual Assets Regulatory Authority (VARA) for its Dubai entity, CRO

DAX Middle East FZE. This approval paves the way for the launch of the

Crypto.com Exchange, a platform targeting institutional investors in the region.The VARA’s approval signifies Crypto.com’s

compliance with the pre-operational conditions outlined in the Virtual Asset

Service Provider license granted to CRO DAX Middle East FZE in November

2023. The license allows the crypto exchange to operate in the region with fiat

capabilities.Stuart Isted, the General Manager for Middle East and

Africa at Crypto.com, mentioned: “We are incredibly supportive of the

steps Dubai is taking to progress the crypto industry, both in-market and

abroad. But this is still just the beginning, and we

look forward to continuing to work closely with VARA in our collective efforts

to effectively and responsibly advance the sector.”We’re excited to announce our full operational approval from Dubai’s Virtual Assets Regulatory Authority 🇦🇪

Crypto․com Exchange will be available for institutional investors as our first launch in the region 🙌 pic.twitter.com/6ZhHDdzPcT

— Crypto.com (@cryptocom) April 9, 2024

Crypto.com Exchange is

designed for institutions and qualified retail investors. It

offers a range of services, including spot trading, staking brokerage, and

over-the-counter offerings in settlements for selected markets.According to the press release, the crypto firm plans

to expand its offerings in the region in the coming months. The expansion

includes a rollout of the Crypto.com app and other products for retail investors. Last year, Crypto.com secured a Minimal Viable Product

(MVP) Preparatory license from the VARA. This license followed a provisional

approval previously obtained by the crypto exchange.We’re proud to announce our latest milestone in global regulatory compliance and licensure.https://t.co/vCNztATSCO has secured its MVP Preparatory License from the Virtual Asset Regulatory Authority in Dubai. 🇦🇪

Learn more:https://t.co/ApmdXpUBI3 pic.twitter.com/iwYCznyYXQ

— Crypto.com (@cryptocom) March 20, 2023

Dubai’s Crypto Regulatory Landscape

Established under the Dubai Virtual Asset Regulation

Law, VARA has been instrumental in positioning Dubai as a burgeoning global

crypto hub. The authority aims to foster a robust ecosystem for virtual assets,

attracting key players into the region.With the issuance of the MVP Preparatory license,

Crypto.com joins the ranks of prominent crypto exchanges with the capability to

offer a spectrum of crypto products and services, including spot and

derivatives instruments for virtual assets. Besides that, Crypto.com has obtained licenses in

major markets, including the United Kingdom, France, Italy, and Brazil.Meanwhile, Crypto.com recently unveiled plans to launch a specialized trading platform exclusively for Korean users. Scheduled for release on April 29, 2024, the platform aims to cater to the unique preferences and needs of Korean investors. The firm emphasized Korea’s cultural influence and the adoption of new technologies as key factors driving this initiative.

[ad_2]

Source link -

Ethereum Whales Signal Bullish Run With $40 Million Bet

[ad_1]

Ethereum (ETH), the world’s second-largest cryptocurrency by market capitalization, is experiencing a surge in optimism in the cryptocurrency market. The emergence of two new whales, according to crypto tracking platform Spot On Chain, further adds to the bullish sentiment surrounding Ethereum.

These whales have collectively withdrawn a substantial amount of ETH, totaling nearly 11,700 coins, worth approximately $40 million, from leading cryptocurrency exchange Binance.

Their significant purchase, made when ETH was priced around $3,450, indicates their confidence in the potential for further price appreciation.

The $ETH price sharply rebounded by ~4% in the past 2 hours, now beyond $3,500!

During this period, our system detected two more whales, 0x666 and 0x435, that withdrew a total of 11,657 $ETH ($40.28M) from #Binance at ~$3,455!

Follow @spotonchain and set alerts for $ETH now so… https://t.co/Tz4or4Pzc0 pic.twitter.com/ZoVXTtDWZq

— Spot On Chain (@spotonchain) April 8, 2024

Ethereum Trading Volume Soars

The cryptocurrency market is experiencing a surge in optimism, fueled by a strong performance from Ethereum (ETH) and the looming Bitcoin halving event.

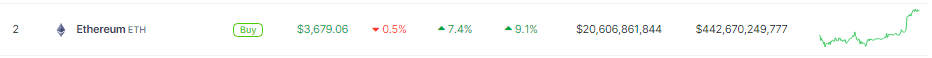

ETH has seen its price jump nearly 10% in the past 24 hours, reaching $3,679 as of today. This impressive gain is accompanied by a significant rise in trading volume, which has spiked by nearly 70%, surpassing $15 billion.

Source: Coingecko

Source: CoingeckoMeanwhile, Ethereum’s impressive rally is not an isolated event. The broader cryptocurrency market is experiencing a period of bullish momentum. Bitcoin, the undisputed leader, has also witnessed a significant surge, climbing above the $72,000 mark. This upward trend is largely attributed to the anticipation surrounding the upcoming Bitcoin halving, scheduled for approximately 11 days from now.

The Bitcoin halving is a pre-programmed event that occurs roughly every four years. It reduces the number of new Bitcoins awarded to miners for verifying transactions on the network.

Historically, these halving events have been followed by substantial price increases for Bitcoin, as the reduced supply often leads to increased demand and scarcity. Investors are hoping for a similar outcome this time around, contributing to the current marketwide rally.

Renewed Optimism Grips Crypto Investors

The recent surge in prices and trading volumes across the cryptocurrency market suggests renewed optimism and bullish sentiment among investors. Analysts and experts are anticipating further price gains for both Ethereum and Bitcoin in the coming days and weeks.

Featured image from Pexels, chart from TradingView

Disclaimer: The article is provided for educational purposes only. It does not represent the opinions of NewsBTC on whether to buy, sell or hold any investments and naturally investing carries risks. You are advised to conduct your own research before making any investment decisions. Use information provided on this website entirely at your own risk.

[ad_2]

Source link -

Asian Firm HashKey Unveils Global Exchange Post Bermuda Licensing

[ad_1]

The HashKey Group, an Asian entity specializing in digital

asset services, has unveiled the HashKey Global exchange after securing a

license in Bermuda to provide regulated digital asset trading services. The

announcement was made today (Monday), marking a milestone for the firm

headquartered in Hong Kong, with operational presence in Singapore and Tokyo.With the unveiling of HashKey Global, the firm is poised to

expand its offerings, starting with spot trading services for 21 digital

assets. Among the featured assets are popular cryptocurrencies such as bitcoin, ether, Tether’s USDT, and Circle’s USDC. Additionally, the

exchange has revealed plans to introduce futures trading product services in

the coming weeks, further diversifying its portfolio and catering to the needs

of its clientele.“HashKey Group aims to establish one of the world’s largest

clusters of licensed exchanges within the next 5 years, surpassing all current

regulated exchanges,” said Livio Weng, COO of HashKey Group.The HashKey Group attained unicorn status earlier this year

following a fundraising round. The infusion of capital, which brought the

company “nearly” to its $100 million fundraising objective, bolstered

its position in the industry.Establishing HashKey Global in Bermuda’s Favorable

Regulatory LandscapeThe choice to set up HashKey Global in Bermuda highlights

the firm’s emphasis on operating within a regulated framework, with a

commitment to compliance with industry standards and the cultivation of trust

among investors and stakeholders. Bermuda’s favorable regulatory environment

has positioned it as an appealing jurisdiction for companies exploring

opportunities in the digital asset sector while maintaining adherence to

rigorous regulatory protocols.Earlier, HashKey

obtained all necessary licenses, making it the first Hong Kong firm to

offer crypto retail trading, as reported by Finance Magnates. This achievement

marks a notable milestone in legal regulations, as it updated Type 1 and Type 7

licenses issued by the Securities and Futures Commission, allowing it to

operate a virtual asset trading platform and provide automatic trading services

to both institutional and retail users.The HashKey Group, an Asian entity specializing in digital

asset services, has unveiled the HashKey Global exchange after securing a

license in Bermuda to provide regulated digital asset trading services. The

announcement was made today (Monday), marking a milestone for the firm

headquartered in Hong Kong, with operational presence in Singapore and Tokyo.With the unveiling of HashKey Global, the firm is poised to

expand its offerings, starting with spot trading services for 21 digital

assets. Among the featured assets are popular cryptocurrencies such as bitcoin, ether, Tether’s USDT, and Circle’s USDC. Additionally, the

exchange has revealed plans to introduce futures trading product services in

the coming weeks, further diversifying its portfolio and catering to the needs

of its clientele.“HashKey Group aims to establish one of the world’s largest

clusters of licensed exchanges within the next 5 years, surpassing all current

regulated exchanges,” said Livio Weng, COO of HashKey Group.The HashKey Group attained unicorn status earlier this year

following a fundraising round. The infusion of capital, which brought the

company “nearly” to its $100 million fundraising objective, bolstered

its position in the industry.Establishing HashKey Global in Bermuda’s Favorable

Regulatory LandscapeThe choice to set up HashKey Global in Bermuda highlights

the firm’s emphasis on operating within a regulated framework, with a

commitment to compliance with industry standards and the cultivation of trust

among investors and stakeholders. Bermuda’s favorable regulatory environment

has positioned it as an appealing jurisdiction for companies exploring

opportunities in the digital asset sector while maintaining adherence to

rigorous regulatory protocols.Earlier, HashKey

obtained all necessary licenses, making it the first Hong Kong firm to

offer crypto retail trading, as reported by Finance Magnates. This achievement

marks a notable milestone in legal regulations, as it updated Type 1 and Type 7

licenses issued by the Securities and Futures Commission, allowing it to

operate a virtual asset trading platform and provide automatic trading services

to both institutional and retail users.[ad_2]

Source link -

Commercial Bank of Dubai (CBD) joins Dubai FinTech Summit as a Strategic Banking Partner | by BitMedia Buzz | Apr, 2024

[ad_1]

Our PR partner, yourPRstrategist, is a proud media partner of the Dubai FinTech Summit, and we are pleased to extend their 10% discount to our community. Discount code: YPRS10

The collaboration reinforces Dubai FinTech Summit and CBD’s shared commitment to strengthen the global financial ecosystem through innovation and knowledge exchange. The partnership will open doors to new opportunities for growth and development of the fintech sector.

Dubai, U.A.E., April 8, 2024 — Commercial Bank of Dubai (CBD), one of the UAE’s leading national banks, has joined the Dubai FinTech Summit (DFS), organised by Dubai International Financial Centre (DIFC), the leading global financial centre in the MEASA region, as a Strategic Banking Partner, underscoring its dedication to supporting innovative and future thinking businesses on a global scale. The partnership agreement was signed in the presence of Arif Amiri, Chief Executive Officer and DIFC Authority, and Dr. Bernd van Linder, Chief Executive Officer of Commercial Bank of Dubai, by Mohammad Alblooshi, Chief Executive Officer of DIFC Innovation Hub, and Ali Imran, Chief Operating Officer of Commercial Bank of Dubai.

Commercial Bank of Dubai was the first bank to establish a Digital Lab at the DIFC Innovation Hub. Over the years, the bank has been playing a pivotal role in the development of a dynamic and technology-driven financial ecosystem, paving the way for a smarter, more connected financial future. Through strategic programs and initiatives such as the Buy Now, Pay Later (BNPL) solution by Postpay, CBD has been actively engaged in enhancing the overall payments sector aimed at accelerating the growth of the FinTech industry.

“The Dubai FinTech Summit is creating a powerhouse of partnerships bringing together pioneers, thinkers and disruptors from around the globe who are shaping the future of finance. Our collaboration with Commercial Bank of Dubai is a testament to our shared dedication in cultivating an energetic and forward-thinking FinTech ecosystem. It not only amplifies Dubai’s stature as a premier hub for business but also paves the way for us to convert challenges into avenues of opportunity, as we continue to cultivate the most sophisticated, inclusive and tech-savvy financial community on the global stage,” said Arif Amiri, Chief Executive Officer at DIFC Authority

Dr. Bernd van Linder, Chief Executive Officer at Commercial Bank of Dubai, said, “Commercial Bank of Dubai is thrilled to be a part of the Dubai FinTech Summit 2024, a global platform that brings together the brightest minds in the industry to shape the future of finance. Our participation in this event aligns with our commitment to innovation and our vision to be at the forefront of the FinTech revolution. As a forward-thinking bank, we place our customers at the heart of our business, constantly striving to provide them with innovative solutions that meet their evolving needs. We are proud to have signed an MoU as Strategic Banking Partner with Dubai International Finance Centre as part of our sponsorship partnership. We look forward to engaging in insightful discussions and exploring new opportunities for growth and collaboration.”

In line with the D33 Agenda to position Dubai as the top four global financial hub by 2033, the 2nd edition of the Dubai FinTech Summit is designed to encourage cross-border collaboration and innovation, pivotal to transforming the global FinTech sector. It presents a unique opportunity to explore emerging FinTech trends and their potential to drive financial progress in the MEASA region.

The Dubai FinTech Summit, scheduled for May 6–7, 2024, at Madinat Jumeirah, Dubai, will see an unprecedented gathering of over 8,000 decision-makers, over 300 thought leaders and over 200 exhibitors showcasing cutting-edge technologies.

Visitors can purchase tickets for the Dubai FinTech Summit 2024, with early bird prices ending soon.

About Dubai FinTech Summit

Dubai FinTech Summit is an annual mega event organised by the Dubai International Financial Centre (DIFC), the leading global financial centre in the Middle East, Africa and South Asia (MEASA) region. The 2nd edition of the Dubai FinTech Summit will bring together over 8,000+ global industry leaders, 1,500+ investors, and policymakers, signaling increased appetite for growth opportunities in the region.

Dubai FinTech Summit signals a new wave of financial innovation, opportunity, transformation, and growth for the international financial services sector. As a rising FinTech hub, Dubai is also spearheading the evolution of the financial services industry, with investments in FinTech projected to grow by 17.2% CAGR to USD 949 billion from 2022 to 2030. The summit aligns with the Dubai Economic Agenda D33’s strategic goal of propelling Dubai into the ranks of the top four global financial hubs by 2033.

The expanded programme of Dubai FinTech Summit is set to exceed expectations by delving into key tracks, including the future of FinTech, embedded and Open Finance, climate finance, Web3 and digital assets. The summit stands as a thought leadership-driven platform, addressing industry challenges head-on and championing innovation.

To register for the event, visit www.dubaifintechsummit.com.

For further enquiries, please contact:

Samia Ahmad

Assistant Manager, Marketing

DIFC Innovation Hub

+971529980096

E: samia.ahmad@difc.ae

Shadi Dawi

Director of PR & Strategic Partnerships

Trescon Global

+971 55 498 4989

shadi@tresconglobal.com

[ad_2]

Source link

Charles Hoskinson has criticized “all the dunking of Cardano,” and asserted that the protocol offers the “optimal route for scalability, governance, and innovation.” According to Hoskinson, the crypto industry’s problem is that it allows “carnival barkers [to] dominate the conversation.” Cardano FUD Charles Hoskinson, co-founder of Input Output Global Inc., has criticized “all the dunking […]

Charles Hoskinson has criticized “all the dunking of Cardano,” and asserted that the protocol offers the “optimal route for scalability, governance, and innovation.” According to Hoskinson, the crypto industry’s problem is that it allows “carnival barkers [to] dominate the conversation.” Cardano FUD Charles Hoskinson, co-founder of Input Output Global Inc., has criticized “all the dunking […]