[ad_1]

XY Finance has built an efficient and user-friendly cross-chain swap for DeFi & Metaverse and single-token liquidity provision service through X Swap and Y Pool. Of them, X Swap caters to users’ cross-chain needs between multiple chains, and the newly launched Y Pool can reimburse swapping fees and token rewards for liquidity providers.

With the coexistence of multiple chains and the boom of DeFi+NFT+GameFi, cross-chain exchange aggregators have become an essential and critical infrastructure in the entire cryptocurrency market, and the search for more efficient and convenient cross-chain exchange never stops.

XY Finance, a cross-chain swap aggregator for DeFi & Metaverse, aims to provide users with efficient cross-chain swapping services at the best price. It recently closed a $12 million round of funding from Circle (Circle Internet Financial), Infinity Ventures Crypto, Mechanism Capital, Morningstar Ventures, YGG (Yield Guild Games), and Animoca Brands. We are honored to see investors across core pillars in the industry: exchanges, venture funds, research firms, GameFi DAOs, and game developers, such as MEXC Global, TRON Foundation, gCC (gumi Cryptos Capital), Lemniscap, Evernew Capital, PANONY, Axia8, Looksrare.vc and more.

In addition to institutional investors, XY Finance gets backing from individual investors, such as Ben Chan (VP Engineering at Chainlink Labs), Kevin Tai (Co-Founder of Linear Finance), Tom Schmidt (Investment Partner at Dragonfly Capital), and Tempo (CEO of Perpetual Protocol), etc.

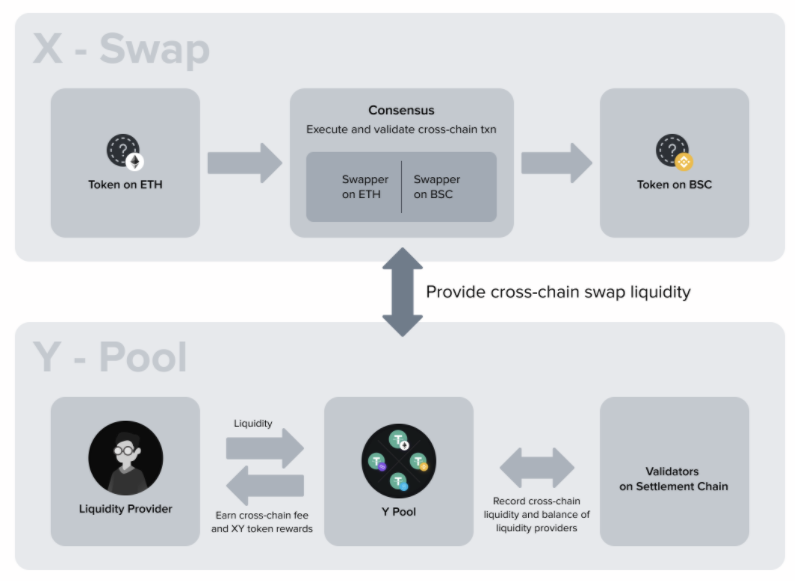

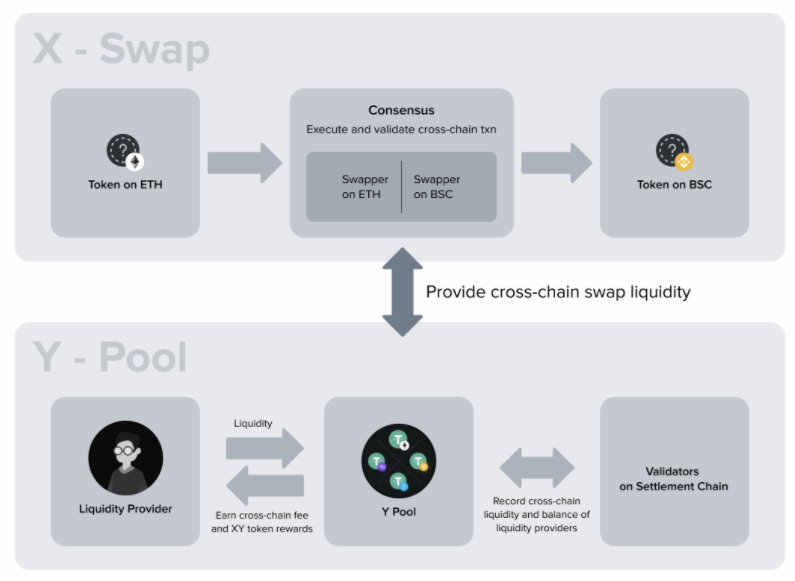

XY Finance’s advantage comes from the combination of two components, i.e., X Swap and Y Pool, which is also the operating model of XY Finance. Of them, X Swap will provide cross-chain transfer and swapping services for users, and Y Pool is used to incentivize users to provide liquidity. In return, liquidity providers can receive both swapping fees and governance token rewards. Currently, X Swap already supports cross-chain swap on Ethereum, BSC, Polygon and Fantom. The newly launched Y Pool has opened up liquidity provision services to users.

Simply put, X Swap will find the optimal cross-chain and transaction path for users, supporting cross-chain swaps between any assets, and allowing users to either swap assets on one specific chain or transfer/swap across two chains. For example, if you want to swap UNI on Ethereum to BUSD on BSC, you will first swap UNI to bridgeable assets (such as USDT, USDC etc.) on Ethereum, and migrate to BSC through Y Pool or bridge partners ( AnySwap, O3 Swap, and Multichain.xyz) before you finally convert to BUSD.

Although the operation seems complicated at first glance, X Swap only requires the user to initiate a transaction on the first chain, and the subsequent swap and cross-chain processes are automatically executed by the protocol, thus greatly simplifying the user’s transaction operation process.

Currently, X Swap mainly uses liquidity from DEXs such as Uniswap, SushiSwap and 1inch, while the newly launched Y Pool will allow users to provide liquidity directly on XY Finance, so that they can also earn swapping fees and XY token rewards.

The biggest advantage of Y Pool is that one pool can manage the liquidity of the same asset on multiple chains. For example, the USDT Y Pool pool can receive USDT assets from various chains such as ERC-20 USDT, BEP-20 USDT, Polygon USDT, etc., which are used to provide liquidity for X Swap. In addition, in order to balance the liquidity in the Y Pool, XY Finance proposes a rebalancing incentive mechanism that will reward users with XY Tokens for helping to rebalance assets on different chains.

Regarding XY Finance’s tokenomics in the Y Pool, in addition to the XY liquidity bonus, the founding team also allocates 80% of the swapping fees from X Swap to liquidity providers and another 20% to the DAO vault. Besides, of the fees allocated to the DAO vault and royalty income from the GalaXY Kats (an XY Finance’s NFT + GameFi project), 60% of them are used to repurchase XY Tokens from the secondary market, and 50% of the repurchased XY Tokens will be burned. This helps XY to form a virtuous cycle.

XY Finance’s native token, XY, will be offered on each chain supported by the protocol. There will be a total of 100 million tokens, of which 35% will be used for liquidity mining funds and GameFi rewards, 15% will be allocated to the team and advisors, 24% will be allocated to seed, private and strategic investors, 15% will be used for marketing and bounties, 6% will be used for public sales and 5% will be used for insurance, XY Finance will conduct an IDO on the Copper platform on December 9.

XY tokenomics

After locking XY in the staking pool, XYers can gain governance power to propose, vote, or change system parameters in real time, as well as start new Y Pools, etc. In addition, a portion of the swap fee will be allocated to XY Finance and the XY DAO as a security fund.

Regarding XY Finance’s future development plans, the agreement also plans to support Cronos, Ronin, Avalanche, Arbitrum and launch NFT Satellite, an NFT liquidity aggregator, by the end of this year; it will support more networks such as Flow, Solana and Polkadot in the first quarter of next year; more importantly, XY Finance will also support the NFT marketplace and launch the NFT wrapper and “NFT Sweeper”, and later launch the limit order swaps.

XY Finance Roadmap

Overall, XY Finance has built an efficient and user-friendly cross-chain swap aggregator and single-token liquidity provision model through X Swap and Y Pool, which not only satisfies users’ cross-chain needs across multiple chains but also helps liquidity providers earn revenue. The mutually reinforcing between the repurchase and burn mechanism and its NFT project GalaXY Kats will lend more strengths to the project. Let’s wait and see if XY Finance will be the dark horse in the cross-chain swap sector.

XY Finance Official Channels

Website: https://xy.finance

Twitter: https://twitter.com/xyfinance

Medium: https://medium.com/@xyfinance

Telegram: https://t.me/xyfinance

Discord: https://discord.gg/HWwMHRUH

Documents: https://docs.xy.finance

[ad_2]

Source link